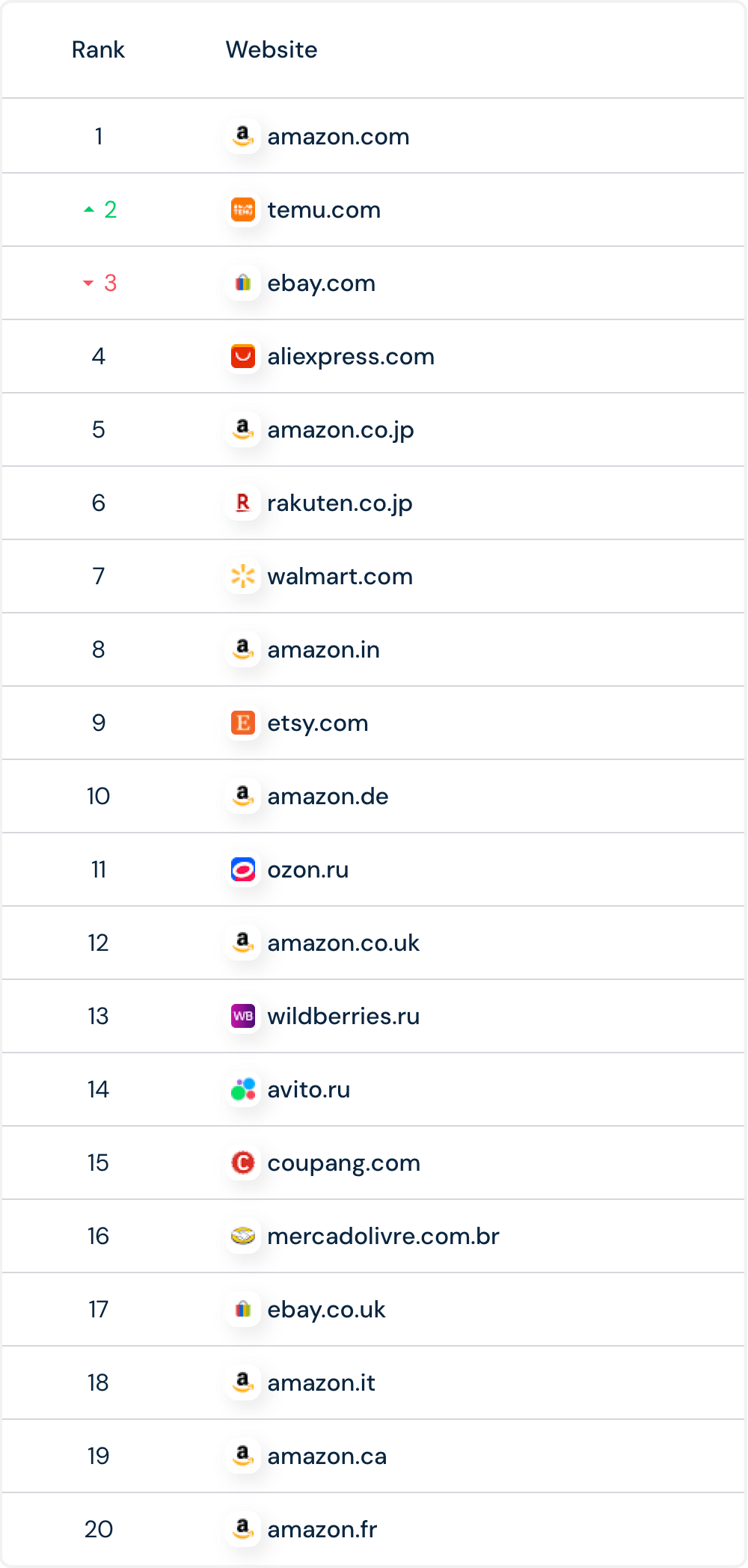

Two years after its launch, Temu overtook eBay to become the world’s 2nd most visited e-commerce website.

Temu, all caveats aside, is the only e-commerce company in the Top 20 most-visited list to launch in the past decade. Ignoring Coupang from South Korea, it is the only top e-commerce website to launch in the past two decades. Global e-commerce incumbents are well-established, and the status quo at the top has not materially changed in years. At the brink of entering the Top 20 is Temu’s often-compared rival, Shein.

