Temu has started onboarding sellers with inventory in local warehouses rather than shipping from China. But there are no U.S. sellers yet. Instead, it is Chinese sellers with inventory in the U.S.

Since Temu launched in the U.S. in September 2022, it has used a consignment model requiring sellers to agree on wholesale pricing and ship goods in bulk to Temu’s warehouses. Temu then handles the listing, marketing, fulfillment, customer service, and pricing and pays the seller once someone orders their product. This model gave Temu control over quality, selection, and pricing but prevented it from onboarding sellers from other countries.

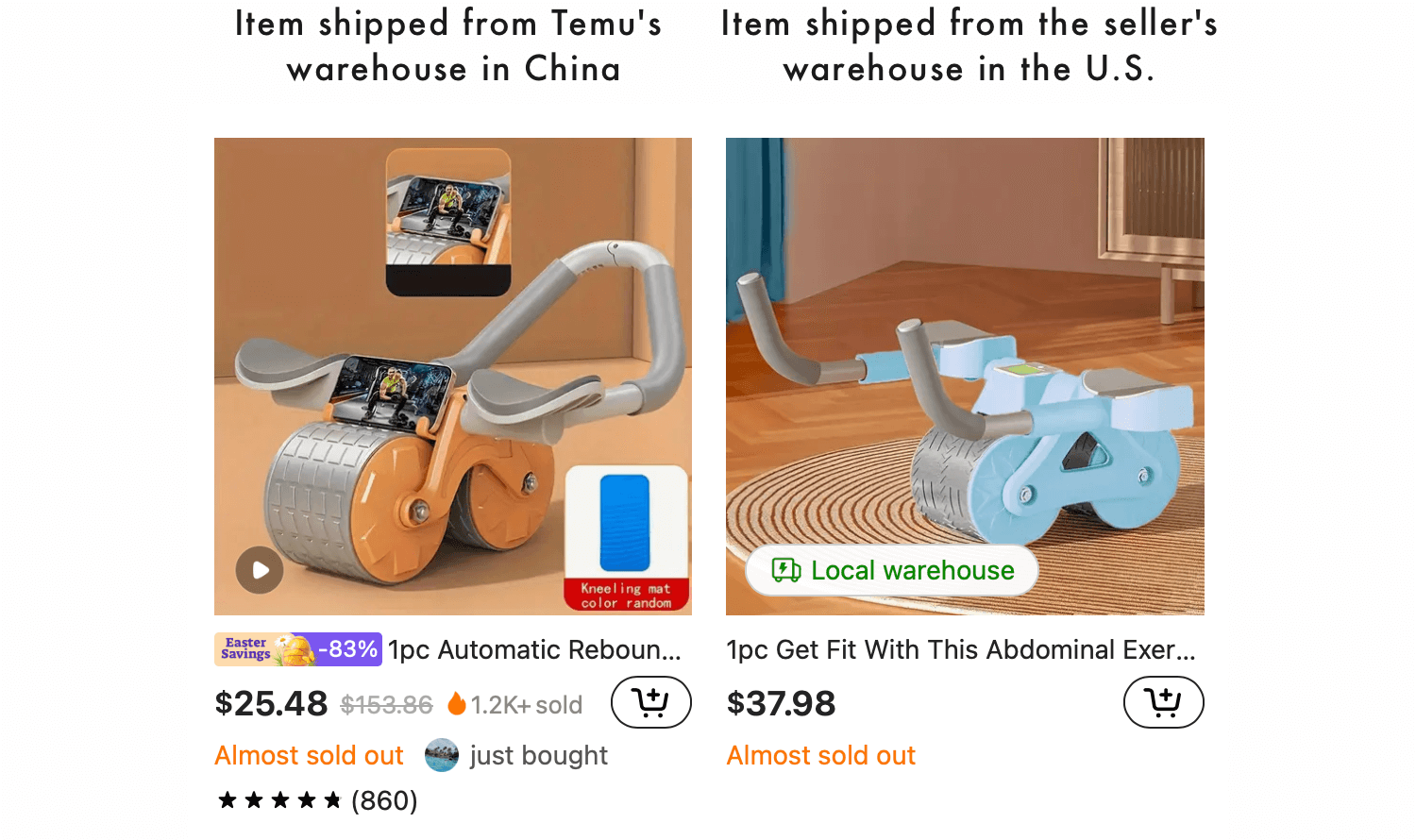

According to Marketplace Pulse research, Temu now has 1,000 sellers with inventory in the U.S. that join its 150,000 consignment sellers. On Amazon, some sellers use FBA for warehousing, while others handle their own fulfillment. Temu now has two types of sellers, too. The new second type, those that use owned warehouses or 3PLs in the U.S., make Temu a true marketplace comparable to Amazon or eBay. It will also allow Temu to onboard U.S. and European sellers (the same functionality is due to launch in Europe soon).

