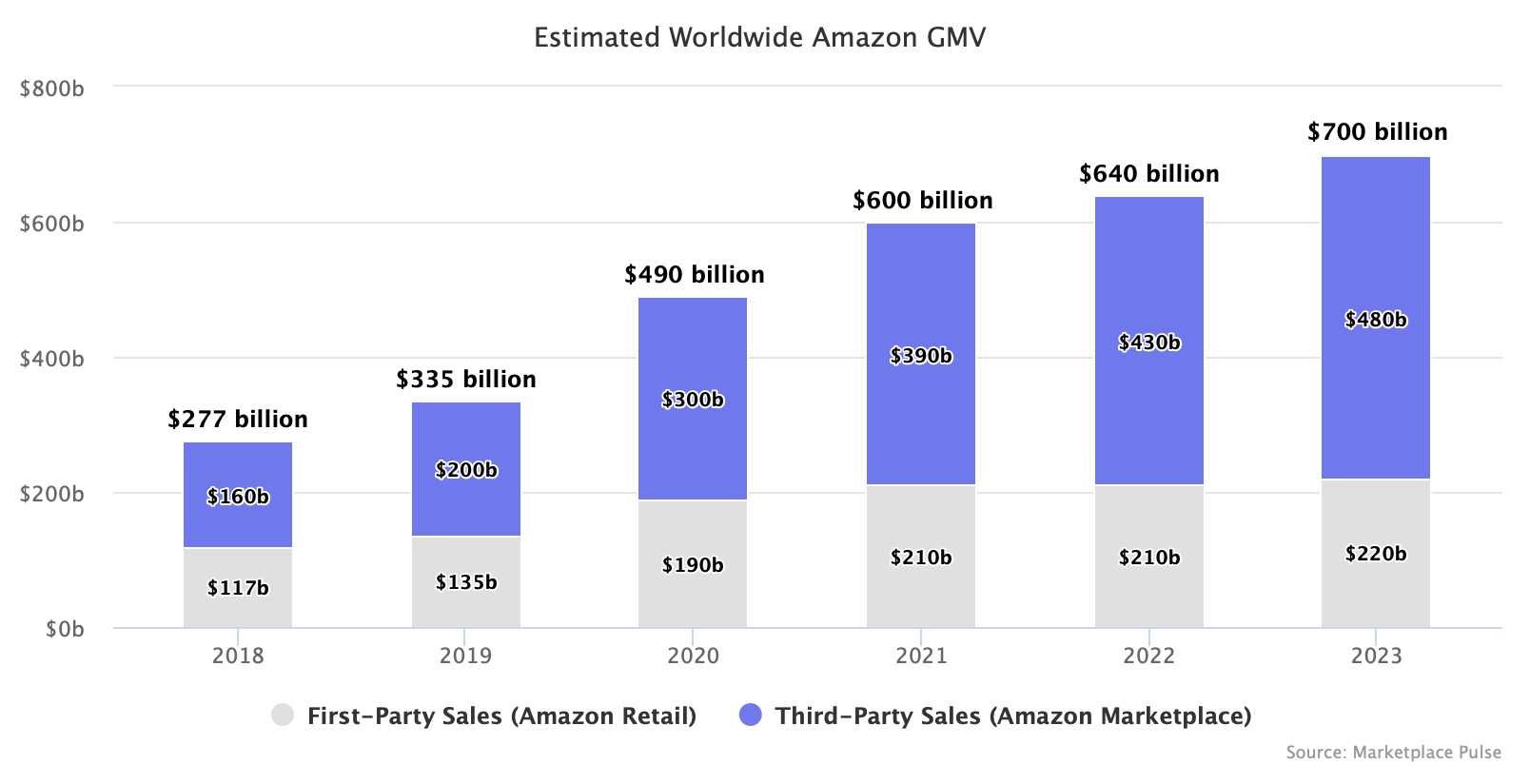

Amazon and its sellers sold $700 billion worth of goods in 2023. Gross merchandise volume (GMV) has more than doubled in four years; most of that growth came from the third-party marketplace.

According to Marketplace Pulse estimates based on Amazon disclosures, in 2023, sales by Amazon (also known as first-party sales) reached $220 billion, up 6% year-over-year, and third-party marketplace sales reached $480 billion, up 13% year-over-year. Total worldwide GMV was $700 billion, up 11% year-over-year. GMV estimates are crude calculations and only serve to approximate Amazon’s scale. It discloses first-party sales but reports marketplace sales as revenue from transactional and fulfillment fees collected. The ratio of fees to sales is a Marketplace Pulse estimate based on historic sales adjusted for fees increasing over time.

Amazon is big and continues to get bigger, even if in markets like the U.S., it is no longer carving out more market share. But it is the marketplace that plays the key role. Since 2019, sales on Amazon grew by an estimated $365 billion and thus more than doubled. Yet the third-party marketplace alone was responsible for roughly 75% of that incremental GMV. For years, Amazon has been on a controlled yet slow shift away from 1P sales to 3P sellers. Over the past eight years - since the marketplace overtook retail sales in 2016 - sellers have been gaining 150 basis points in market share every year. The shift hadn’t accelerated or slowed, except for 2020, when it struggled to keep its warehouses operational and restricted many sellers from sending in inventory.

The undercurrent of all this is Amazon’s fulfillment prowess. In 2023, it said it delivered “at the fastest speeds ever, with more than 7 billion items arriving same or next day.” But more importantly, “for the first time since 2018, we’ve reduced our cost-to-serve on a per unit basis globally. In the U.S alone, cost-to-serve was down by more than $0.45 per unit compared to the prior year,” said Andrew Jassy, CEO of Amazon. It is delivering faster and more effectively, which serves the marketplace, too, since most sellers use Amazon for fulfillment.

Andrew Jassy added, “It’s not hard to lower prices; it’s hard to be able to afford lowering prices,” when discussing fourth-quarter results. The statement celebrates per-unit cost-to-serve reduction and digs at Shein, Temu, and TikTok’s attempted e-commerce disruption. Low prices remain one of its pillars, but on Amazon, shipping is as much part of the product as the products themselves and their price. It doesn’t compete with Shein, Temu, and TikTok on price alone. And thus, the 7 billion items arriving the same or the next day are where the estimated $700 billion comes from.