Amazon’s sales growth is unrelated to its catalog increase. No matter how many products Amazon adds to the catalog, there are only 48 items on the first page of search results. The outdated retail concept of the catalog size disregards the nuances of e-commerce, where shelf space has no cost and is thus endless.

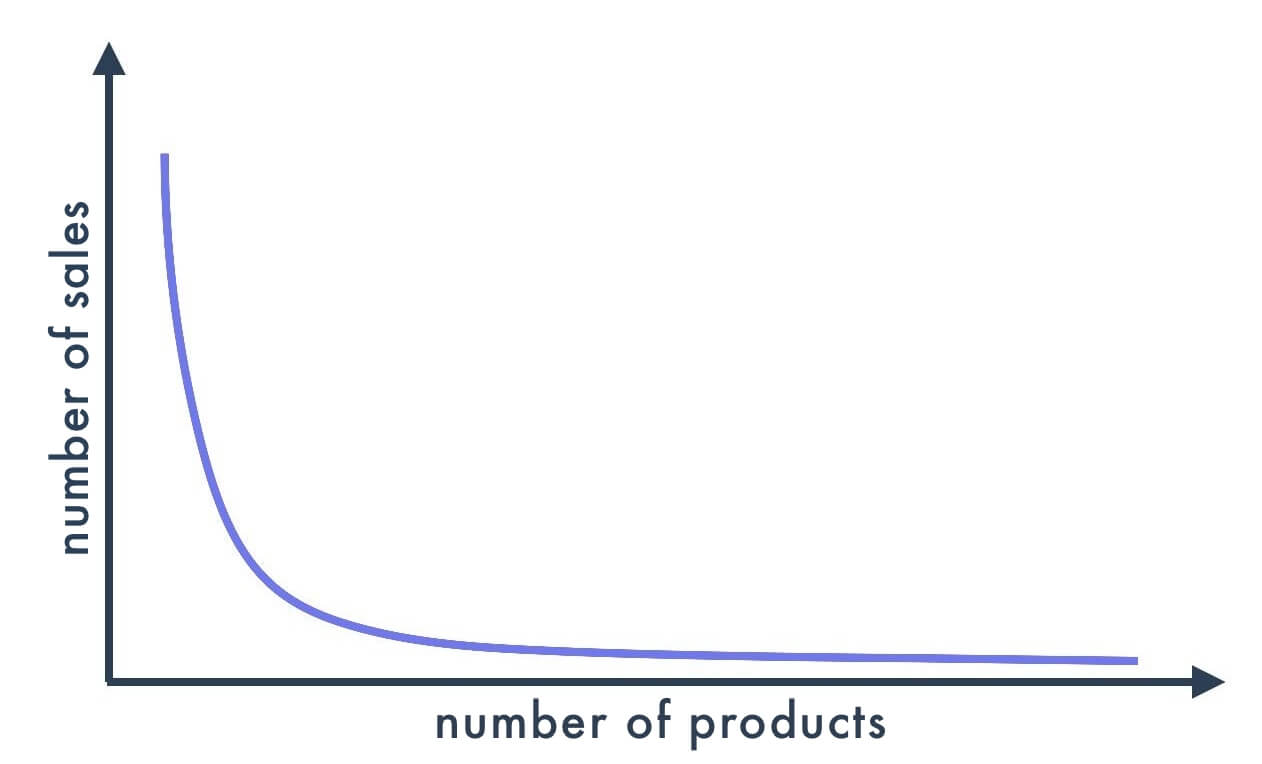

There is a cliché that Amazon has infinite shelf space. Technically it does, as it can support a virtually endless number of products since each has a zero marginal cost. However, most shoppers will only see a few options before making a purchase decision. There are over fifty million t-shirts on Amazon, for example, but the top 0.01% outsell the rest combined.

