Years ago, Jeff Bezos couldn’t imagine a customer saying, “I love Amazon, but if only they could deliver my products a little more slowly.” Today, it launched a Shein and Temu competitor called Amazon Haul, which does precisely that.

In October 2007, Harvard Business Review published an interview with Jeff Bezos. In the interview, Jeff Bezos said he often gets asked, “What’s going to change in the next five to ten years?” But he rarely gets asked, “What’s not going to change in the next five to ten years?” He knew that Amazon shoppers want selection, low prices, and fast delivery — and he was confident that won’t change. “I can’t imagine,” he said, “that ten years from now [our customers] are going to say, ‘I love Amazon, but if only they could deliver my products a little more slowly.’“

Amazon Haul is Amazon but delivered “a little more slowly.”

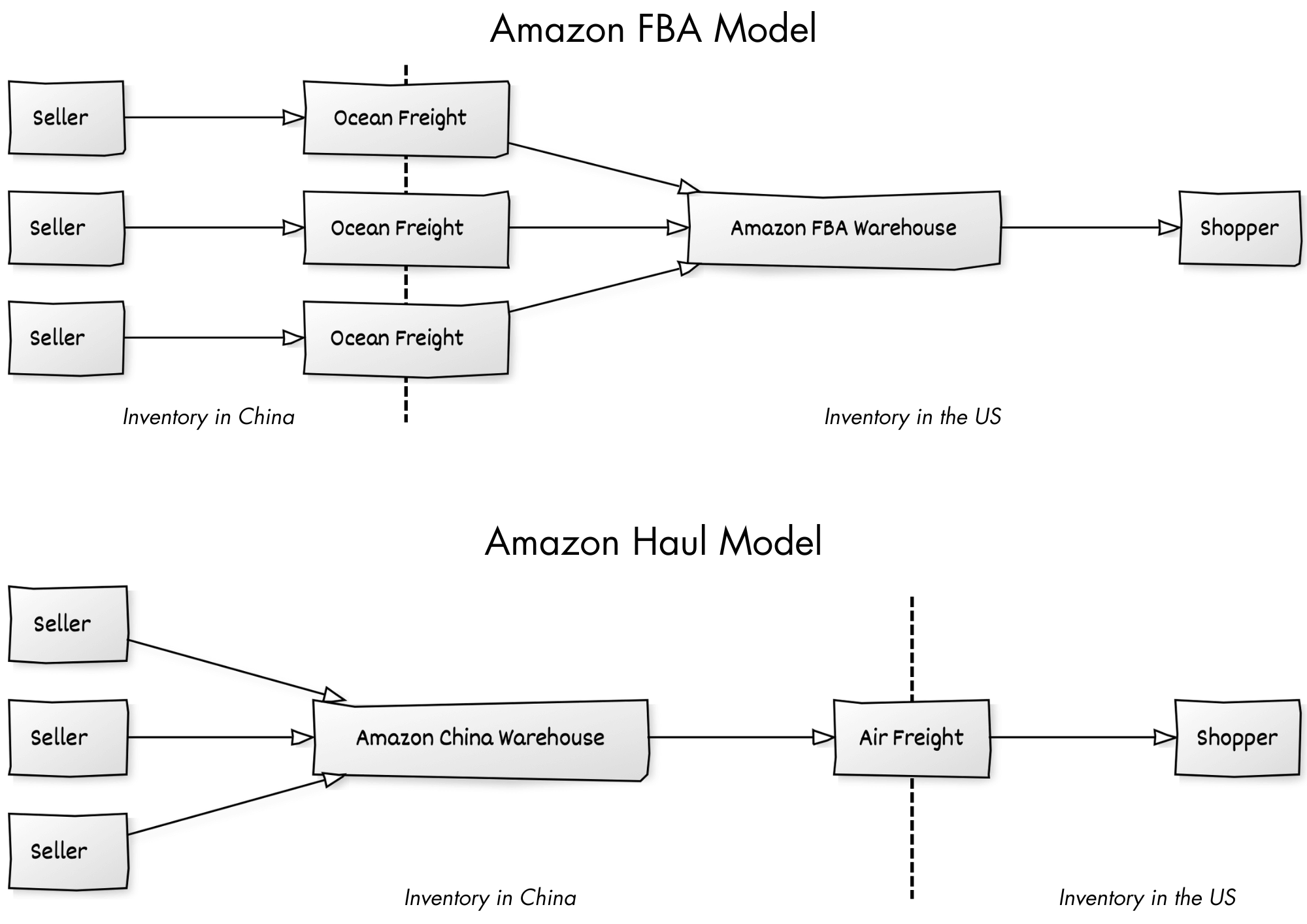

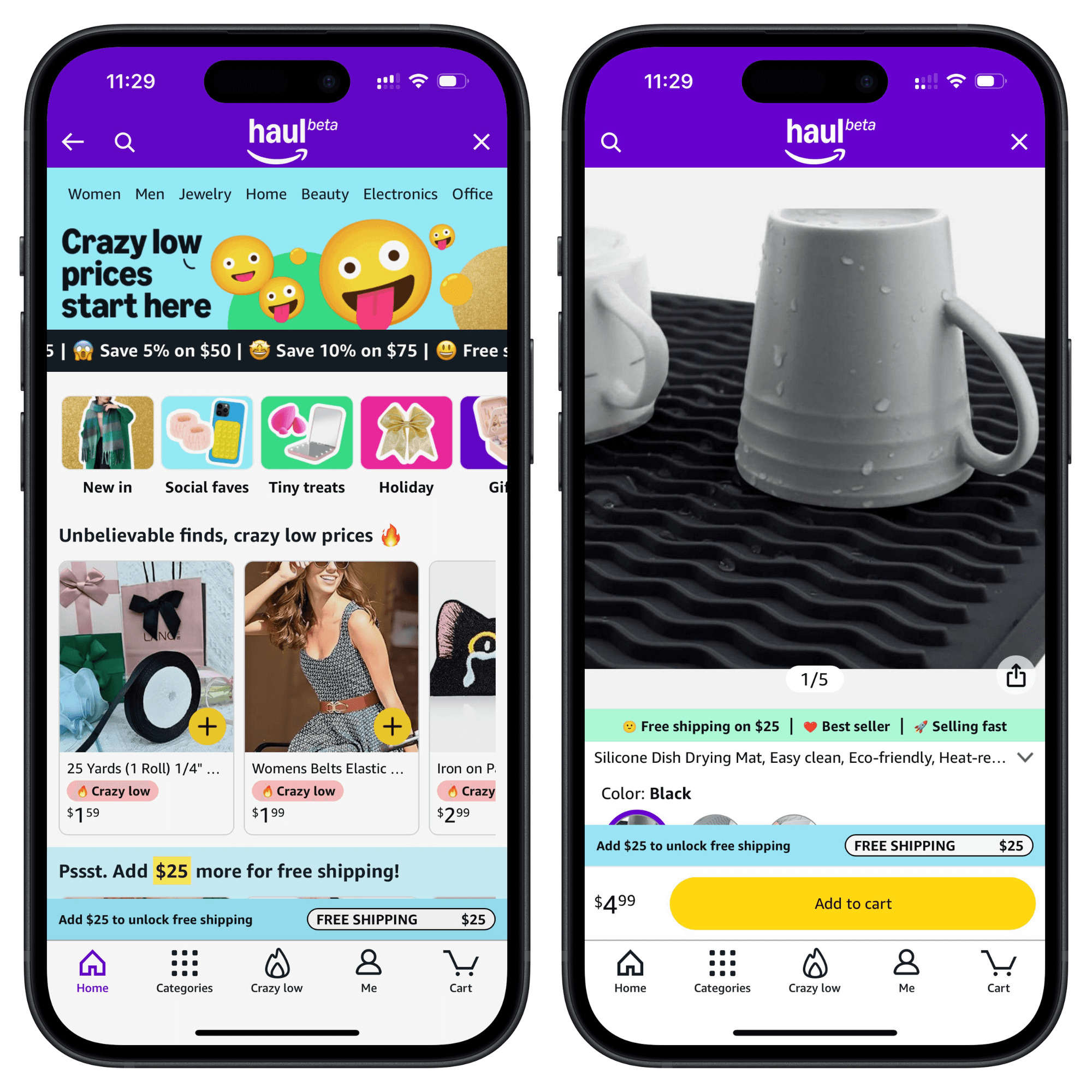

It sells unbranded low-priced items from its warehouses in China directly to shoppers in the U.S. The goods are the same as on the regular Amazon, sold by the same China-based sellers, but significantly cheaper because they won’t pay customs tax or get warehoused in the U.S., and delivered in one to two weeks rather than the same or the next day. It is the same supply chain model used by Shein and Temu, although according to The Information, nearly half of Temu’s sales in the U.S. now come from inventory imported wholesale, like the FBA model.

News of the upcoming marketplace first leaked in June when Amazon hosted select sellers in Shenzhen in an invite-only event. Subsequently, a few sellers leaked the presentation materials. Later, in October, Amazon revealed rules and requirements for its upcoming low-cost store, like price ceilings, fulfillment fees, and returns handling.

