TikTok Shop launched in the U.S. twelve months ago and sold billions worth of goods since. However, the things selling on TikTok and how they become top sellers is counterintuitive.

There are no major brands with significant sales on TikTok. All top sellers are brands that figured out a unique strategy for it or went viral early when the platform launched, like GuruNanda. Since content drives sales on TikTok, it is either the brands themselves creating it or, most often, a sea of influencers incentivized by a share of revenue. Affiliates are as old as e-commerce but are deeply integrated into TikTok to avoid discount codes and special links and enable accurate tracking.

Goli Nutrition, a vitamins and supplements brand, is currently the top brand on TikTok. According to TabCut, its sales exceeded $7 million over the past 30 days. It deployed an aggressive affiliate campaign for an already popular product on marketplaces like Amazon that included rewards beyond the typical revenue share to get there. For example, affiliates that drive enough sales volume could earn a BMW car as a reward. It is both an impressive feat and a strategy most brands would never consider. Nor would it work if repeated often.

| TikTok Shop Name | Location | Monthly Revenue | Sales 07/27-08/25 | Sales 08/26-09/24 |

|---|---|---|---|---|

| Goli Nutrition | US | $7.1M | 170.8K | 423.4K |

| MyDepot | China | $4.9M | 101.5K | 107.6K |

| Micro Ingredients | US | $4.7M | 201.2K | 174.5K |

| wavytalk | China | $4.5M | 124.4K | 142.9K |

| Halara US | China | $4.5M | 146.1K | 155.1K |

| Mavwicks Fragrances LLC | US | $3.9M | 349.2K | 434.5K |

| MaryRuth's | US | $3.5M | 73.4K | 80.1K |

| Medicube US | South Korea | $3.5M | 53.5K | 68.1K |

| TYMO-BEAUTY | China | $3.4M | 59.3K | 80.1K |

| FeelinGirl LLC | China | $3.1M | 152.1K | 151.5K |

| O QQ | China | $2.9M | 48.7K | 133.7K |

| The Beachwaver | US | $2.8M | 15.3K | 54.1K |

| Gopure | US | $2.5M | 57.4K | 63.8K |

| Tarte Cosmetics | US | $2.4M | 96.3K | 79.5K |

| American Seair Imports | US | $2.4M | 80.5K | 81.5K |

| simplymandys | US | $2.4M | 45.8K | 58.8K |

| CAKES body | US | $2.4M | 197.8K | 89.1K |

| Merach fitness | China | $2.4M | 31.7K | 36.7K |

| vevor store | China | $2.3M | 41.6K | 39.5K |

| oqqfitness | China | $2.3M | 44.1K | 95.8K |

TikTok’s shopping funnel is unique. Amazon, Walmart, eBay, and the rest of the shopping marketplaces in the U.S. are well-understood problems with known inputs like advertising spend, conversion rate tracking, listing optimization, and the like. They have the typical discovery, consideration, and purchase funnel. TikTok is none of those things. Nor is it a replacement or competitor to Amazon and the rest. TikTok Shop is a content and affiliate problem that, for now, only a few select brands have figured out.

