Amazon will launch a Temu, Shein, and AliExpress competitor featuring low-price items shipped directly from China. Amazon’s main quest remains Prime, but it has accepted a new side quest.

Amazon will launch a separate section inside the Amazon app and website for low-priced, slow-shipping items. They will ship from warehouses in China directly to shoppers in the U.S., giving up fast delivery for significantly lower prices. On Wednesday, Amazon hosted select sellers in Shenzhen in an invite-only event to present the idea of a new marketplace model. Subsequently, a few sellers leaked the presentation materials. According to the presentation, the new marketplace will offer unbranded fashion, home goods, and daily necessities at under $20 and lighter than one pound.

Amazon has been the primary channel for Chinese sellers to reach shoppers in the West for nearly a decade. According to Marketplace Pulse research, they represent nearly 50% of the top third-party sellers on Amazon. Until now, goods sold by Chinese merchants always involved FBA. The new marketplace introduces an alternative path.

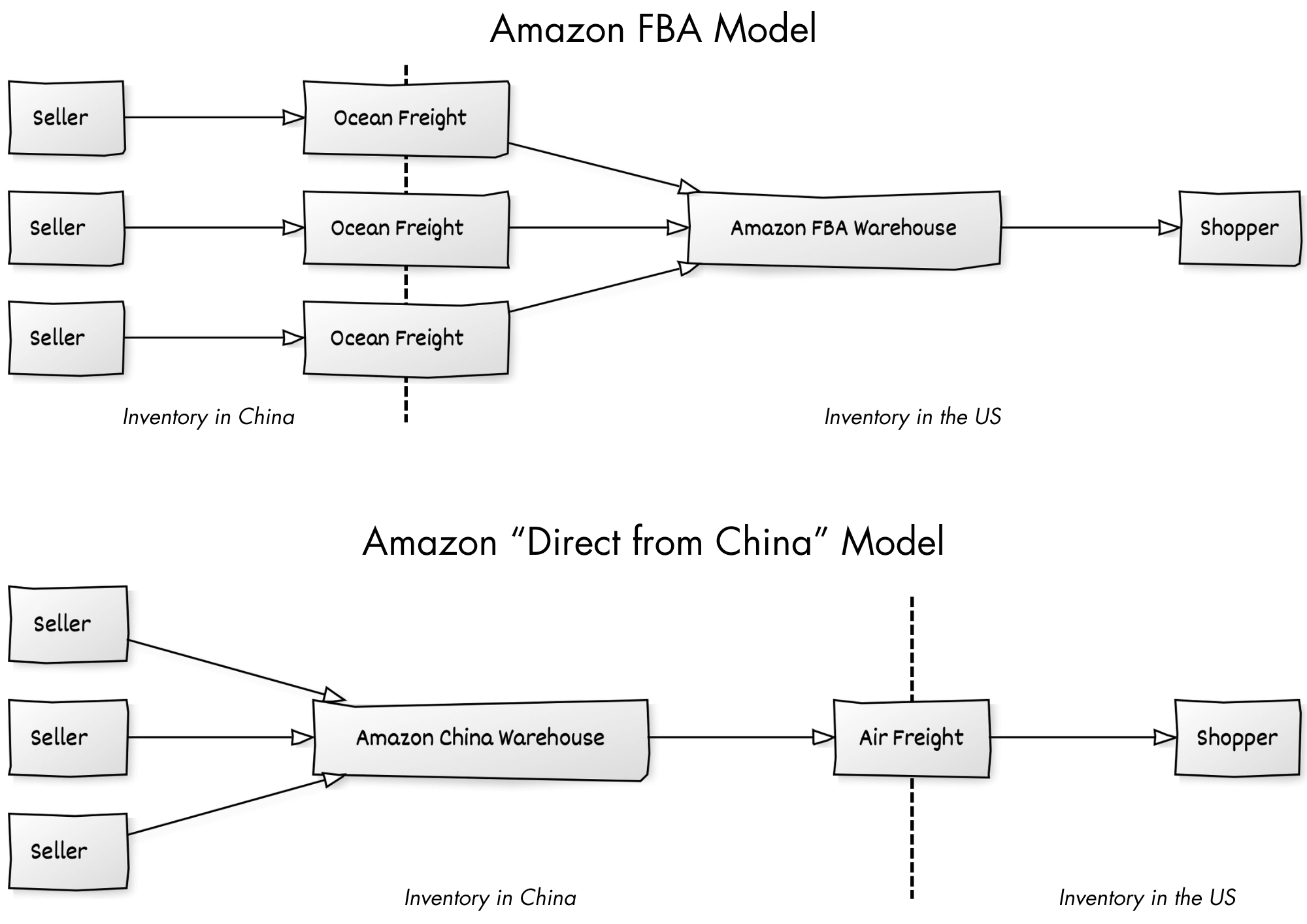

Fulfillment by Amazon (FBA) was supply chain integration at the destination; this will be integration at the source in China. Millions of sellers individually ship inventory using ocean freight from China to FBA warehouses to be ready for two-day or faster domestic delivery. Now, sellers will be able to ship to Amazon’s warehouses in China, from where customer orders will be shipped using air freight and reach shoppers in the U.S. in 9-11 days and under the de minimis threshold and thus tariff-free. The new marketplace is similar to the Temu, Shein, and AliExpress fully-managed marketplaces, where sellers offload products to the marketplace, but on Amazon, they’ll retain pricing and selection control.

Last year, Amazon lowered the transaction fee it charges sellers from 17% to just 5% for under-$15 apparel items as a reaction to Shein. However, this was a half-solution because Shein’s offer is not just low prices but, more crucially, fast iteration through small batch production. The new direct-from-China marketplace is a full solution. It addresses Shein’s core advantage in categories like clothing, which benefit from shipping directly from China to get lower prices, more dynamic selection, and less inventory risk for sellers.

Whenever you change the supply chain model, selling patterns change — brands do not sell the same things in department stores as on Amazon, nor do they sell the same things on Amazon as on Shein. Price and delivery speed are not the only dimensions; supply chains also inform what gets made.

Chinese retail apps can’t match Amazon’s one-day or two-day delivery, but they can offer bargain prices while taking a week to deliver. Amazon sells products with fast shipping; Temu, Shein, and AliExpress sell products with slow shipping. Shipping speed is inseparable — the logistics are as much part of the product as the products themselves. The only way Amazon could match prices was to replicate the supply chain advantage.

The reason an identical product costs $7 on Temu versus $20 on Amazon is not because they are sourced from different manufacturers. They are the exact same product. It costs more on Amazon because Amazon is more convenient, and that means there are higher fees for sellers to pay for that convenience. Amazon spent decades and hundreds of billions on a bet that convenience is worth the higher price. They were right: “In March, nearly 60% of Prime member orders arrived the same or next day across the top 60 largest U.S. metro areas,” wrote Doug Herrington, CEO of Worldwide Amazon Stores.

Meanwhile, Temu, Shein, and AliExpress have bet — correctly — that a segment of customers are willing to pay less and wait longer to receive certain shipments. Estimates put the combined global sales of Temu, Shein, and AliExpress at nearly $200 billion this year. The supply chain integration at the source has allowed them to offer reliability, consistency, and speed unseen on early attempts by eBay, Wish, and AliExpress, where items would take weeks to deliver and sometimes would fail to show up. A year ago, Amazon said Temu didn’t meet its standards and was thus excluded from the fair pricing policy, but today, Temu has forced its hand.