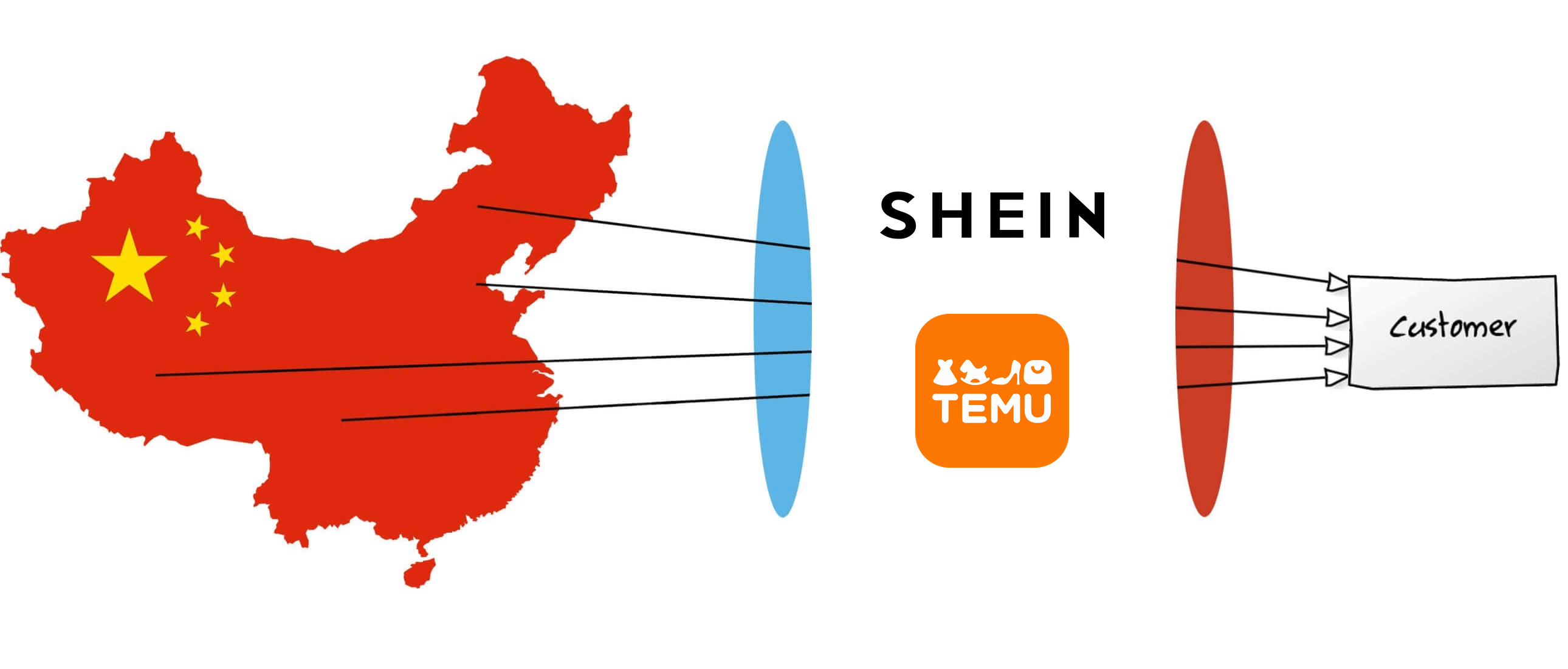

Temu and Shein are the fastest-growing e-commerce marketplaces in the U.S., yet they have practically no U.S. sellers. More than half of Amazon sellers are based in China, and the two newest marketplaces are exclusively for Chinese sellers.

Shein, the Chinese fast-fashion app, launched a marketplace in the U.S. in May. According to Marketplace Pulse research, it has since added tens of thousands of sellers. The marketplace doesn’t identify the business location of the sellers; however, by cross-referencing the list with other marketplaces, nearly all sellers are based in China.

Shein’s marketplace was meant to bring U.S. sellers to localize an otherwise China-dependent retailer. As Shein’s head of strategy, Peter Pernot-Day, described in a Modern Retail podcast episode, the marketplace is part of Shein’s localization strategy. “The final piece [of this strategy] is finding both suppliers who make and manufacture Shein clothing, but also third-party sellers who are interested in coming alongside us and reaching our customer base in these local geographies,” he said.

Temu, a direct-from-China AliExpress-reimagined retailer, was a marketplace from day one when it launched in September 2022. Marketplace Pulse research shows that it has grown to over a hundred thousand sellers in only slightly over a year. Like Shein, it doesn’t disclose the business location of the sellers. Nonetheless, all Temu’s sellers are based in China.