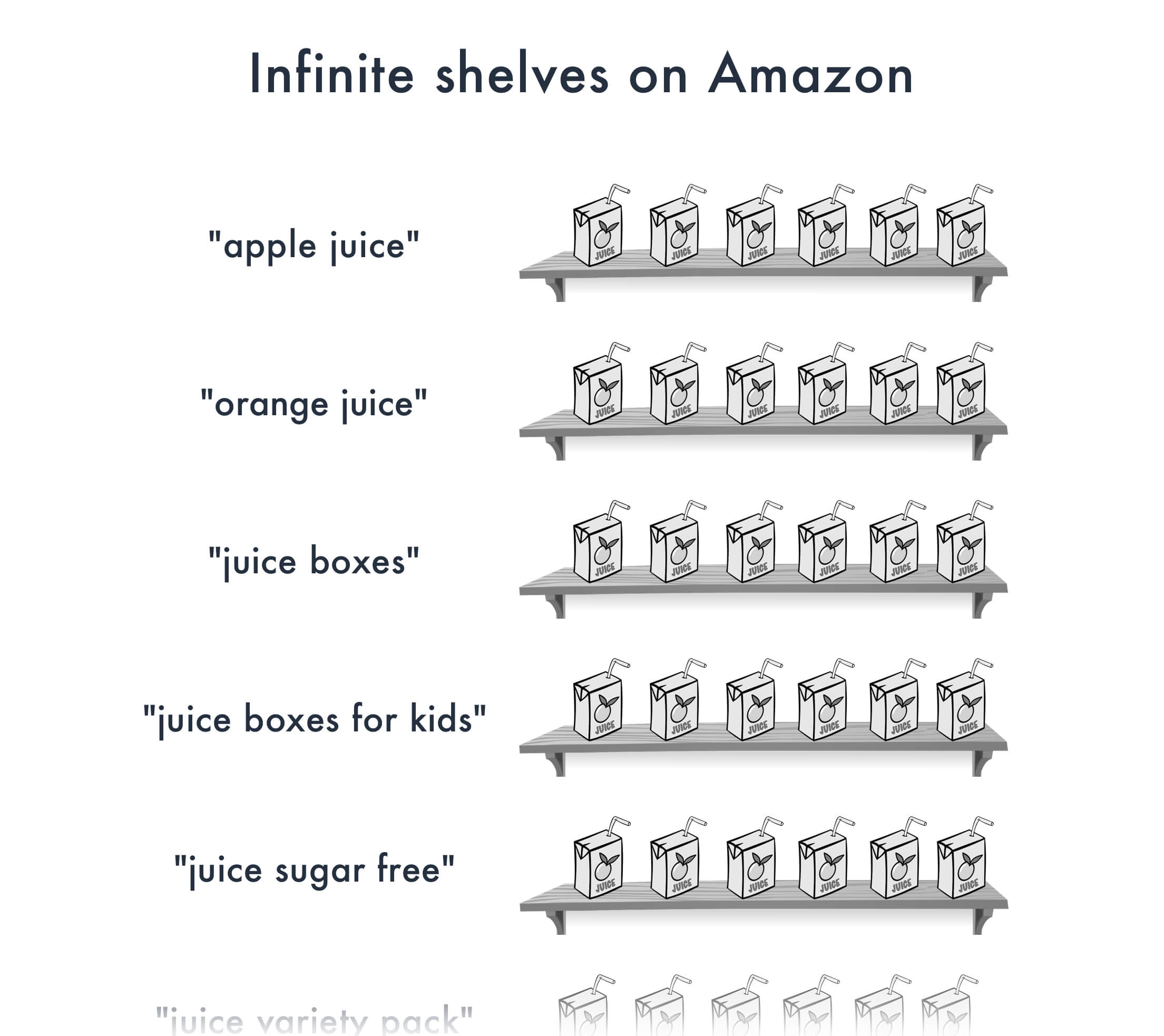

Amazon has an infinite number of shelves, instead of one endless shelf. Each search keyword has one that is a couple of dozen products long.

It’s not the depth of the shelf that matters; it is how to get customers to find what they need. Whether Amazon had twenty-five million t-shirts last year and is going to double again to one hundred million next year, it does not inform if customers are buying more t-shirts. At some number, the scale tips and the metric becomes meaningless. On Amazon, the scale tipped many years ago.

Millions of marketplace sellers have brought hundreds of millions of products, creating an explosion in catalog size. Algorithmically generated merchandise that gets manufactured on demand, dropshippers with access to millions of SKUs from major distributors, and endless private label experiments continue to get added daily. Most never sell.

However, the paradox of an infinite shelf is that while few products generate significant sales, many contribute a few. As a result, total sales are higher than that of a curated and thus constricted shelf. “A very, very big number (the products in the tail) multiplied by a relatively small number (the sales of each) is still equal to a very, very big number,” wrote Chris Anderson in the book “The Long Tail.” Therefore an endless catalog is valuable because its better than predicting a short selection of top-performer products.

The hidden cost of an endless catalog is the inability to manage them without the use of automation. Issues of counterfeits, product safety, or even editorial decisions not to sell certain items are near-impossible challenges. Much harder than for a traditional retailer with a mostly hand-picked assortment. Amazon had more than 8,000 employees fighting fraud in 2019; it will continue to add more to keep up.

Product prices, fulfillment options, and brand selection on the supply side are table stakes. Ignoring minor differences, Amazon and its competition have many of the same products, at the same prices, and shipped quickly. The supply side is not where differentiation happens. There are brands that Walmart doesn’t carry and items that are cheaper on eBay, but Walmart’s and eBay’s catalog size comparison to that of Amazon doesn’t answer that. The goal of a marketplace is to have broad enough selection that it appears endless, beyond that, it stops being a significant number (and because infinity is not a number).

What matters for horizontal marketplaces like Amazon is the demand side. Curation, recommendations, search quality, advertising, live video, and others. The high number of products on Amazon is one of its challenges, rather than principal strengths, as it attempts to surface the most relevant products out of an endless pool of seemingly similar options. That’s why advertising is growing in importance - without it, getting to the front of the shelf takes time, and new product launches risk never being discovered.

Amazon, in other words, is a retailer unconstrained by finite shelf space. That enables the selection of products for practically any search query - the infinite shelves. However, not without the drawback of ever more difficult policing. Measuring the number of products only works for retailers constrained by shelf space. Amazon is not one.