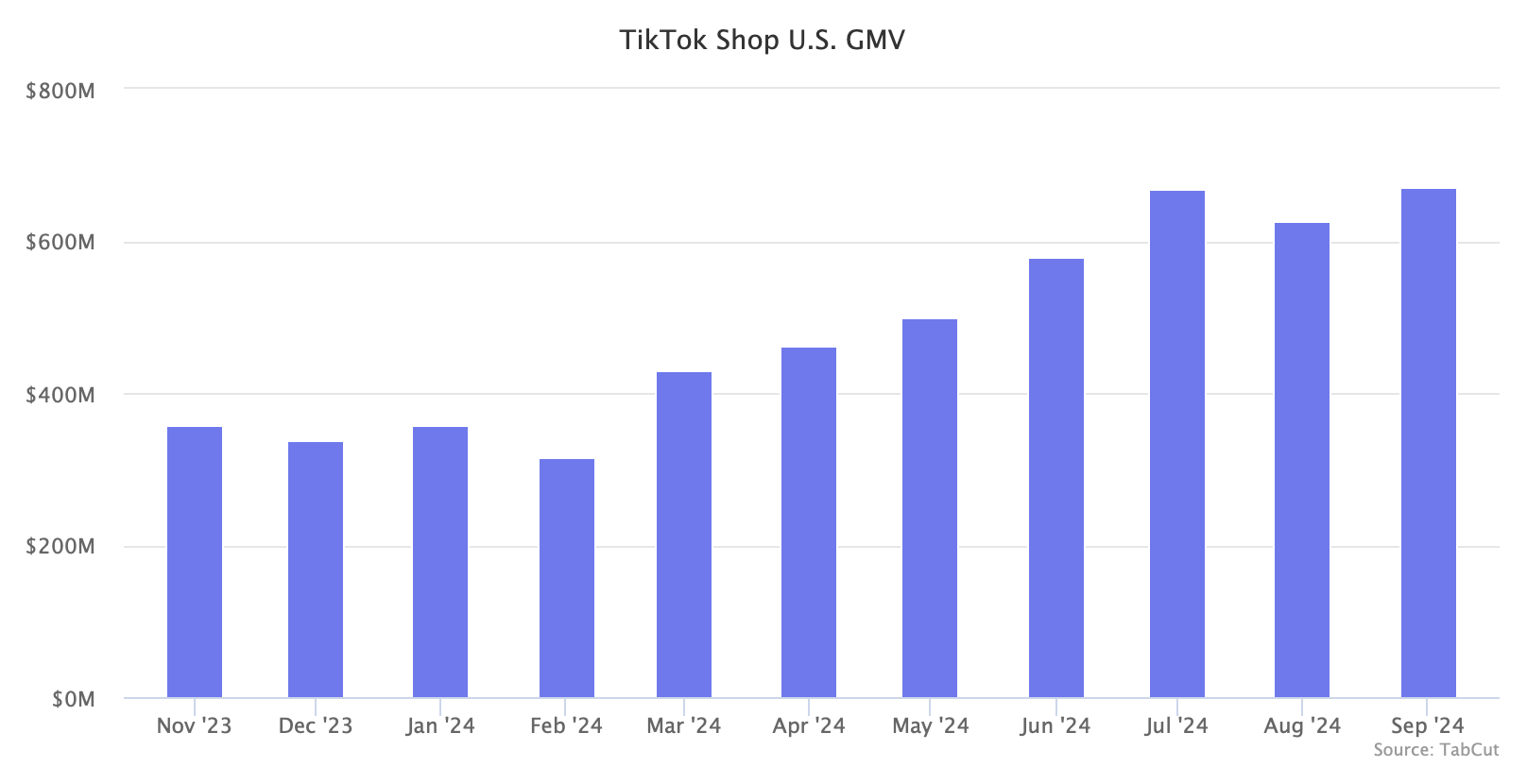

As Bloomberg has reported, TikTok had plans to grow TikTok Shop in the U.S. to $17.5 billion this year, its first full year. It is trending significantly below that — it will reach less than half of it (according to TabCut, year-to-date GMV is $4.6 billion). According to TabCut, the top 20 brands sold roughly $70 million of goods over the past 30 days. Extrapolated to an annualized run rate that’s less than $1 billion. The inaccuracies in estimated sales volume and the long tail of smaller brands cannot account for the other $16 billion.

To get bigger, TikTok Shop lacks the assortment customers want. Also, Western users are only now getting used to the social commerce paradigm. For example, it hosted a few live-streaming events that grossed over $1 million each, but most users have no patience to watch that type of content, and most brands have no vision to produce it. Before TikTok, Facebook and Instagram gave up too early to see social commerce through and refocused on selling ads. “Mark Zuckerberg had high expectations for turning Facebook and Instagram into shopping destinations. Now, the effort he was once intensely focused on has been boiled down to ads,” wrote Sylvia Varnham O’Regan for The Information in October 2022.

TikTok Shop is a failure and a success at the same time. Its aggressive shopping content push worked to create a marketplace that transacts billions, but it is not tens of billions yet. A few brands have reached millions in monthly sales, but most brands have no idea how to approach it, and it has only worked for health, wellness, and beauty brands. It has some recognizable brands, but it primarily sells unbranded low-price items. It brought social commerce to the U.S. but at the cost of “enshittifcating” itself (enshittification is a pattern in which online products and services decline in quality, coined by writer Cory Doctorow).

TikTok is solving the chicken-or-the-egg dilemma for social commerce. I couldn’t get brands to join because there was no scale, and it couldn’t push users to shop because there wasn’t much to buy. It’s spent the first year solving the cold start problem by getting brands interested and users used to social commerce. The top brands list will look different in twelve months.