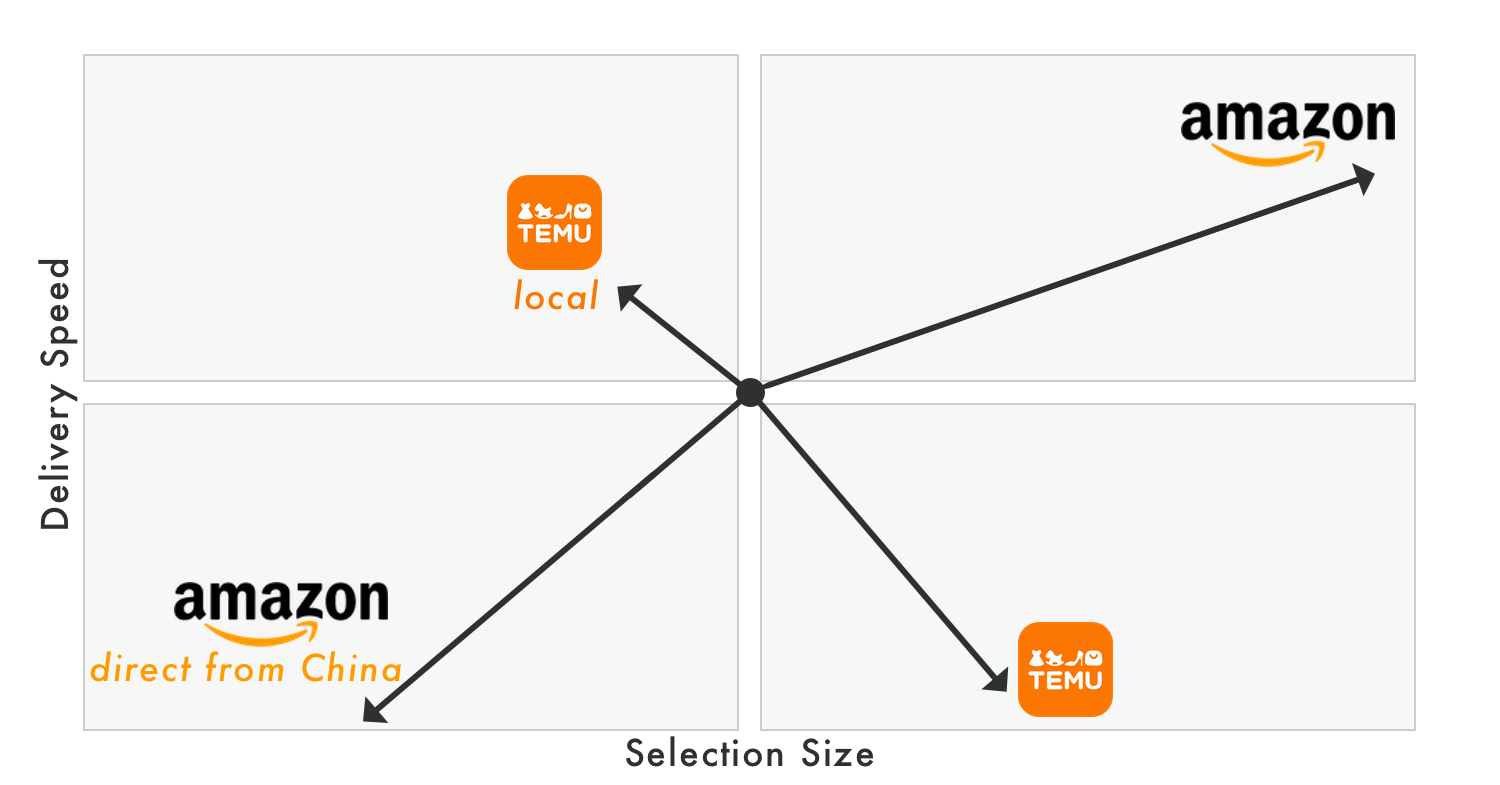

Temu wants to be more like Amazon, to reduce supply chain risk and offer faster shipping, while Amazon is racing to replicate Temu because it cannot ignore the fact that its low prices trump Amazon’s convenience for some shoppers.

20% of Temu’s U.S. sales now come from local warehouses in the U.S., not China, according to two people close to Temu, reported The Information. It was 0% at the start of the year. That’s a massive and fast change for a marketplace that only started onboarding local sellers less than four months ago in March. According to Marketplace Pulse research, local sellers account for most new sellers joining Temu.