Amazon’s discount store is a reaction to competitors and an admission that e-commerce is not one-dimensional and not everything needs Prime and one-day shipping. Some shoppers — many shoppers, given the rapid rise of both Shein and Temu — prioritize price over fast shipping and convenience. Amazon is right to admit that cheap trumps fast for many people. But it is not best fit to serve them given the decades and billions it has spent optimizing for something else.

While Shein and Temu are squarely focused on serving cheap, that’s a side quest for Amazon. Amazon is already succeeding in its main quest: “Over 40 million customers this past quarter have had their orders delivered for free with same-day delivery, an increase of more than 25% year-over-year,” said Andrew Jassy, CEO of Amazon.

Amazon has many experiences hidden inside its app: Amazon Handmade, its Etsy competitor; Amazon Luxury Stores, which sells expensive fashion and beauty items; and even Amazon Inspire, a TikTok competitor. Amazon Haul adds to that list. Its low-priced items won’t appear in the regular product search — shoppers must first open the Haul store. It has historically lacked the aggression to push these new experiences to shoppers. That alone is why Haul might remain one of Amazon’s many niche experiences.

It benefits few if it grows up to be more than a niche. “In the logic of this new economy [direct from China retail], store clerks, marketing executives, furniture designers, importers, even Amazon-warehouse employees—everyone but factory and logistics workers in China—are seen as gatekeepers and middlemen standing in the way of people’s ability to keep buying more, cheaper stuff. The fact that it arrives a little slower is only a minor annoyance, one last thing for Shein and Temu [and for Amazon Haul] to take over and optimize,” wrote Louise Matsakis for The Atlantic.

This year, Temu spent tens of millions of dollars to run multiple ads during the Super Bowl. A drop in the bucket relative to its total ad spend but a seminal marketing move noticed by shoppers. Amazon will not buy Super Bowl ads for Amazon Haul next year.