Amazon acknowledged the Chinese seller market share on its marketplace for the first time, calling it “significant.”

In the annual Form 10-K filing with the SEC, Amazon added new language to the warning about the risks its international operations expose it to.

“[B]ecause China-based sellers account for significant portions of our third-party seller services and advertising revenues, and China-based suppliers provide significant portions of our components and finished goods, regulatory and trade restrictions, data protection and cybersecurity laws, economic factors, geopolitical events, security issues, or other factors negatively impacting China-based sellers and suppliers could adversely affect our operating results.”

Third-party seller services revenue is transaction and fulfillment fees collected from marketplace sellers. In 2023, third-party seller services revenue was $140 billion. Sellers also bought advertising services totaling $47 billion in 2023 (not all of this was from sellers - a big part of Amazon’s advertising revenue comes from first-party brands).

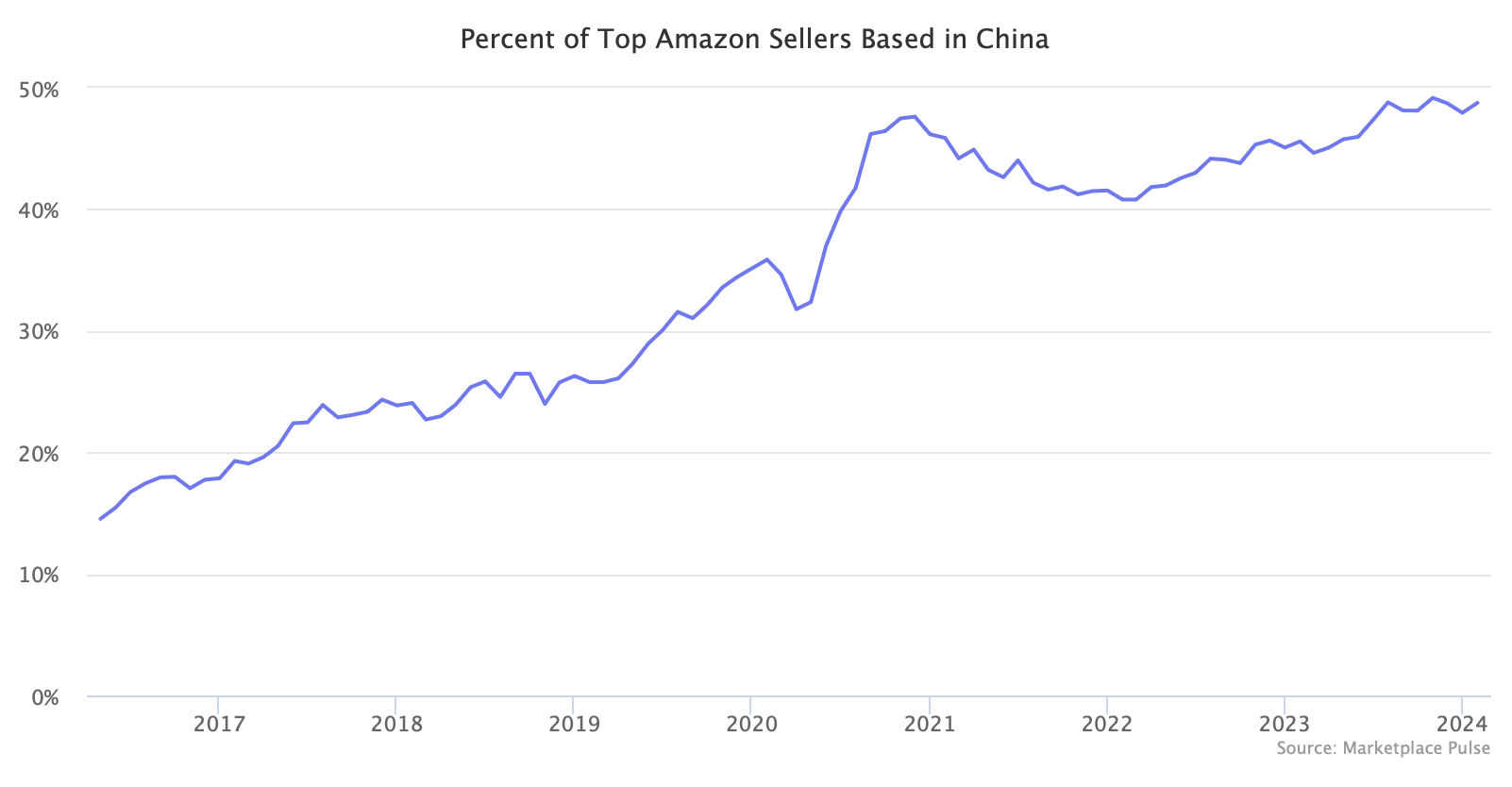

China-based sellers represent nearly 50% of the top 10,000 sellers on Amazon in the U.S., a cohort that likely drives almost half of the third-party GMV, based on Marketplace Pulse research. Amazon’s new disclosure loosely confirms that. While their share has not increased much over the past few months, it has been growing steadily since the start of tracking in 2016. Their market share on Amazon’s other twenty international marketplaces is lower than in the U.S., but only by a small amount, and they also exhibit an increase over time.

Amazon is a retailer that, like other retailers, sources many of the goods it sells from China-based suppliers and domestic brands with manufacturing in China. Most are well aware of this. Amazon added the new disclosure because China is no longer just a manufacturing source but also a direct participant in the West in retail, technology, entertainment, and more. That’s not yet well understood.

Invisibly, Chinese-American tech interdependence - on Amazon and elsewhere - has been increasing, as John Herrman put it at the Intelligencer. Meta said China accounted for 10% of Facebook’s and Instagram’s advertising in 2023. That’s $13.69 billion. It was 6.5% in 2021 and 2022, presumably because Temu had yet to launch. Like Amazon, they were acknowledging it for the first time. “The online commerce and gaming verticals benefited from strong demand by advertisers in China reaching people in other markets,” said Susan Li, Meta’s chief financial officer.

Amazon put it in the risk section, but its significance is not the risk or share of revenue. Instead, it is the signal of evolving retail trade. “For decades, factories in China made goods that filled the shelves of U.S. retailers and brands. The next phase is factories that used to make products for retailers like Walmart or brands like Nike, selling them directly to shoppers through platforms built to serve them.” Whether it is 40%, 50% or 60% of Amazon’s GMV is not as noteworthy as the significant scale of direct-from-China retail through Amazon, Shein, Temu, AliExpress, TikTok Shop, and other marketplaces.