No one else had the ambition and capital to try to speed-run building a retailer from zero to tens of billions of dollars in two years. Temu gets little organic traffic; it buys the hundreds of millions of visits through ads. Everyone else could be buying them, too. Thus, Temu’s meteoric rise is notable for the fact that it has never happened in retail before alone. (Maybe it will turn out, for a good reason)

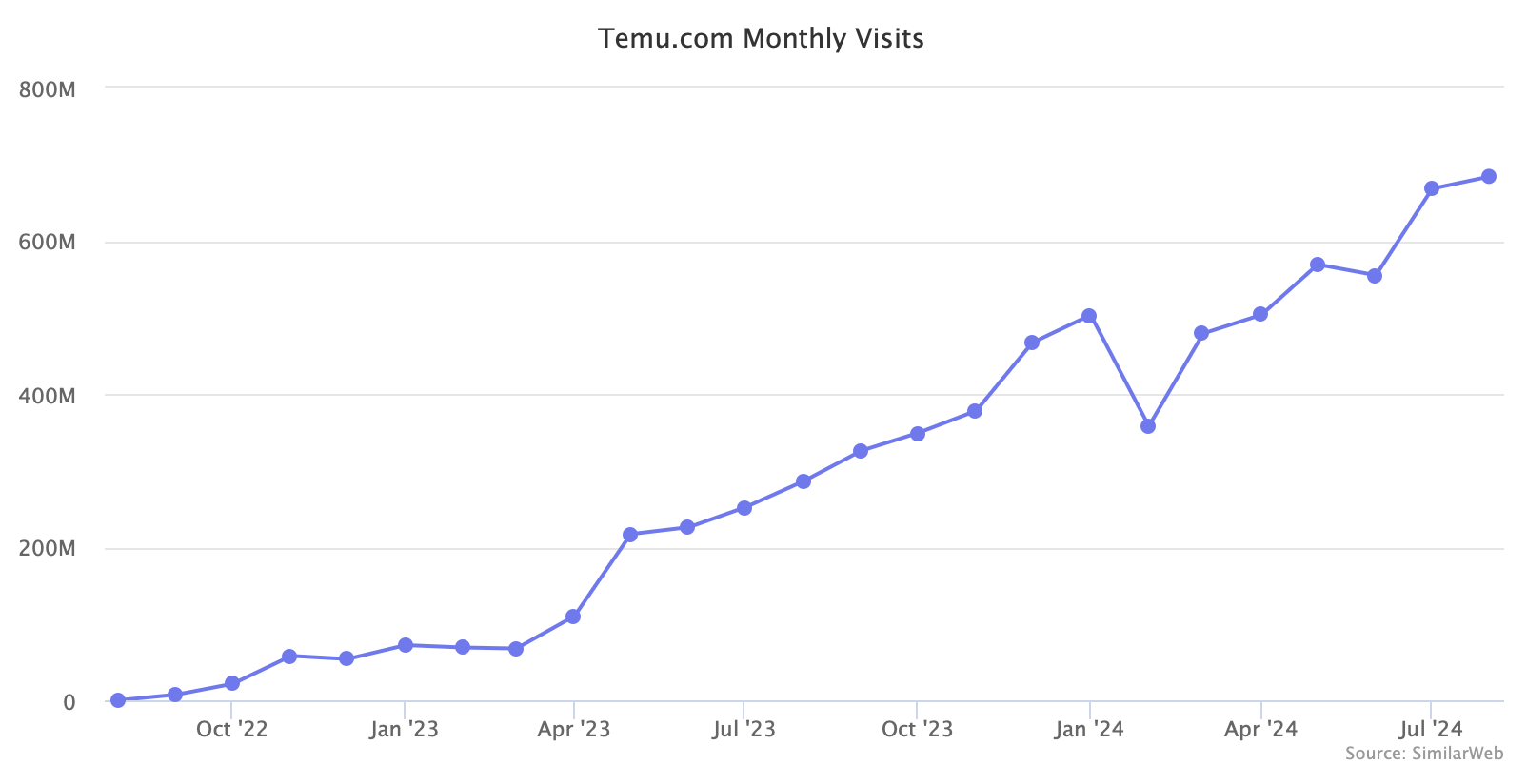

According to SimilarWeb data, Temu.com gets nearly 700 million monthly visits. Only a quarter of that comes from visits in the U.S. — Temu operates in 79 countries. For comparison, Amazon.com attracts 2.7 billion visits, almost all from users in the U.S. While initially only selling in the U.S. when it launched, Temu is now a global retailer, and the U.S. represents only a minor part.

Temu’s sales presumably mostly happen on the app, not the website. So, its web traffic is only a component of the whole story. Many other e-commerce giants, especially in China, get little web traffic, so Temu’s status as 2nd most visited e-commerce website doesn’t make it the 2nd biggest online retailer. Temu has set a $60 billion sales goal for this year, an order of magnitude smaller than Amazon’s. But reporting in China has hinted that Temu aims to become 2nd only to Amazon in the U.S. and number one in Europe.

Temu became the most downloaded shopping app in the U.S. just weeks after launching in September 2022. It has since held the top spot every day for nearly two years. It now ranks number one in most of the almost 80 countries in which it operates.

Temu got to 700 million monthly visits with a strategy that had an expiration date because of how obviously unprofitable and exposed to regulatory risk it was. When Temu launched, it was an ultra-cheap direct-from-China marketplace. But today, 20% of Temu’s U.S. sales already come from local warehouses in the U.S., reported The Information, at prices only slightly lower than Amazon. Built on the de minimis threshold, it might no longer need it once countries overhaul it.

Web traffic and app downloads are not revenue or profit. But they indicate ambition. Having gotten big, Temu is switching out what it is.