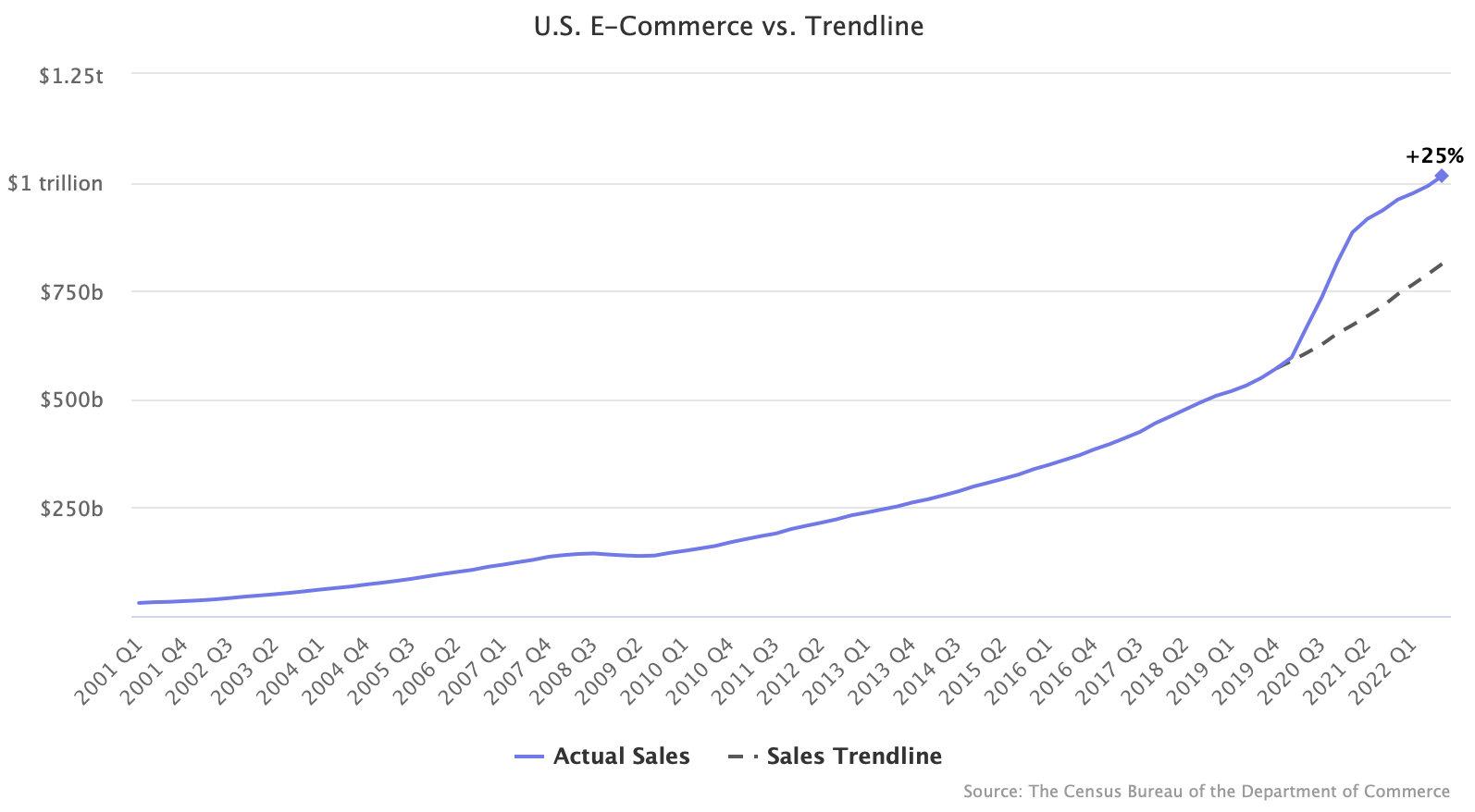

E-commerce spending in the U.S. exceeded $1 trillion over the past twelve months. A milestone that pre-pandemic trends predicted would only occur in 2024.

According to the Department of Commerce, e-commerce sales over the past twelve months reached $1.02 trillion. The market has nearly doubled in size in three years.

But for the first time since 2009, e-commerce growth will likely be down to single digits in 2022. The trailing twelve months are up only 9% from the period before, and Q4 will probably grow slower. Admittedly, that’s compared to the historic growth in 2020 and 2021.

E-commerce spending is 25% bigger than pre-pandemic forecasts would have suggested. If the pandemic didn’t happen and e-commerce grew at the rate it was growing for years before, 14-15%, the annualized run rate would have been $815 billion today. A massive $200 billion smaller than the current $1 trillion run rate.

Total retail spending has increased even faster than online retail, however. It reached a $7 trillion run rate in Q3. Thus, despite e-commerce continuing to trend above the trendline, e-commerce penetration has been falling back to the pre-pandemic trend. In the latest quarter, 14.1% of consumer spending happened online. Excluding retail categories that don’t typically compete with e-commerce - restaurants, car dealers, and gas stations - e-commerce represented 21% of retail.

Confusingly, e-commerce has both returned and not returned to prior trends. E-commerce spending is bigger than the trendline in dollars but roughly in line with the pre-pandemic penetration percent trendline. That is, e-commerce spending is $1 trillion rather than $815 billion, but that’s only 14.1% of retail, which is nearly the same as the 13.6% prediction.

E-commerce was up 10.8% in the third quarter, back to double digits for the first time since the second quarter of 2021. E-commerce is again accelerating, but now on a much larger base of total e-commerce.