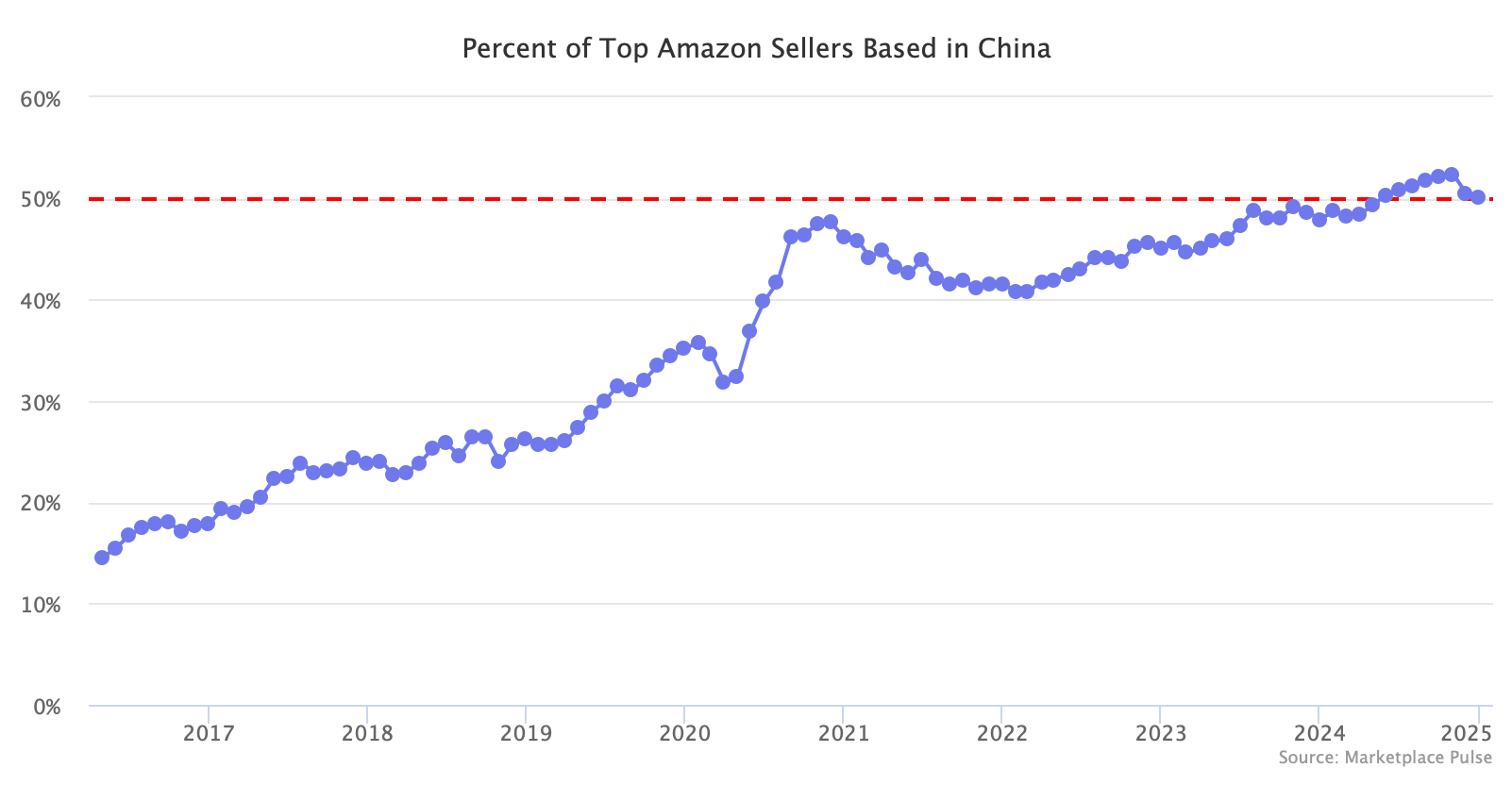

In 2024, China-based sellers increased their market share to more than 50% on Amazon.

American sellers have dropped below 50% nearly two years ago. However, Chinese sellers have grown above 50% only recently, as there is a small percentage of sellers in other countries. Based on Marketplace Pulse research, Chinese sellers now represent more than 50% of the top sellers on Amazon.com, with U.S. sellers representing roughly 45% and the rest in the U.K., Canada, or other countries. China’s share of all active sellers is even higher. (Some international sellers incorporate in the U.S., so American sellers’ actual share is lower than 45%)

Amazon acknowledged the Chinese seller market share on its marketplace for the first time in the annual Form 10-K filing with the SEC in February 2024, calling it “significant.” However, it was significant years before Amazon called it out — their share has steadily increased for nearly a decade on Amazon.com in the U.S. and its other worldwide marketplaces.

In November 2024, Amazon introduced Amazon Haul, a new section on Amazon to buy directly from sellers in China. It is a small experiment; still, in December, Amazon heavily discounted it by subsidizing the discount (offering as much as 60% off everything). According to Marketplace Pulse data, 100% of Amazon Haul sellers are based in China, just like Temu, which Haul attempts to copy.

There is no “Made in America” section on Amazon, but Amazon rushed to get Amazon Haul out, an emoji-filled “Made in China” section. Of course, most of everything on Amazon is “Made in China,” even when sold by U.S. sellers. Yet, “Made in China” and “Sold by China” are starting to diverge as Chinese sellers shift their manufacturing to other countries like Vietnam to avoid tariffs. According to the annual reshoring index from Kearney, China accounts for less than half of the U.S.’s low-cost imports from Asia. China has been losing its share of imports while Chinese sellers on Amazon have been gaining.

That’s hundreds of billions of dollars in sales on Amazon globally by third-party sellers in China (given that sales by all third-party sellers on Amazon exceeded $500 billion in 2024). Amazon called that “significant” because it exposed the company to regulatory and tariff risks. It makes the same fee irrespective of where the seller is based, but nurturing sellers in China promises getting closer to the source at a significant expense of sellers, jobs, taxes, safety, quality, counterfeit, and many other issues in the U.S. Issues beyond Amazon — Walmart is at 30% Chinese sellers, up from 20% ago — as it executes in a market with little protectionism.