In 2024, Amazon again had a record-breaking year despite growing criticism from workers, sellers, governments, and shoppers.

Thousands of Amazon workers went on strike in December, less than a week before Christmas, in what the Teamsters union said was the largest-ever strike against Amazon. A month earlier, thousands in 20 countries went on strike during Black Friday. Drivers and warehouse workers, who represent the majority of Amazon’s more than 1.5 million employees, led the strikes.

At the end of the year, Amazon announced changes to seller policy, reducing reimbursement for lost inventory, effectively resulting in sellers making less profit. A month earlier, in November, Amazon celebrated not increasing seller fees and said, “In 2025, we want to focus on simplicity and stability, minimizing your operational burden and costs.” Most sellers would describe Amazon and specifically its fees as the opposite of simple or stable.

A week before Black Friday, Buy Now, a film highlighting how retailers and brands manipulate shoppers to promote consumerism, was the most-watched documentary and one of the most-watched films on Netflix. According to Netflix, it was viewed more than seven million times during the week of November 18-24. The documentary focused on Amazon as one of the examples.

Federal Trade Commission (FTC) sued Amazon in September 2023 (the trial is slated for October 2026) for illegally maintaining monopoly power, which “inflates prices, degrades quality, and stifles innovation for consumers and businesses.” The company is also involved in multiple investigations outside the U.S. Despite some fines and settlements, such as its settlement with the EU in 2022 or the $1.2 billion fine by an Italian regulator in 2021, none have made Amazon change its ways.

Governments, sellers, workers, and shoppers have gripes with Amazon. However, Amazon continues to grow bigger in terms of dollars spent, Prime members, and market share. As the strikes worldwide tried to raise awareness of Amazon’s working conditions, millions watched the Buy Now documentary, which tried to make people spend less, including on Amazon. That didn’t happen; they spent more — Amazon announced record-breaking sales during Black Friday. Most surveys also show Amazon as one of the most liked and trusted retailers.

Because Amazon continues growing, workers return to work, and sellers continue to sell on it. That’s the point the FTC and other regulators are trying to make — sellers would go on strike too, or stop selling on Amazon if they found fees too high, but they don’t because Amazon is most of their revenue. Instead, their only choice is to adapt silently. Most of Amazon’s roughly $750 billion GMV in 2024 was done by third-party sellers, the same businesses squeezed by ever-increasing fees. It is tough to be on Amazon because of fees; it is tougher not being on Amazon because of its market share.

That’s why competition in any shape is so important. Be it Walmart, Shopify, Temu, or TikTok. As Ben Thompson of Stratechery coined it, they are collectively the Anti-Amazon Alliance because, as a sum, they are roughly as big as Amazon. Any dollar spent on either of them is a dollar not spent on Amazon, forcing it to lower fees or compete directly.

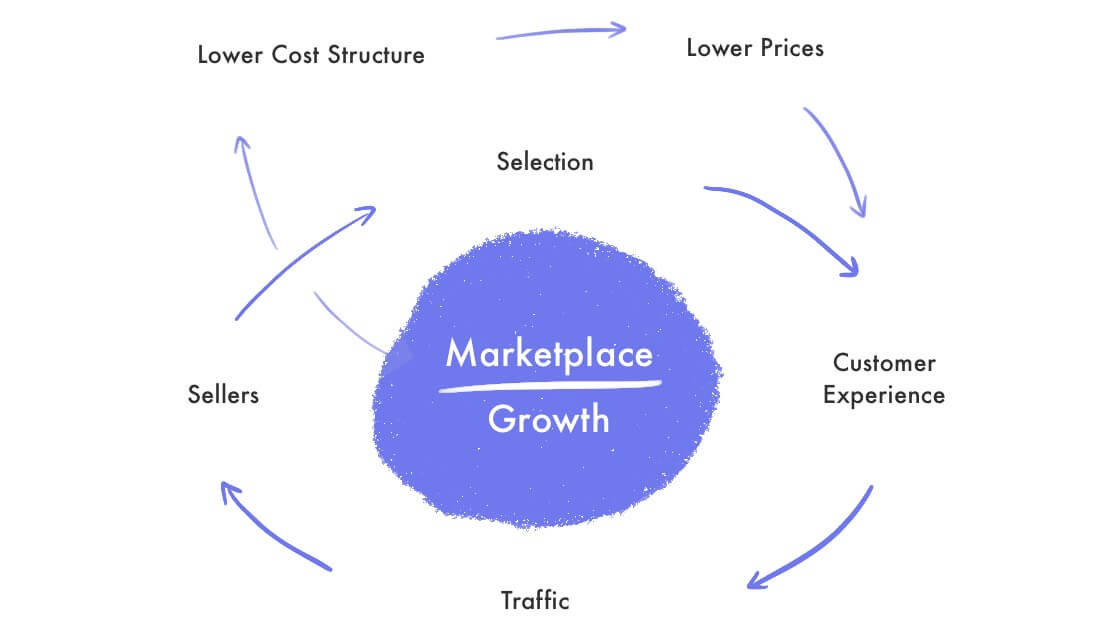

Said simply, Amazon is a net benefit. Some of its critiques in isolation appear inexcusable, but it works as a whole. Amazon is famous for spinning up flywheels: more shoppers on Amazon attract more sellers, improving selection and making shoppers spend more. It’s been accelerating that for thirty years. Shoppers canceling Prime after watching Buy Now, sellers diversifying after seeing increased fees, and workers staging another walkout ultimately do not slow down the flywheel. The momentum is too high.