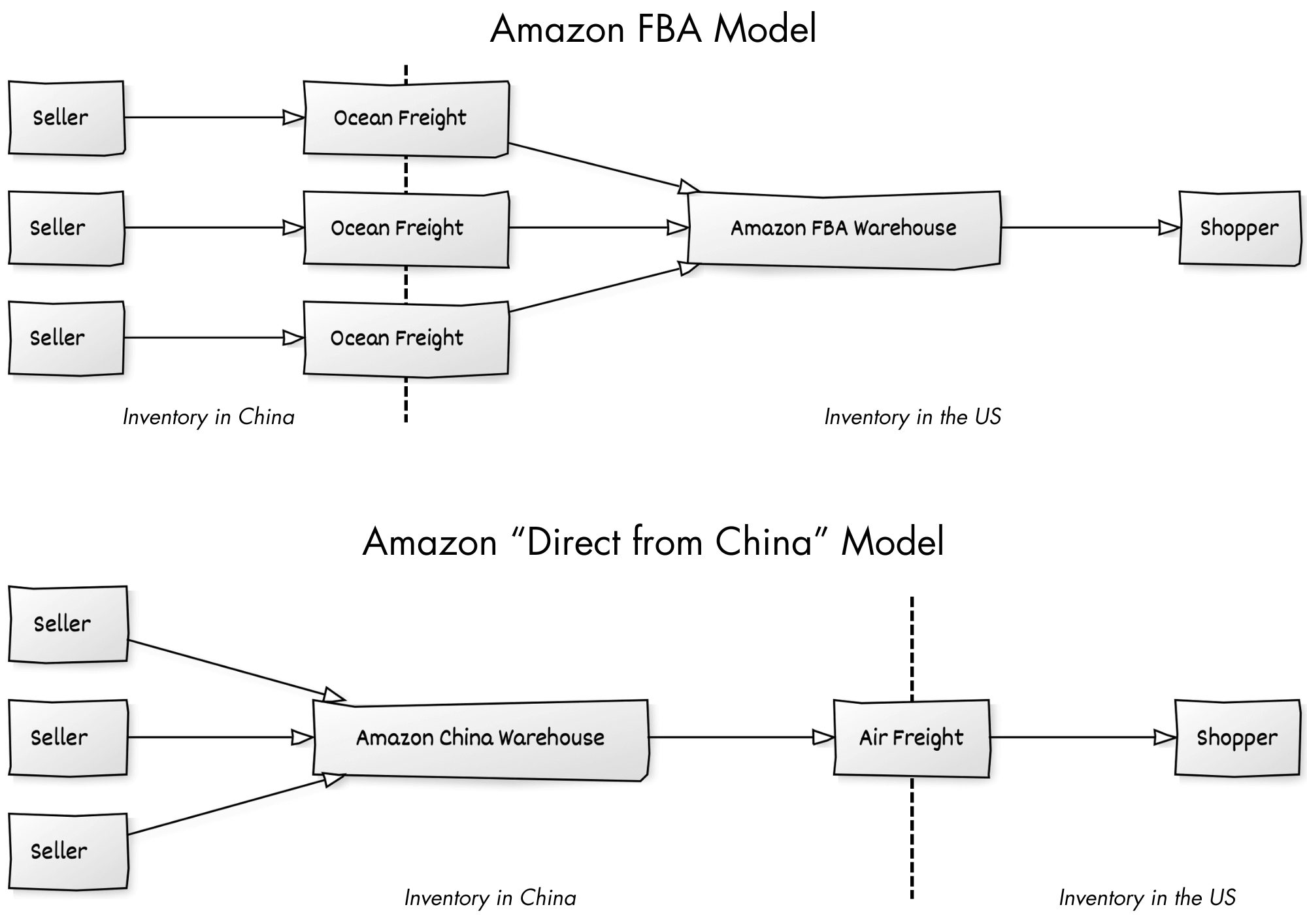

Temu is diversifying from the direct-from-China supply chain and thus reducing its reliance on duty-free shipments enabled by the de minimis threshold. The new local sellers are still Chinese businesses, but now they import goods wholesale and store them in domestic U.S. warehouses. Thus, they can also sell large items like furniture or e-bikes. Marketplace Pulse research shows Temu recently onboarded its first thousand U.S. sellers. However, they appear to be Chinese companies incorporated in the U.S.

Temu’s pivot is obvious on its homepage — 103 of the 120 recommended products ship from U.S. warehouses and thus arrive in less than five days. Most items on the deals and best-sellers pages are fulfilled locally, too. The goods are mostly the same, but they no longer ship to customers directly from factories in China. The factories first import them to the U.S. According to reports in China, Temu’s sales from local warehouses will be on par with direct-from-China volume in six months.

Meanwhile, Amazon is setting up the same Chinese supply chain as Temu’s to better compete on price because it cannot match Temu while paying customs duties and domestic warehousing costs. It is replicating Temu’s supply chain, while Temu appears to be moving away from it.

Amazon will launch a separate section inside the Amazon app and website for low-priced, slow-shipping items. They will ship from warehouses in China directly to shoppers in the U.S., giving up fast delivery for significantly lower prices. Amazon has been the primary channel for Chinese sellers to reach shoppers in the West for nearly a decade. According to Marketplace Pulse research, they represent 50% of the top third-party sellers on Amazon. Until now, goods sold by Chinese merchants always involved FBA warehouses. The new marketplace introduces an alternative path.

Direct-from-China enables on-demand manufacturing and consumer-to-manufacturer (C2M) retail that wholesale imports cannot handle. It enables faster and iterative creativity at the cost of slower delivery. Shein’s ultra-fast fashion is built on this, as it introduces thousands of new designs daily while only manufacturing low quantities. The model would break if it had to import all of them to domestic warehouses first. Amazon is exploring this for the same reason — not everything needs to flow through FBA, and different things can be created when they don’t need to be made in large quantities.

Temu is not abandoning direct-from-China. It is playing defense against regulators that threaten to scrap de minimus thresholds and playing offense by expanding price points and the types of goods it can sell. It got its first users by offering uber-cheap goods, but it was inevitably going to move beyond that. It is giving up some price advantage to provide more convenience.

Meanwhile, Amazon is not abandoning Prime, but it cannot deny that the supply chain model perfected by Temu and Shein is part of modern retail. It’s not the whole thing — which is why Temu itself is moving beyond it — but it enables manufacturing and prices FBA cannot support. Yet, Amazon said it will not add direct-from-China results to the main search so this will remain a low priority.

Amazon hopes to figure out social commerce before social networks like TikTok can solve shopping. Here, too, Amazon hopes to support direct-from-China retail before Chinese apps like Temu and Shein can transform into fast-delivery competitors.