Competition from Shein and Temu forced Amazon to lower fees, enabling sellers to lower prices, which, in turn, led to shoppers buying more items on Amazon.

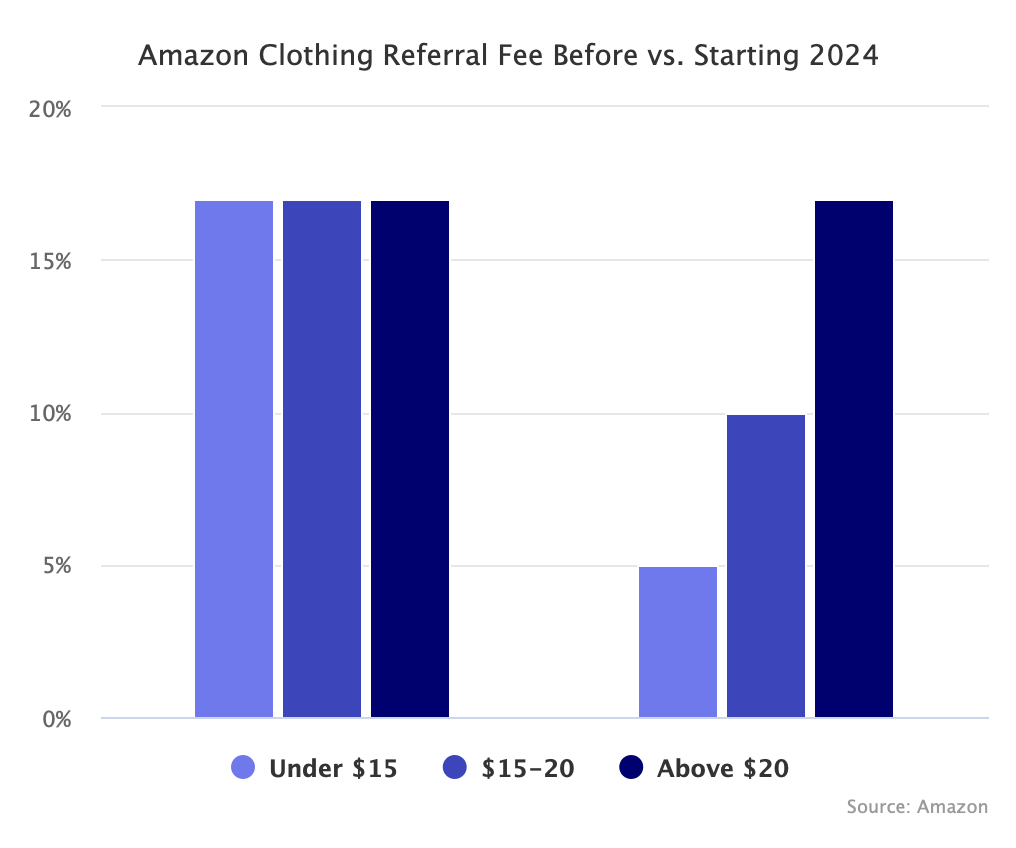

In January, seller fees on clothing cheaper than $15 dropped from 17% to 5%, and for items priced from $15 to $20 dropped to 10%. In March, Amazon followed up on lowering fees in the U.S. by cutting them in its European, Canadian, and Japanese marketplaces. The moves were a reaction to growing competition from Shein and Temu, which both focus on ultra-low prices.

On Thursday, Amazon said, “lowering apparel fees has spurred substantial year-over-year unit growth in apparel” in the second quarter. Andy Jassy, CEO of Amazon, added that they saw lower average prices because “customers continue to trade down on price when they can.” Amazon is selling more but cheaper items because when prices decrease, shoppers don’t spend less — they buy more.

Amazon has avoided focusing on the lowest prices by becoming the default for shoppers, thus making them skip price comparisons. Prime membership is its deepest moat — it doesn’t have to be the cheapest if no one checks. Even if it was sometimes more expensive, Amazon was the most convenient and fastest shipping. It was more expensive because convenience is not free.

AliExpress, Shein, and Temu are not replacements for Amazon. But they are cheaper. And in an economy where customers continue to trade down on price — as Andy Jassy pointed out — they unsurprisingly found demand. Not all, but some shoppers are giving up convenience for lower prices even as Amazon delivered 5 billion same-day and next-day items so far in 2024, a record.

Clothing seller fees were a recent and visible change, but Amazon has been working on lowering its fulfillment cost to serve for the past few years, which would enable it to sell lower-priced items with Prime. “There are a lot of lower price items that we don’t stock because they’re not economic to stock with our current cost to serve,” said Andy Jassy. However, that’s not translating into lower fees for sellers, who are making the same determination whether an item could be stocked in Amazon’s warehouses profitably — their fees have continued to increase.