Amazon taught shoppers to look past brand names, laying the foundation for the rapid growth of Temu. It made buying no-name products the norm, and Temu is now selling them for less.

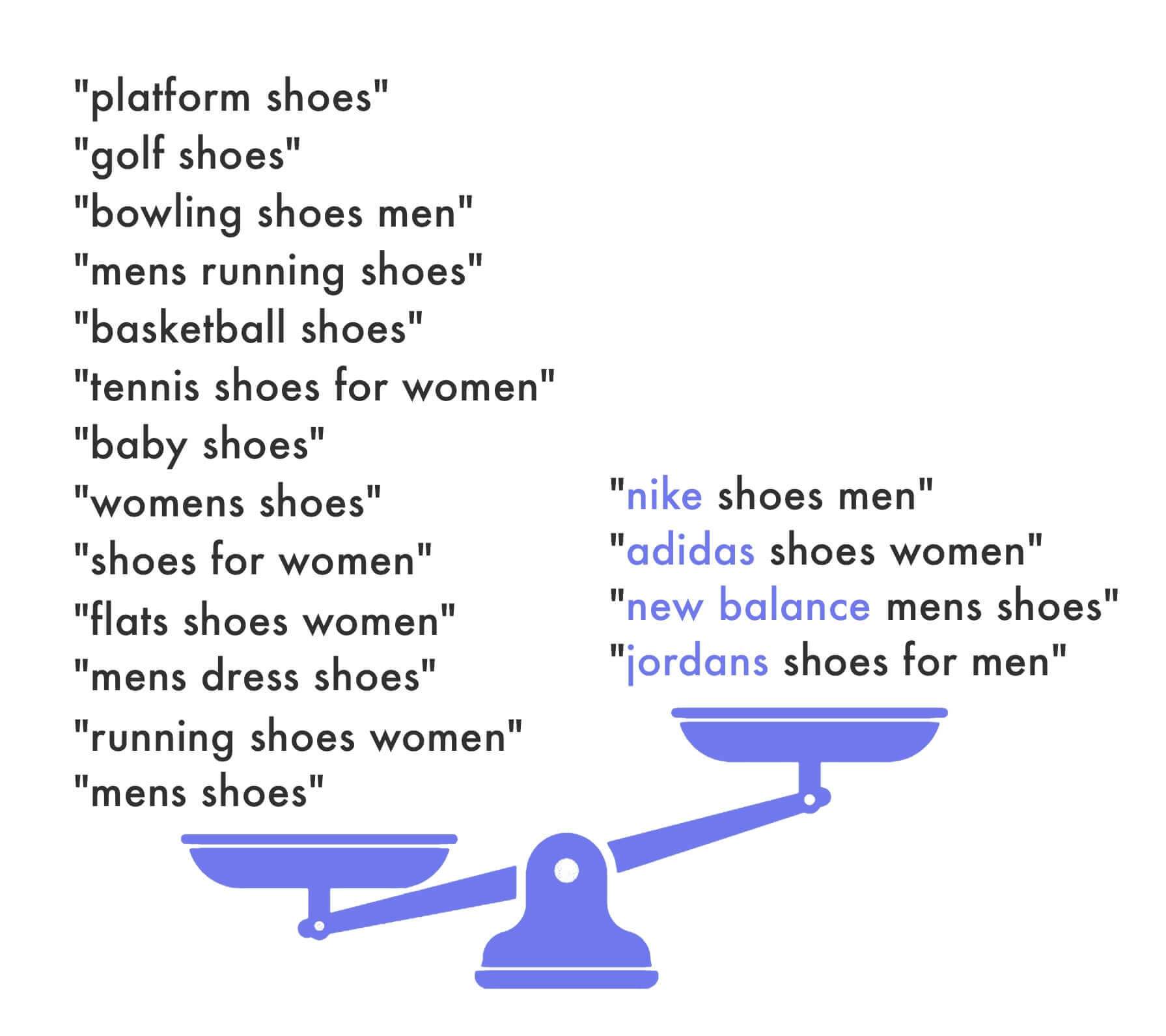

Amazon is a brandless retailer. Most shoppers do not include a brand name in their searches (they look for “running shoes” rather than “Nike running shoes”), and most products carry a brand name shoppers have never seen before. But it all works because they trust Amazon and pick products based on product reviews and ratings.

“There is this erosion of what it means to be a traditional consumer product brand. In a way, Amazon is providing all this information that replaces what you’d normally get from a brand, like reputation and trust. Amazon is becoming something like the umbrella brand, the only brand that matters,” said Scot Wingo, executive chairman of ChannelAdvisor, in an interview with The New York Times in 2017.

Of course, some shoppers search for brands and notice them in search results, and some brands have built brand recognition after starting selling on Amazon. But that’s missing the importance of search ranking and how often shoppers pick unrecognizable products because they are well-reviewed. The best-sellers list on Amazon describes it better than any dollar metric, and the second-order effects of what ranks first are visible everywhere.

Long before Amazon, consumer packaged goods companies created the concept of brands to make shopping easier. A prospective shopper would have to spend less time determining the right product of the right amount of quality, and thus, successful brands could charge more. Customers would pay more because they wouldn’t have to incur search costs comparing many other products once they found brands they trust. That created household names like Coca-Cola, Nike, and Kellogg’s. Over time, brands also became status symbols, separate from the product itself.

Over the past decade, Amazon made buying YTDRGB, Qaubauyt, or ROTTOGOON — the unpronounceable gibberish brand names on most products — just as comfortable and stripped products of branding by-products like status. The explosive growth in the number of brands on Amazon (it has millions of brands in its catalog launched by millions of sellers) trained shoppers to look past the brand name. For as recognizable as Nike is generally, unrecognizable brands are often best-sellers on Amazon. For example, Amazon’s best-selling lamp is not from IKEA, Williams-Sonoma, Mattress Firm, or Restoration Hardware. It is made by Fenmzee, a Chinese firm selling directly on Amazon. For shoppers, it is a “a lamp I bought on Amazon.”

The conversation around Chinese retail apps like Temu focuses on de minimis loopholes and unfair competition. But it ignores what Temu is selling and why shoppers buy it — Temu launched into a market that is used to buying unrecognizable brands. Amazon created that market. Temu pushed Amazon’s fight against brands further — it put price as the most important factor. Amazon replaced brands with reviews and ratings, teaching shoppers to buy the garlic press other shoppers liked most. Temu said looking at reviews and ratings is pointless — all garlic presses are the same, anyway — and the cheapest one is best.

The brand name is so invisible that to attract U.S. sellers, it offers them the option to change their brand name to avoid Amazon penalizing them for selling their products cheaper. Even with the changed brand name, the products will sell just as well.

However, as uninspired as the selection on Amazon and Temu is, it doesn’t mean everything is brandless. Shopping is split into two dichotomies: the infinite unbranded catalog of the two and new, recognizable brands noticed by millions on social platforms and elsewhere. There are still products sold by companies that, for example, attract people to wait in line for hours for a chance to buy at a pop-up. But for all the attention they get, the brandless commerce is quietly bigger.

Amazon and Temu are not alone. Walmart’s marketplace, Shein, AliExpress, and TikTok Shop sell the same. A massive part of e-commerce is brandless. It could even be that most of e-commerce is brandless by market share. Temu’s rapid ascent to the 2nd most-visited e-commerce website in the world is because, on a conceptual level, it is selling the same as Amazon has been for a decade — cheap brandless goods, often from China.