Amazon has outlined the requirements for its upcoming Low-Cost Store. It will sell unbranded low-priced items from its warehouses in China directly to shoppers in the U.S.

News of the upcoming marketplace first leaked in June when it hosted select sellers in Shenzhen in an invite-only event. Subsequently, a few sellers leaked the presentation materials. It wasn’t just an idea — some sellers have already shipped inventory to Amazon’s warehouses in China, and sources speculate that Amazon is already testing it internally and might launch it publicly as soon as this year.

According to the latest documentation provided to sellers, Amazon’s Low-Cost Store, the official name for the marketplace, will operate as follows:

- Invite-only for sellers based on program eligibility criteria and capacity.

- Amazon fulfills all orders from inventory stored in an Amazon-operated fulfillment center in Dongguan, Guangdong province, China. Seller fulfillment is not available.

- No indication if the program is limited to Chinese sellers or if U.S. sellers with manufacturing in China can participate.

- Sellers must list all products with a brand name of “Generic.”

- Items are not part of the regular Amazon search and must be accessed as a separate storefront via the Amazon app.

- Items must not exceed 1 lb in weight or 14 x 8 x 5 inches in measurement.

- Items must not contain batteries, must not be ingestible (for example, food), or intended to go on the skin topically, and no items that require additional documentation for cross-border compliance, like baby, children’s, or pet products.

- Items have maximum eligible price points at the product-type level (nearly 700 types). For example, $14 shorts, $12 hair trimmers, $10 necklaces, $8 calculators, and $7 toothbrush holders. The most expensive categories are at $20. Listings above those price points will get deactivated.

- Listings can only be created using the spreadsheet upload tool. Creating or editing listings using the List Your Products tool or Listing APIs is not supported.

- Fulfillment fees are $0.50 for products 4 oz or less and under $3, $0.99 for apparel, and $0.88 for non-apparel for 4 oz or less and above $3. Products above 4 ounces start at $2.05 for apparel and $1.77 for non-apparel and increase based on weight. Plus, a $0.40 per cubic foot per month storage fee.

- The return window is 15 days from the date of item delivery. Products priced at $3 or less won’t be eligible for buyer returns.

- Returned items will be liquidated and not sent back to the seller. Inventory will be sent for donation or disposal if liquidation is not possible.

Amazon’s fulfillment infrastructure, built over the past two decades in the U.S. and elsewhere, is supply chain integration at the destination; Amazon’s Low-Cost Store is integration at the source. It starts in Guangdong, China, because, according to Marketplace Pulse research, Guangdong is home to 47% of the Chinese sellers on Amazon. According to the same data, Chinese sellers make up more than half of Amazon’s marketplace.

