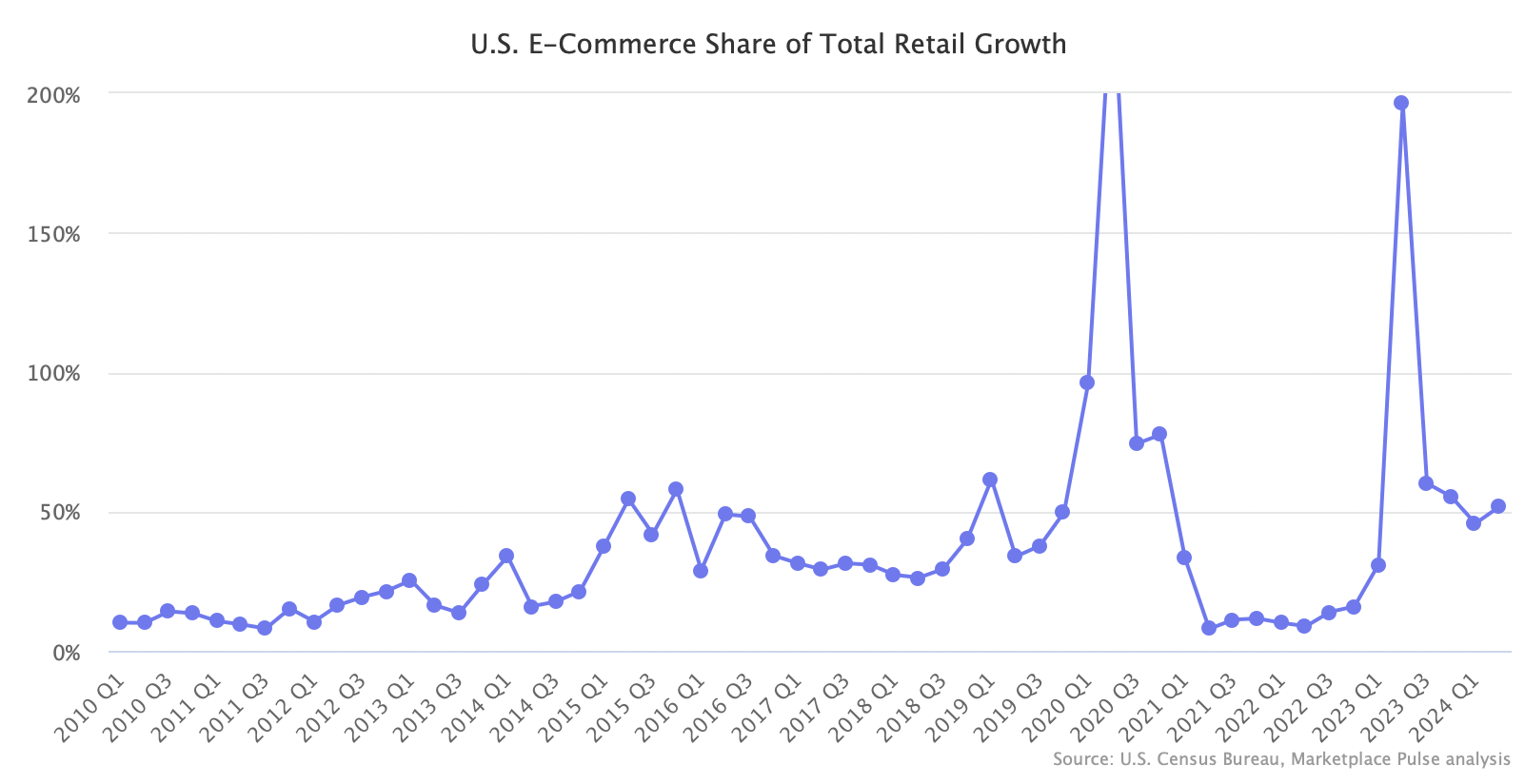

E-commerce growth is slowing again, but not because shoppers are returning to physical stores. Online shopping accounted for 51 cents of every new dollar spent in retail.

