Amazon Haul is offering its deepest discounts yet, with some items reaching up to 90% off through layered promotions, as Amazon continues aggressive subsidization despite the looming changes to the de minimis import threshold.

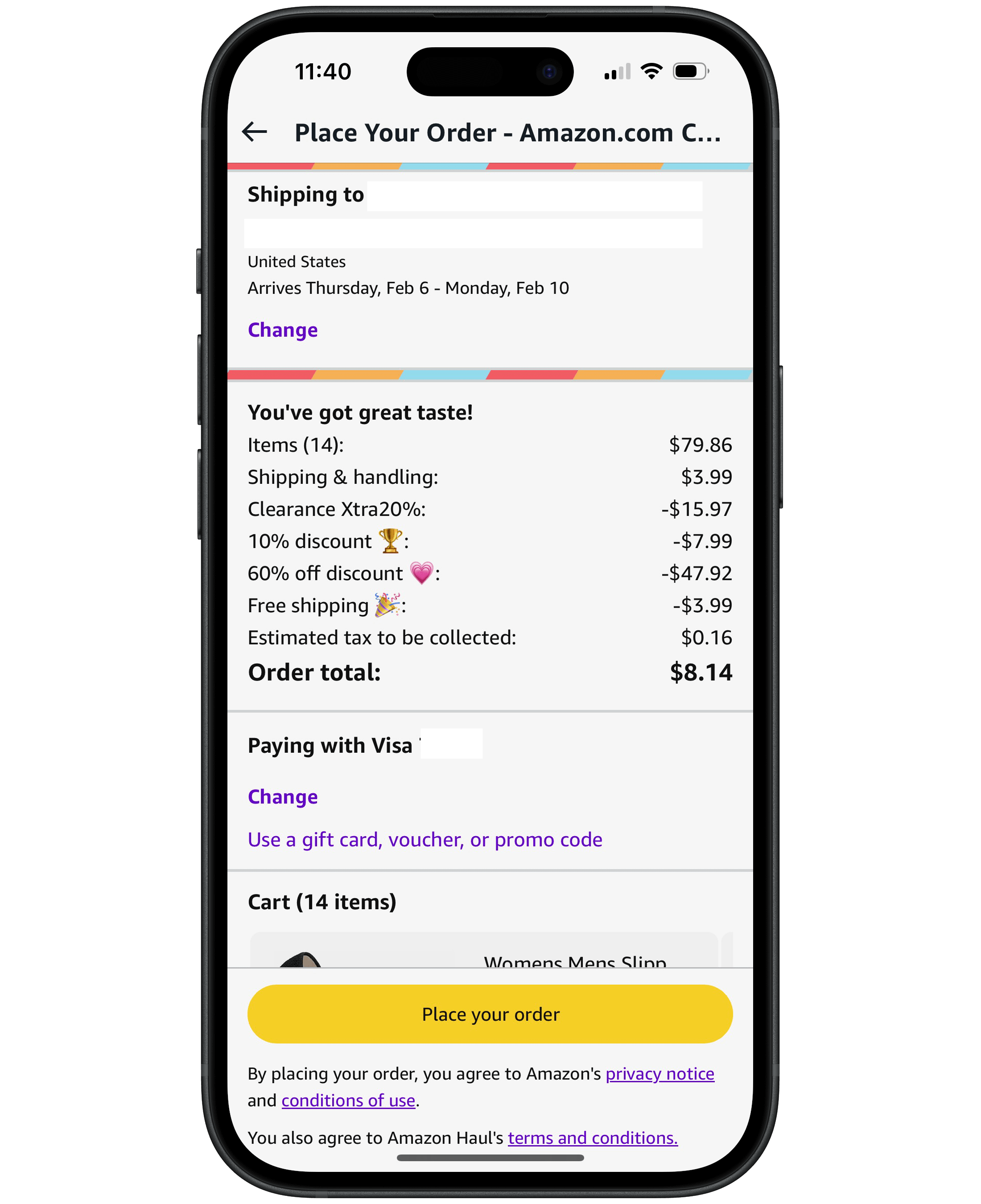

Amazon’s 90% discount combines a 60% sitewide discount with an additional 20% off clearance items and 10% cart discount on orders over $75. This stacking of discounts means some items – for example, a sub-$1 Apple Watch strap – are selling for just 10% of their listed price. This level of discounting can turn a $79 cart filled with a dozen items into an $8 purchase – still with free shipping – suggesting Amazon is losing money on each sale to drive adoption.