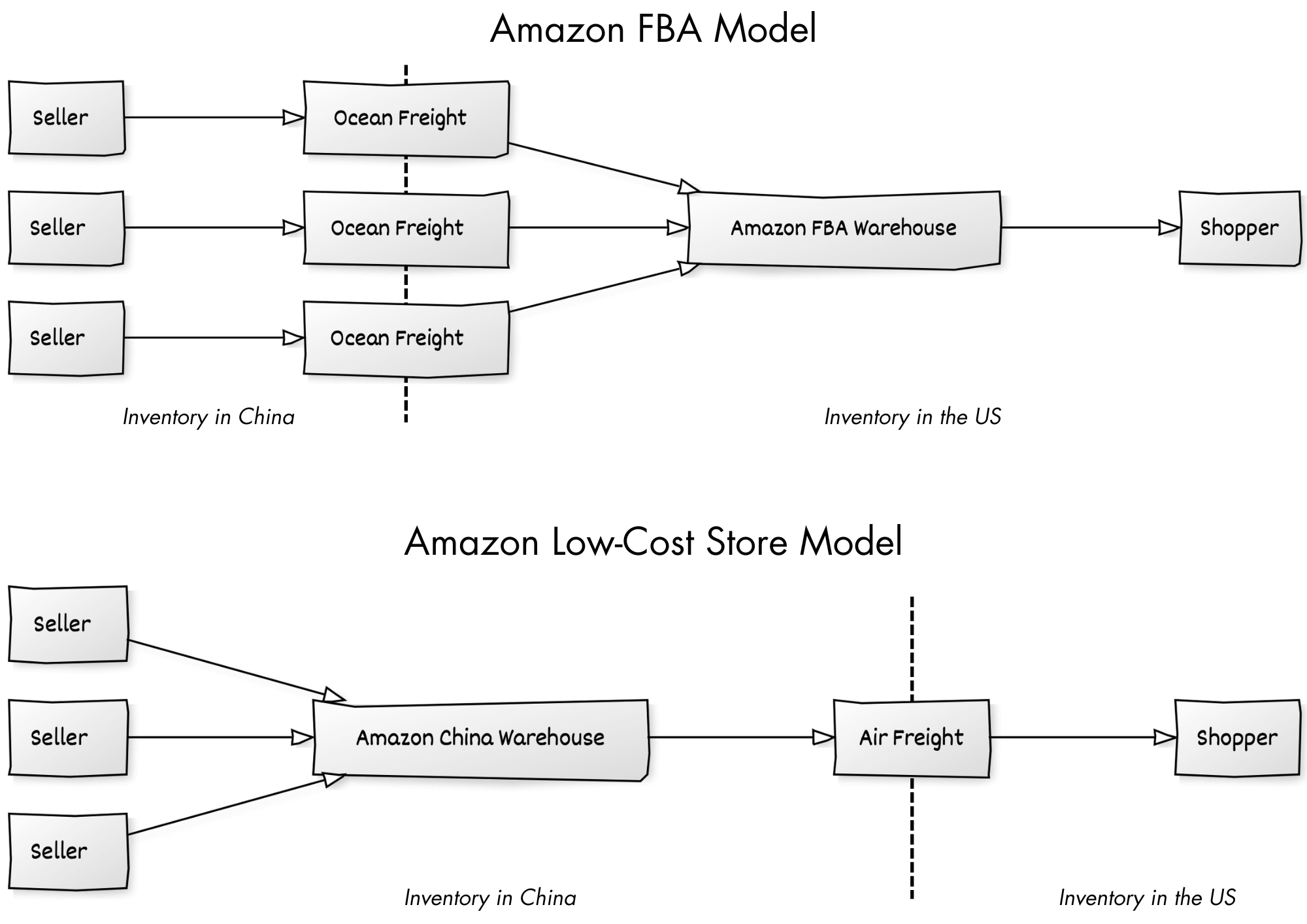

Before Low-Cost Store, most sellers — including sellers in China and U.S. sellers — individually shipped inventory using ocean freight from China to FBA warehouses to be ready for two-day or faster domestic delivery. Now, sellers will ship to Amazon’s warehouses in Guangdong, from where customer orders will be shipped using air freight and reach shoppers in the U.S. in 9-11 days, under the de minimis threshold, and thus, for now, tariff-free.

Amazon is doubling down on brandless commerce, which taught shoppers to look past brand names. It will sell the $8 calculators and $10 necklaces without the letter-salad brand names — like YTDRGB or ROTTOGOON — so common on Amazon. Although, despite the often unpronounceable gibberish brand names, some sellers have built recognizable brands among them. Now, the only brand will be “I bought it on Amazon.”

With no opportunity to build brands and no advantages over sellers in China, the new marketplace is not for U.S. sellers, even if Amazon doesn’t explicitly exclude them.

Before Temu and Shein, Amazon had been the channel for buying from China for a decade — even if it took the company until 2024 to admit its “significant” reliance on Chinese sellers. However, it optimized for fast delivery, hiding the disadvantage of slow supply chain speed using FBA but losing the pricing advantage. That worked incredibly well, but once Temu and Shein showed up, it was clear that some goods at some price points don’t need fast delivery — shoppers would happily wait to spend less.

Amazon’s Low-Cost Store picks the existing supply chain (China), integrates it at the source (lower fees than domestic FBA), strips away all branding (only “Generic” brand), narrows down the selection to low-priced items (per-category pricing caps, no items above $20), ships in 9-11 days rather than one (no customs tariffs), and does away with returns (returnless refunds or liquidated inventory). It is a digital dollar store, but with Amazon’s reach, selling the same goods shoppers have been buying from Amazon for years for less.