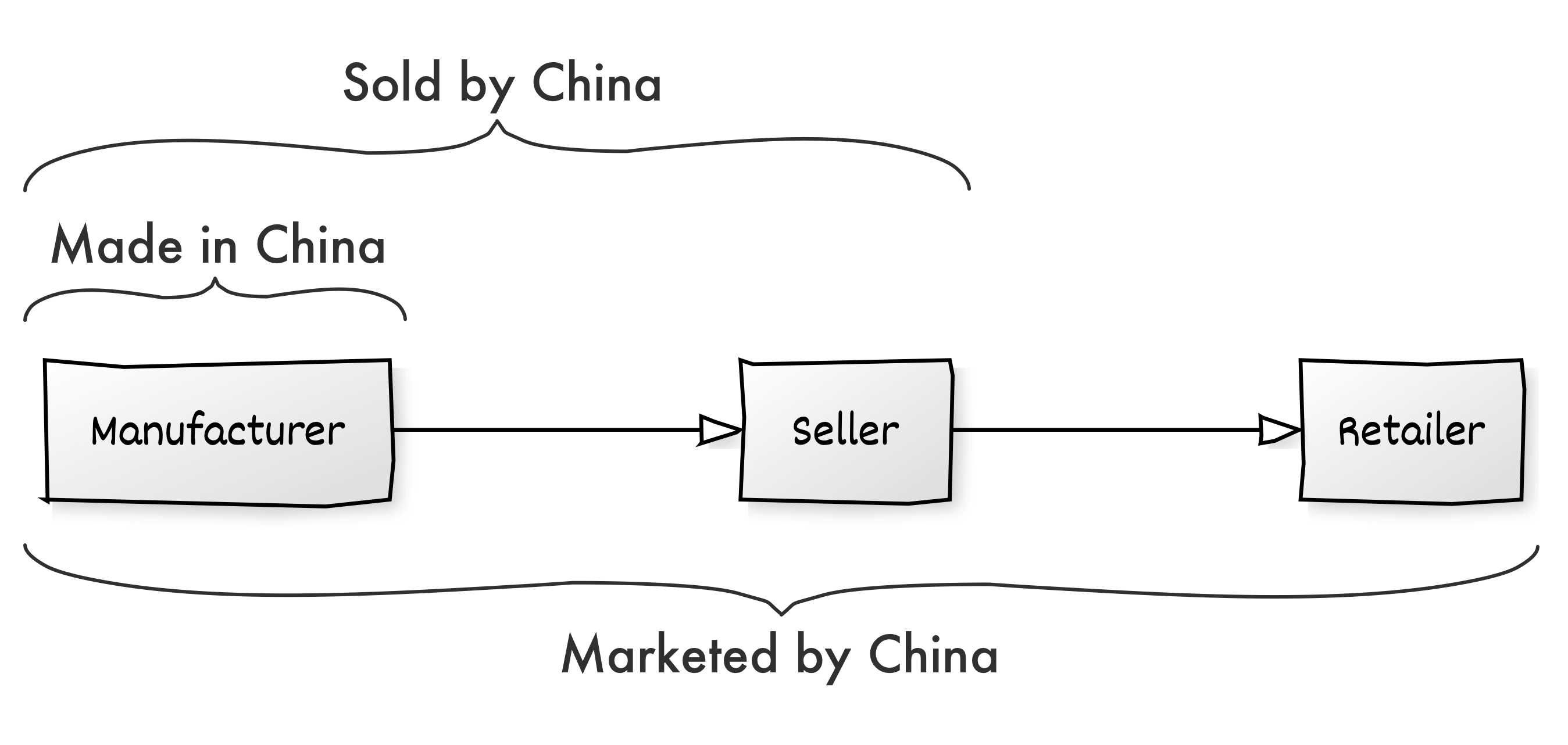

Temu planned to add U.S. sellers, but “Temu is not sure whether there are enough local sellers in the United States that meet their requirements to provide the cost-effective goods needed by the platform at this stage,” reported LatePost in China in July. Another reason is that Temu’s marketplace uses the consignment model, where sellers ship items in bulk to Temu’s warehouses in China and agree on wholesale prices. Temu handles listing, marketing, fulfillment, customer service, and, crucially, pricing. Thus, everything on Temu ships from Temu at a price Temu sets.

Shein was reaching out to Amazon sellers with messages like “With how successful [Brand Name] has been on Amazon, I am reaching out to you today with the opportunity to bring [Brand Name] to SHEIN Marketplace.” Temu has also approached some sellers. But while many Shein and Temu sellers also sell on Amazon, only a few are U.S.-based sellers. Given the price expectations of Shein and Temu shoppers, it’s unclear how most U.S. sellers would perform. However, from a different point of view, limiting supply to one pool in China creates a ceiling on Shein and Temu that will be hard to upmarket.

Various estimates put Temu’s GMV at $15 billion in 2023, its first full year of operation. No other marketplace or retailer has ever grown this fast. Although, of course, no other retailer had a pool of money to spend on marketing as big as PDD was willing to provide. It could become the fastest to crash to zero, too. The more than a billion dollars it has spent on marketing so far, and thus its massive operating unprofitability, might spell the end if shoppers don’t return organically.

Estimates put Shein’s GMV at $40 billion in 2023. For Shein and Temu, roughly half of their business is in the U.S., the rest in the dozens of other countries they operate in.

Shoppers are buying more directly from China. Enabled by Shein and Temu, consumer-to-manufacturer retailers like Beauty Pie and Italic, and Amazon, where many sellers are from China, and accelerated by an integrated fulfillment flow (Amazon FBA and Shein/Temu warehouses) hiding the complexity of shipping from a far away manufacturing hub.

Shein and Temu are unlike anything U.S. commerce had seen before, the third iteration of Chinese commerce. They are retailers from China that only sell outside of China, operate at a scale of tens of billions of dollars, spend so much on marketing to be noticed by other retailers and ad networks like Facebook, and run marketplaces with no U.S. sellers or brands. Their attempts to localize are long-term bets that today are closer to an exercise in smoke and mirrors.