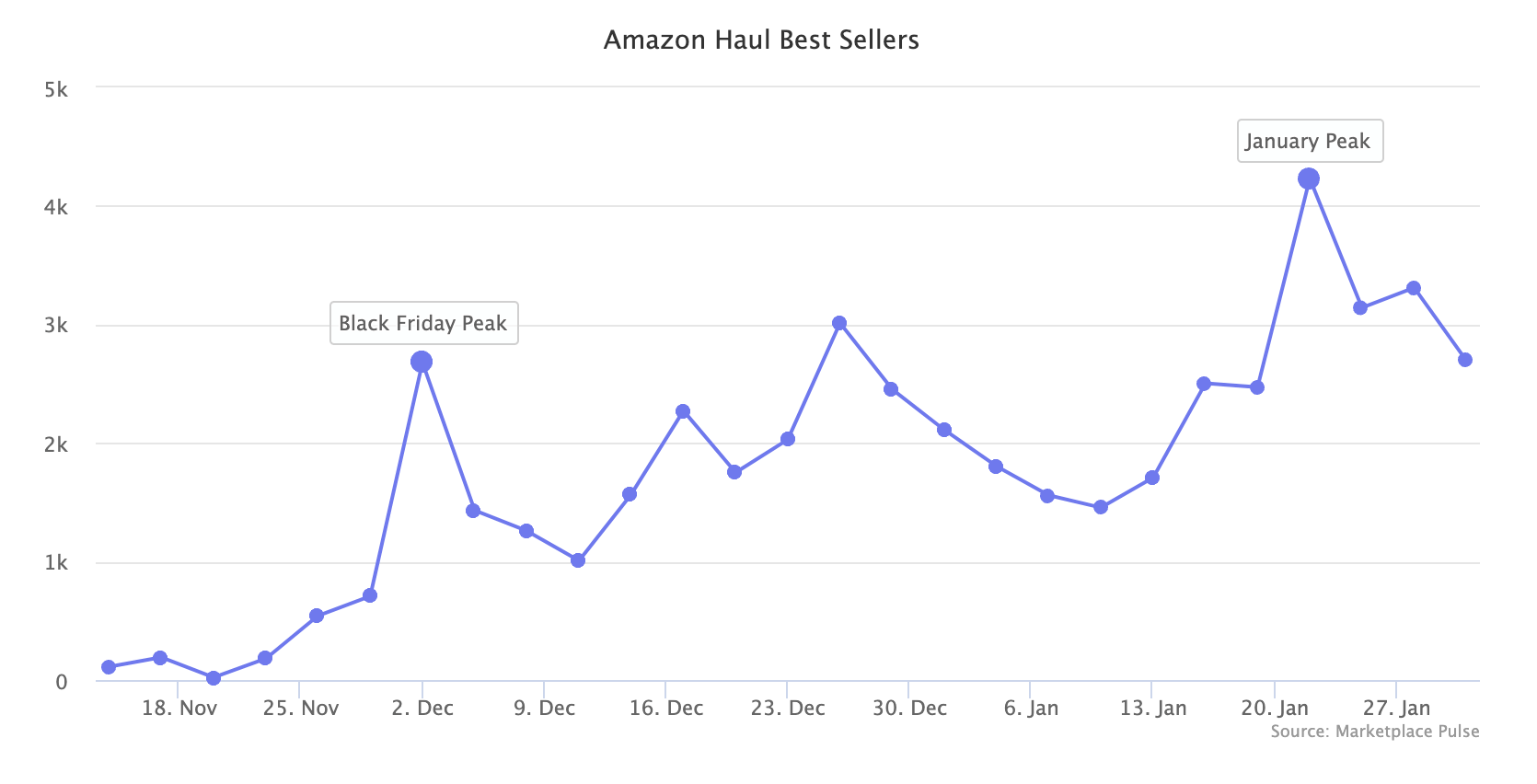

Now, even with Amazon offering up to 90% off through combined discounts, Haul’s sales volume remains a fraction of Temu’s. Still, the number of Amazon Haul products in Amazon’s top 100 best seller lists has grown to highs of 4,200 in January – up from under 1,000 prior to a momentary Black Friday peak of 2,700 – this growth has come at an increasing cost.

Even after introducing sponsored product ads in January – a revenue stream not present at launch – Amazon appears to be subsidizing most orders to maintain competitive prices against Temu.

The addition of sponsored placements suggests Amazon is already looking for ways to offset these losses, even before establishing meaningful market share. At current prices, though, it’s hard to imagine a scenario where sellers dedicate meaningful budgets to this new advertising real estate without further subsidies.

This aggressive discounting strategy comes as Congress prepares to eliminate the de minimis threshold that allows Chinese goods under $800 to enter the U.S. duty-free.

The changes would significantly impact both Amazon Haul and Temu’s current business models, which rely heavily on direct shipments from China.

The challenge for Amazon is that Temu has fundamentally changed customer expectations for direct-from-China commerce. While Amazon historically succeeded by making shopping more convenient, Temu proved that many shoppers will accept slower delivery times for significantly lower prices. Now, even with Amazon offering up to 90% off through combined discounts, Haul’s sales volume remains a fraction of Temu’s.

Amazon has a history of subsidizing growth – Prime membership operated at a loss for years while building market share. However, the timing of these Haul discounts, just as the de minimis loophole is set to close, raises questions about the long-term strategy. Once duty-free imports end, both Haul and Temu will need to fundamentally restructure their operations, likely leading to higher prices and slower delivery times.

The question remains whether Amazon can convert the current discount-driven traffic into loyal customers before the regulatory changes force a pivot. For now, the mounting losses on each sale suggest Amazon is racing against time to establish Haul as a viable alternative to Temu, even as the window for the current business model appears to be closing.