The original class of Amazon Aggregators now span from bankruptcies to success to pivots. None call themselves aggregators anymore.

Thrasio and the more than 100 firms that followed it set out to acquire dozens or hundreds of Amazon brands each. When Fortunet, an investment banking firm, surveyed aggregators in 2021, their responses suggested 1,000 acquisitions in 2022. The majority of the aggregators intended to purchase more than 15 businesses. Few achieved that goal after many started experiencing difficulties when it became clear that operating the acquired businesses took much more work than attracting capital in the 2021 funding environment.

Today, practically none of the Amazon aggregators are aggregating - growing through acquisitions. Most are not buying at all or only rarely. Due diligence has evolved, and not every business is buyable - cash flow is not created equal, and EBITDA multiples don’t capture that. Most would buy one big business rather than multiple smaller ones. Their focus has shifted to growing their existing portfolio, launching products, expanding to new channels, and more. They are operators. While initially, most acquisitions were asset deals, they are now trying to keep the founders and teams, too.

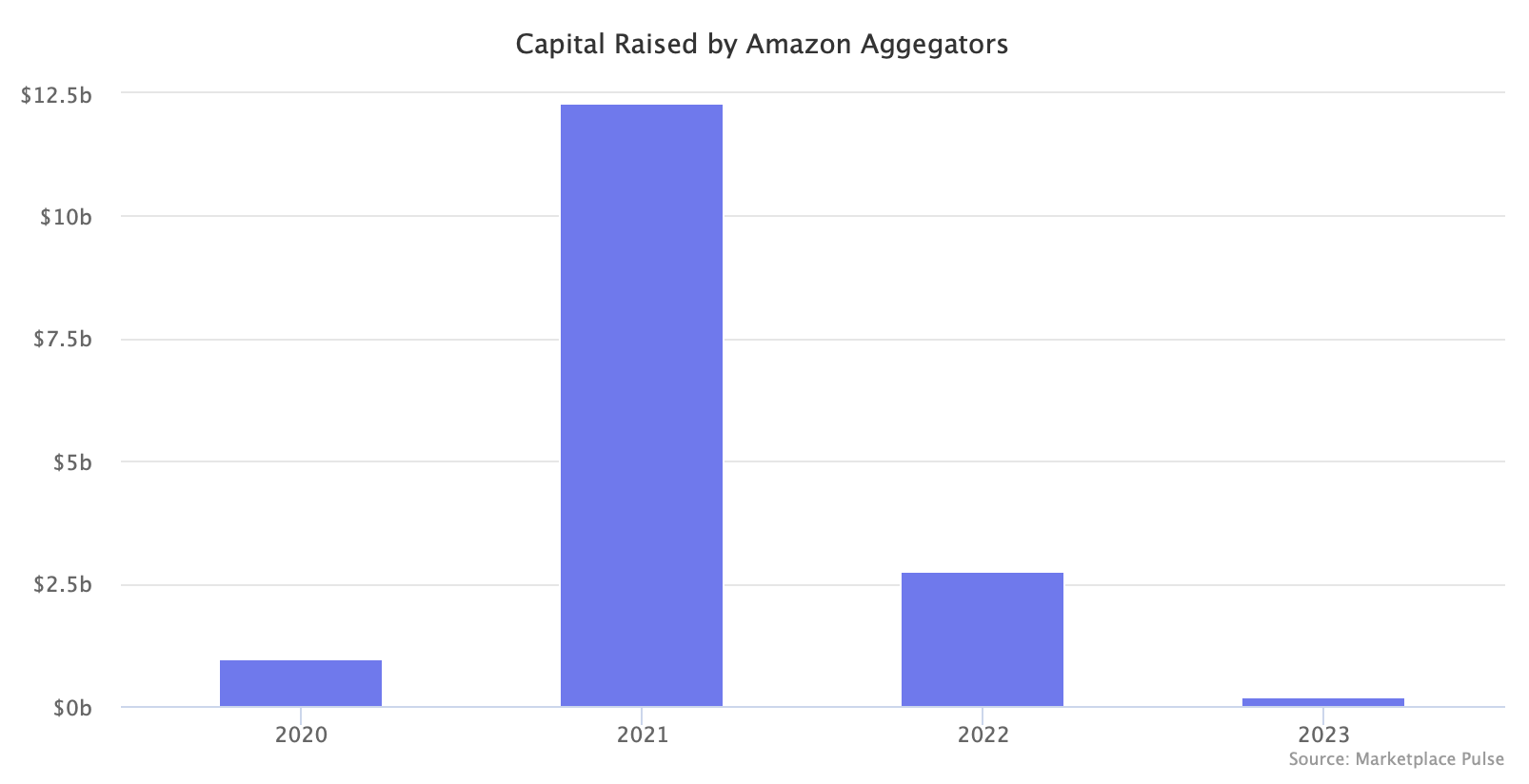

Amazon Aggregators attracted over $16 billion in capital, almost all in 2021, based on public statements analyzed by Marketplace Pulse. New funding was rare over the past two years and was often no longer announced. There was more than $16 billion raised, but now, quietly. Counting deployed capital and dry powder is hard. Most of the money raised was debt, which, for some, became inaccessible due to debt covenants. The big invisible factor is the interest rate of that debt because some firms got loans at variable interest rates while others locked in at low rates.

There are three distinct eras: pre-aggregator before 2021, aggregator boom in 2021, and post-aggregator since 2022. Each has clean-cut supply and demand ratios, valuation multiples, and capital inflows. Post-aggregator doesn’t mean aggregators are gone. Instead, the term “aggregator” is gone, and acquisitions are not the focus for those that used to be called that. There are even new aggregators, buying dozens of brands a year, but now they represent an exception to the rule.

Every firm was lumped into an Amazon Aggregator bucket as a Thrasio-clone. But as Thrasio prepares to file for bankruptcy, according to The Wall Street Journal, after being the first, biggest, and fastest aggregator with the most capital, plenty are not as desperate. They are distancing themselves from Thrasio and the “aggregator” moniker. Both because aggregating is no longer their model and because “aggregator” has become a toxic keyword.

Amazon Aggregator hype cycle was a result of zero interest rates, an e-commerce growth burst, and an idea that putting a few dozen Amazon brands under one roof would lead to something. Conditions changed, and strategies adjusted. A dozen firms out of over a hundred found a way to make it work, some even profitably. The rest are battling or are one of the more than 40 dead aggregators, with more to come. The byproduct is an acquisition market that is still more active than pre-aggregator, even if non-aggregator buyers now likely represent the majority of closed deals.