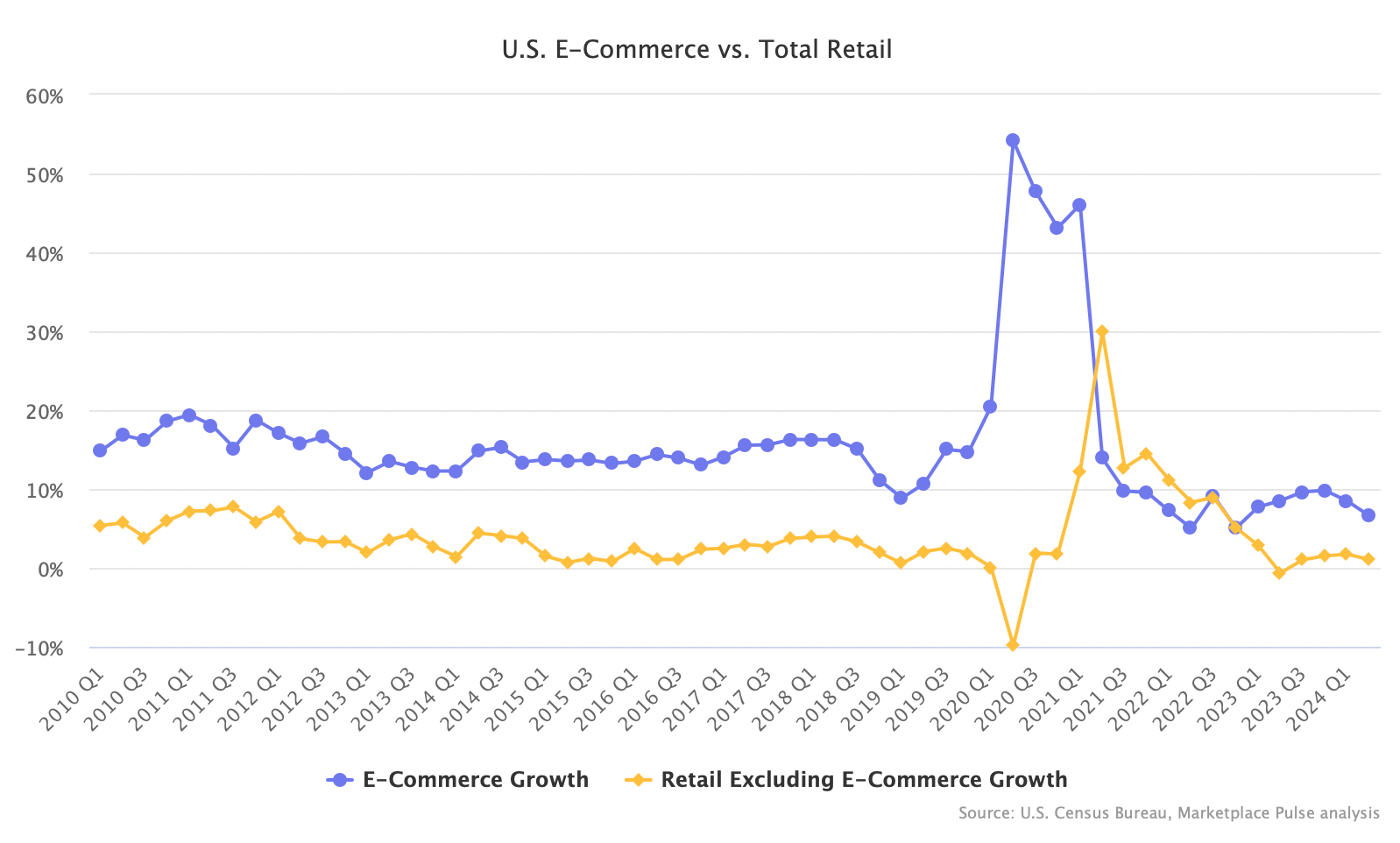

Based on the Department of Commerce data, e-commerce spending in the U.S. was up 6.5% in the second quarter. That’s a slowdown from both the first quarter and 2023 Q2. Three of the slowest e-commerce growth quarters in the past 15 years occurred within the last two years; 2024 Q2 was one of them.

Total retail sales were up 1.9%. However, retail sales without e-commerce — brick-and-mortar sales in physical stores — were up just 1%. A figure smaller than inflation, as measured by the Consumer Price Index (CPI). Because offline retail was up 1% while e-commerce grew 6.5%, e-commerce accounted for $17.4 billion of the $31.4 billion in additional retail spending.

E-commerce remains a small part of retail — 16% of total retail or 22% of core retail as of the second quarter — but has lately contributed more than its share. Over the past four quarters, e-commerce drove 53% of growth. In the past, it was closer to 30%.

Relative to 6.5% e-commerce growth, the largest retailers, Amazon and Walmart, and new upstarts from China, Shein and Temu, are outperforming the market. Meanwhile, many smaller players, including eBay and Etsy, saw flat or negative growth.

E-commerce competition is often described as a zero-sum game. For Walmart to grow, Amazon has to lose. However, the market is all $7 trillion of retail, and the critical outcome of e-commerce competition is more shopping moving online. The loudness of new entrants like Temu, who seemingly have no budget cap to buy ads, grows the whole pie.

E-commerce is driving a sluggish market — its growth is slow because total retail growth is weak, but online shopping is outselling the rest. It should hit $1.2 trillion in 2024 (it reached $1.1 trillion in 2023), but the mid-teen growth seen for a decade before 2020 seems unachievable.