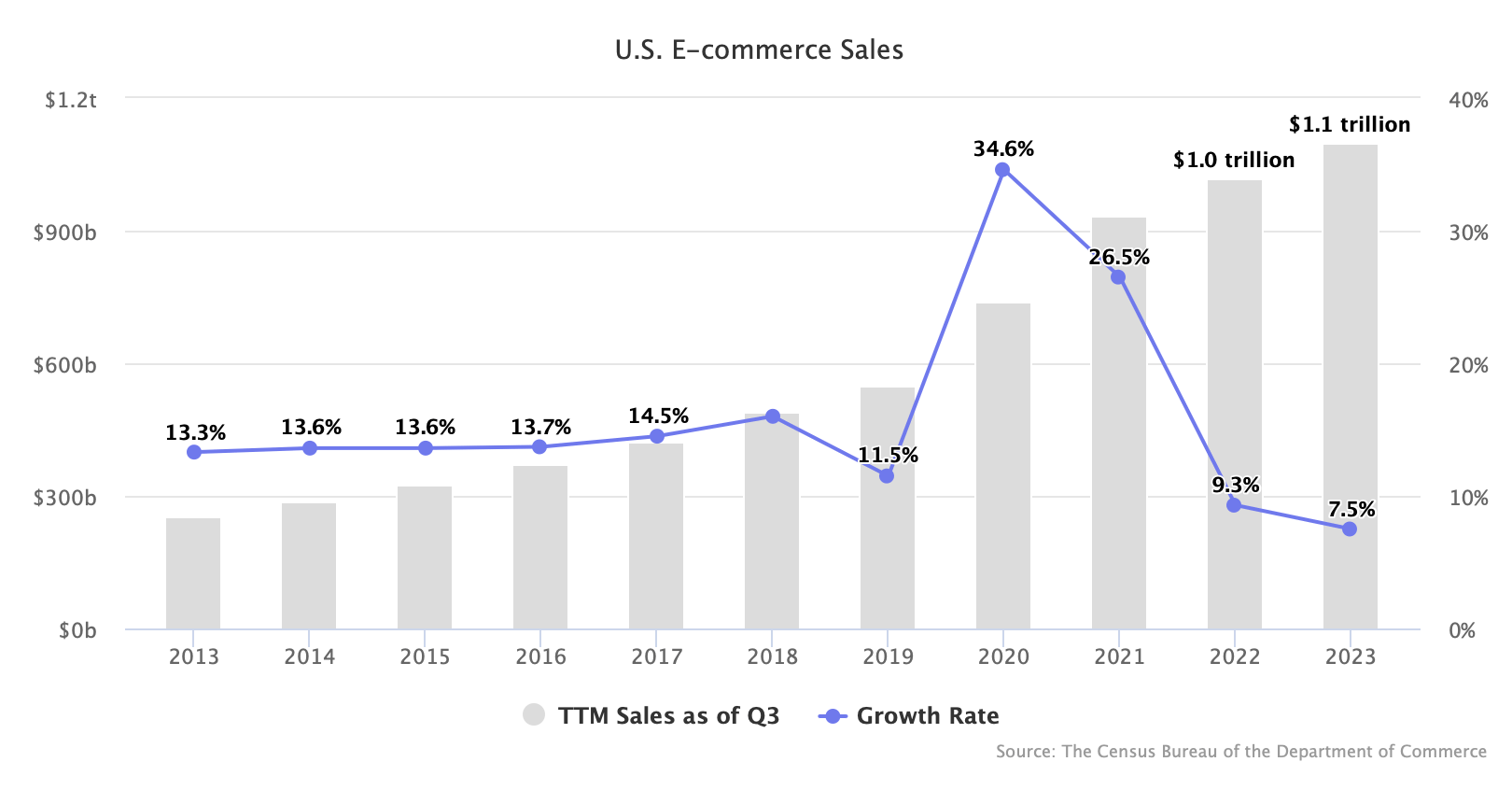

E-commerce sales in the U.S. are on target to exceed $1.1 trillion in 2023. But it will be the slowest year of growth since the 2009 recession.

In 2022, e-commerce spending in the U.S. was $1 trillion, based on the Department of Commerce data. This year, e-commerce grew 7% to hit $1.1 trillion. E-commerce spending remains bigger than the pre-pandemic forecasts would have suggested. Compared to that theoretical market, where the pandemic didn’t happen and e-commerce grew at the rate it had grown for years before, today’s e-commerce is 14% above the trendline.

However, at 7%, 2023 will be the slowest year of growth since 2009, as reacceleration is yet to come. And, adjusting for inflation, the actual growth figure is even smaller. Because of that, the step change created by the pandemic is getting eaten away, which could mean the trendline catches up in a few years. Plus, because the largest retailers, Amazon and Walmart, and new upstarts from China Shein and Temu outperformed the 7% rate, many smaller players in the market likely saw negative growth.

E-commerce continues to get bigger, even if it has been flat for the past three years as a share of retail. The latter is less important than the fact that more dollars flow through e-commerce every year. For a decade, 14-15% growth was the norm, then it accelerated and later decelerated by the pandemic. This year, with 7% growth, was likely the bottom, and e-commerce will accelerate from here to the expected 9-10% growth over the upcoming years.