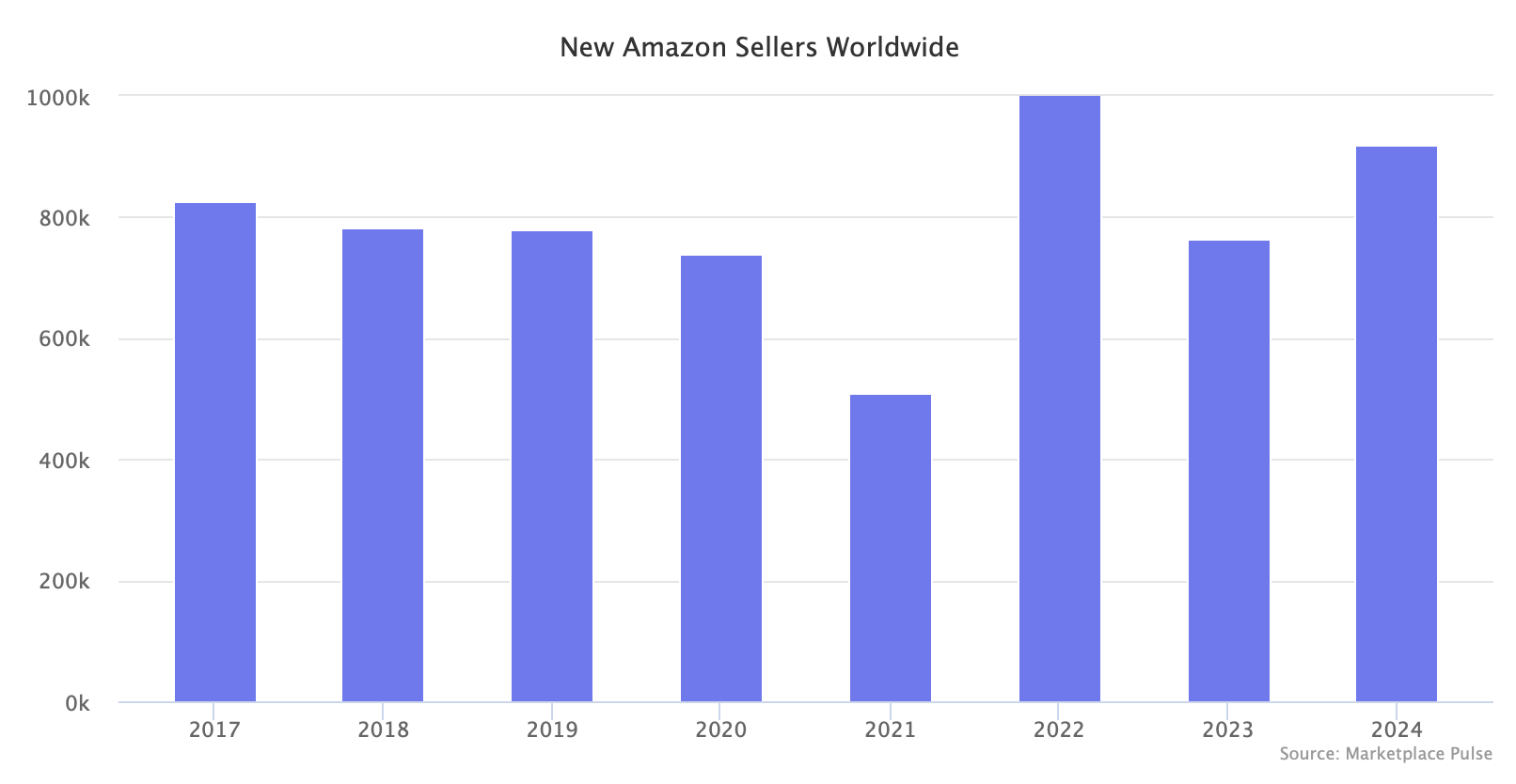

In 2024 — again — nearly a million new sellers joined the Amazon marketplace. There is no shortage of interest despite Amazon’s slower growth, increasing competition, and more complex rules to achieve profitability.

Marketplace Pulse data shows that Amazon added over 900,000 new sellers across its twenty-two marketplaces in 2024 and more than four million over the past five years. Roughly a third of them joined the Amazon.com marketplace in the U.S.

Many never achieve a sale, plenty stop selling after their first few sales, and some replace sellers that quit. Amazon is long past growing sales by growing the seller base or the assortment. Instead, seller growth indicates interest in the opportunity. The number itself is nearly meaningless; it not trending down is the signal.

Despite the influx of new sellers, more than half of the sales volume on the Amazon marketplace comes from sellers who started selling more than five years ago. The goods and brands those sellers are selling might be ever-evolving, but they regularly build long-lasting businesses on Amazon.

Every year, most sellers pay more fees as a percentage of their sales to Amazon. It is tough to be on Amazon because of fees; it is tougher not being on Amazon because of its market share. Because of Amazon’s unabating market share of e-commerce and, crucially, of e-commerce marketplaces, sellers return to selling on Amazon. If they don’t, the more than 2,000 new sellers Amazon adds daily are eager to step up.