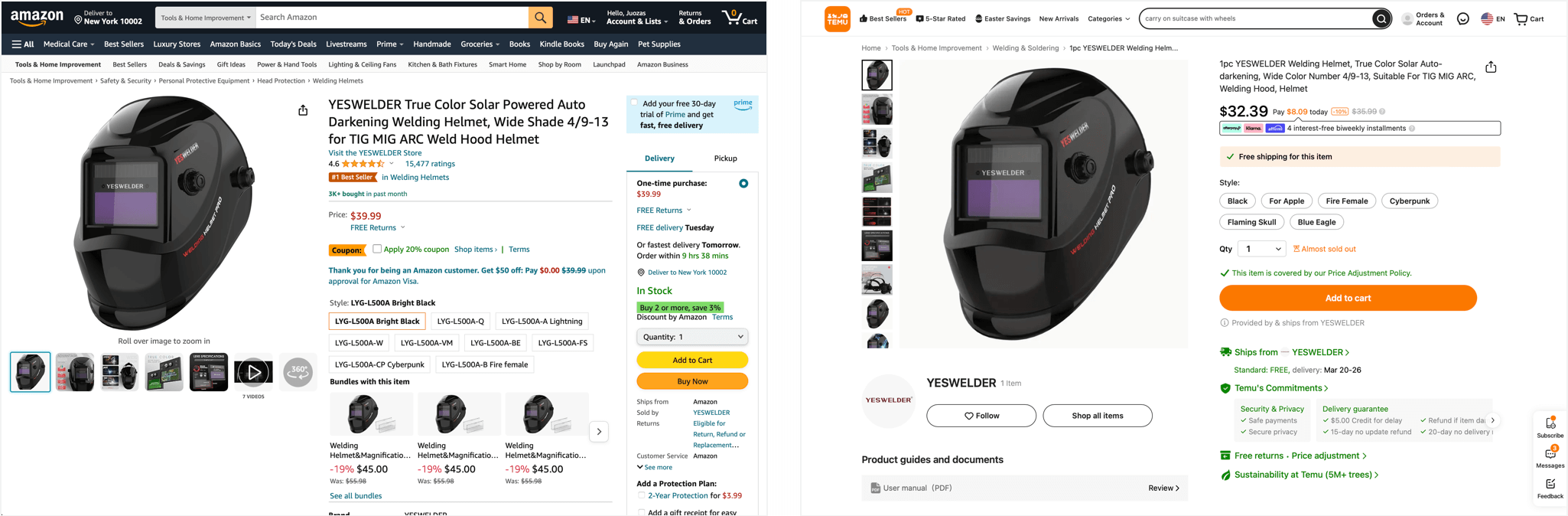

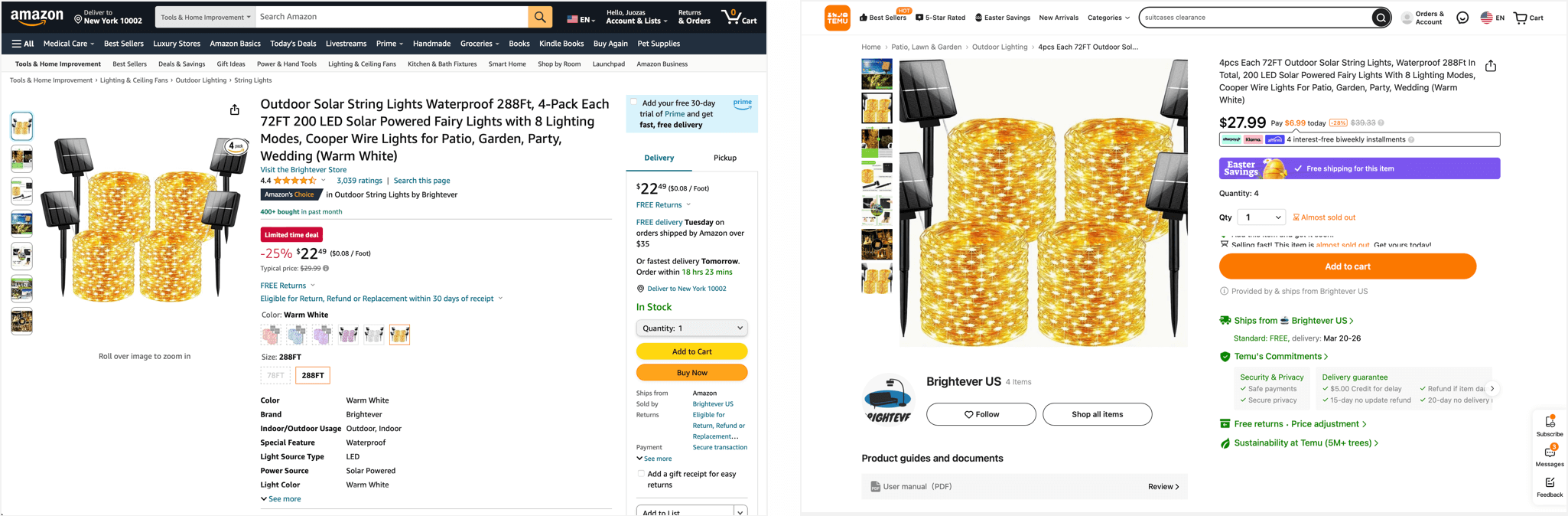

All 1,000 sellers on the Temu marketplace are based in China. Many were already selling on Amazon and thus had inventory in the U.S. Some are selling their products at higher prices than on Amazon, while others are offering them for less. However, none offer shipping as fast as on Amazon. That is expected to change, as quick delivery, an option absent from Temu today, is why Temu is evolving past the consignment model, which requires inventory to flow through its warehouses in China. Sellers with local warehouses are the lever to get that. Expanding the marketplace is less about the location of sellers and more about evolving past shipping each package from China.

100% of items sold on Temu today come directly from China - a likely unprofitable yet impressive feat of supply chain integration enabled by the consignment model. The marketplace allows Temu to decrease reliance on one supply source to avoid regulatory risk, offer faster shipping, and expand selection and price points. It will first try onboarding every Amazon seller, many of whom are China-based and nearly all with inventory in the U.S. It will also go after established brands; even if its rival, Shein, who has been onboarding brands since July last year, has made little progress.