None of the ads from Amazon’s $49 billion ad network won any awards at the prestigious Cannes Lions, but Amazon was the most visible company at the festival.

Amazon spoke at Cannes Lions, a week-long festival for advertisers, for the first time in 2020. At the time, its ads business was $14 billion. In 2022, it had grown to $32 billion, and Amazon built a separate 27,000-square-foot event space at the port in Cannes. The ad business is now $49 billion, and “The House of Amazon” was its biggest yet.

Cannes Lions would never consider Amazon and other ad networks, like Facebook (Meta), TikTok, and Google, for an award. Their advertising is in the performance marketing category. Most of the ads on Amazon are products boosted higher in search; of the first twenty products a shopper sees, only four are organic results. Advertising has also replaced product recommendations on Amazon. They don’t fit a festival celebrating creativity.

Amazon’s ad business grew 5x in five years and more than 50x in ten years. It launched an industry of agencies, tech tools, and other partners. Thus, Amazon’s presence at Cannes is best described as “a rising tide lifts all boats.” Or, “during a gold rush, sell shovels” because many sellers are unhappy with spending more on Amazon advertising every year, but the partner ecosystem is built on that.

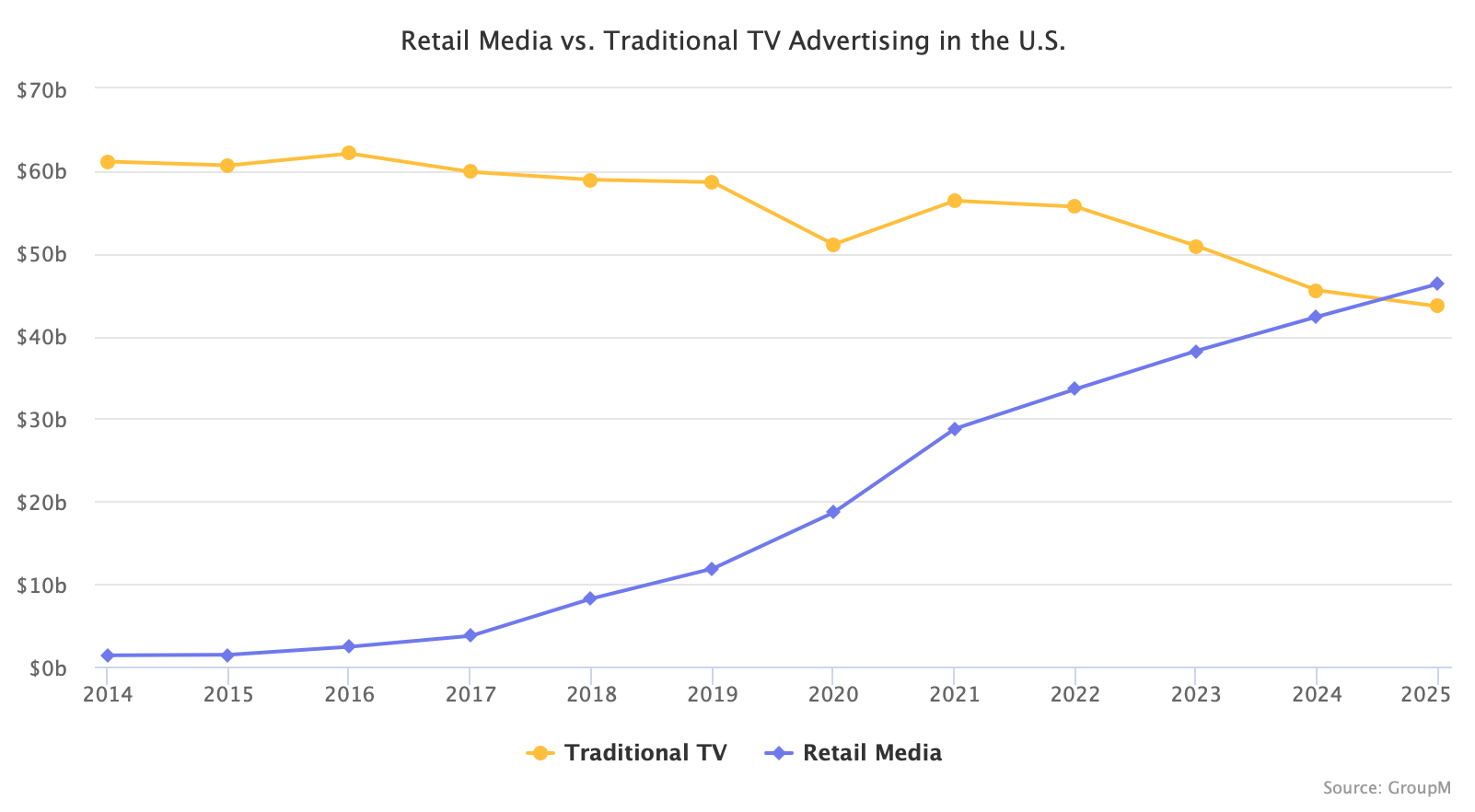

When people hear “advertising,” they imagine a Super Bowl ad, a beautiful, elaborate display promoting a big brand like Coca-Cola or Nike. But that type of advertising is dying. In 10 years since Amazon cautiously let brands boost their products in search, the advertising category (now called “retail media” as other retailers joined in) has nearly become the No. 2 ad spend channel. According to GroupM, ad spending in the U.S. retail media sector is expected to overtake traditional TV ad spending in 2025. The two largest advertising channels will be search led by Google and retail media led by Amazon.

“Everything is an Ad Network,” a catchphrase coined by mobile marketing guru Eric Seufert. Retailers like Walmart, Target, Kroger, Instacart, travel companies like Uber and United Airlines, and payment companies like Chase and PayPal want to replicate Amazon’s advertising network success. Retail media — covering both online and in-store — promises margins unheard of in retail and works well due to the troves of data available and the ability to measure sale attribution. “I can’t remember a business with the margin structure of the advertising business here at Walmart,” CEO Doug McMillon said in 2022. They were all at Cannes, hosting meetings to get brands interested and hoping Amazon agencies and tech tools would integrate their ad networks.

Years ago, tech companies took over Cannes Lions, and talks on artificial intelligence, data, tracking, and privacy replaced — or perhaps better said, expanded — many creative conversations. Snapchat, TikTok, Pinterest, Microsoft, Reddit, Google, Meta, and LinkedIn were there. Digital advertising overtook TV ad revenue a few years ago, and now it is retail media’s turn.

Ten years ago, the audience would have laughed Amazon out of the room at Cannes Lions — paying a few cents to boost a product in search results is not advertising. Cannes, a festival started in 1954, represented advertising as portrayed in Matthew Weiner’s “Mad Men” television series. But then, that uncreative advertising grew too big to ignore, while TV, radio, and publishing ads lost their relevance. They didn’t disappear, of course. They will continue to win awards at Cannes Lions.

Amazon has long been evolving past the simple sponsored product ad type. It added more ad types — even those that allow creative control — and can serve ads off Amazon. This year, it started showing ads for viewers on its Prime Video streaming service. Amazon didn’t belong at Cannes Lions, and now it awaits advertisers to bring their award-winning ads from shrinking TV advertising to Amazon.