Amazon Haul, Amazon’s newly launched low-price section, had its biggest day on Black Friday, driven by an aggressive 50% storewide discount. However, stockouts slowed its momentum during the rest of the holiday weekend.

From November 21st to December 2nd, Amazon offered a temporary 50% discount on everything sold on Amazon Haul. Amazon subsidized that discount, accepting short-term losses to jumpstart Amazon Haul. Starting on Black Friday, it put the 50% discount banner front and center on the Amazon app.

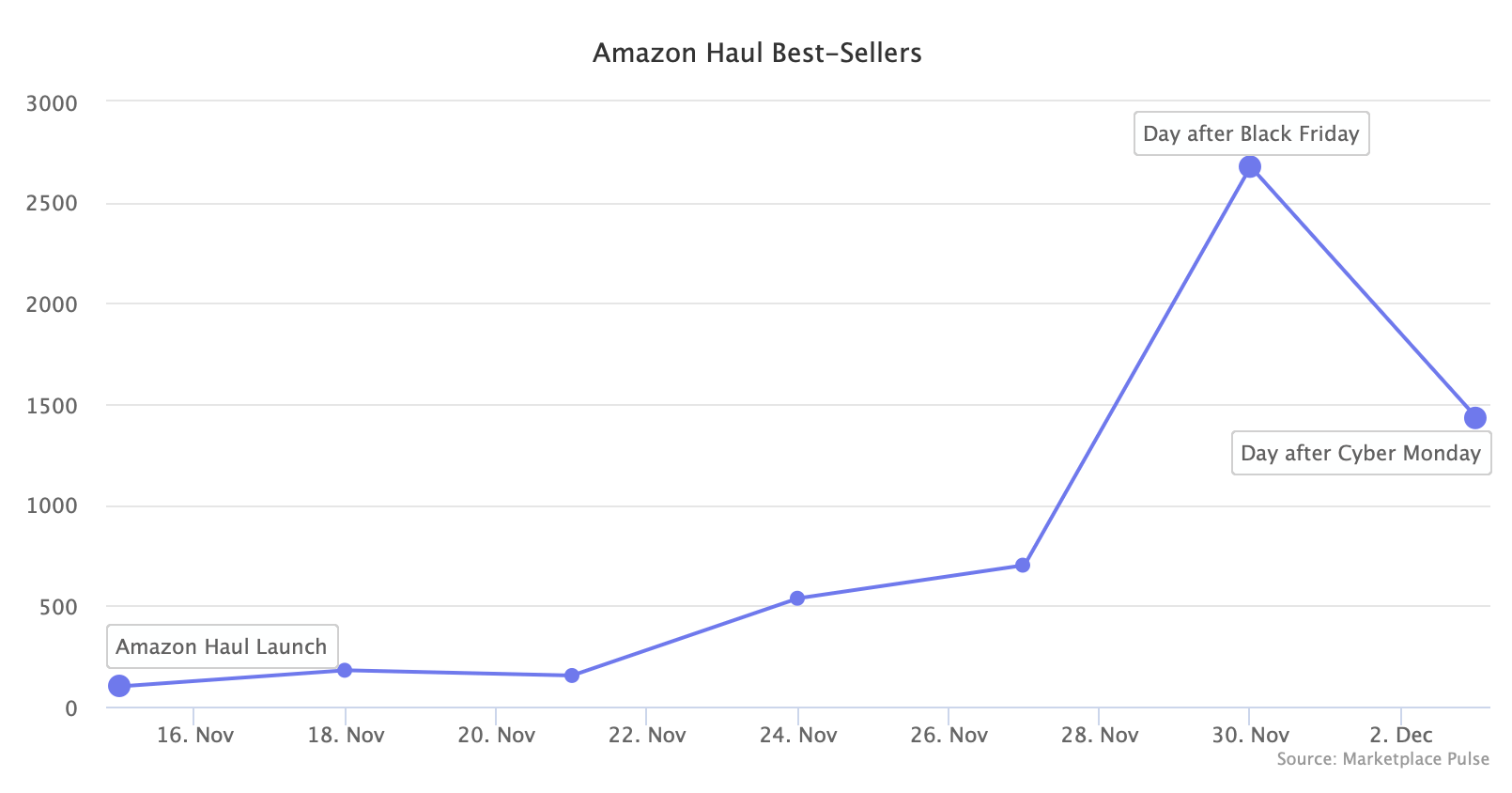

Amazon Haul took off on Black Friday. Marketplace Pulse research shows hundreds of third-party sellers (almost all exclusively China-based sellers) sold thousands of different products. By comparison, the first two weeks since the launch on November 14th were relatively quiet as it required shoppers first to discover the new section of Amazon.

The day after Black Friday, Amazon Haul reached 2,700 best-sellers — products ranking in the top 100 across Amazon’s categories. While all are in small categories like Pepper Mills or Jewelry Boxes, the spike indicates momentum.

However, most products on Amazon Haul sold out because Amazon or the sellers underestimated demand. Amazon Haul goods ship from its warehouses in China and are stored there by third-party sellers. They didn’t send in enough units — products that sold well during the past week quickly became out of stock.

Because products sold out, Cyber Monday wasn’t as big as Black Friday for Amazon Haul. The 50% discount and the ad on the app’s homepage were still in place, and Amazon even emailed shoppers. But there were fewer things to choose from, and thus, the number of best-sellers collapsed.

Despite the spike during Black Friday, sales volume on Amazon Haul is tiny. Yet, the 50% discount and Amazon Haul feature on the homepage are proof of aggression. Something Amazon has often lacked in its other initiatives. It will need a lot more of that to challenge Temu, the dominant direct-from-China platform, though.

On the surface, Amazon Haul looks like Temu, but in reality, it is a scaled-down version of Temu in terms of its number of sellers, catalog size, and category coverage. Marketplace Pulse research shows it has hundreds to Temu’s 500,000 sellers. “Haul feels more like an algorithmically disorganized wholesale catalogue than the hyperpromotional “shop like a billionaire!” manipulation machines on which it’s based,” wrote John Herrman, a tech columnist at Intelligencer.

Amazon Haul is now gone from the app’s homepage. With that, so is most of the demand. Temu spends billions of dollars a year to create demand. It’s unclear how Amazon will match this — the blip on Black Friday was not enough to kickstart a flywheel — but it has started running ads on Facebook and Instagram this week.