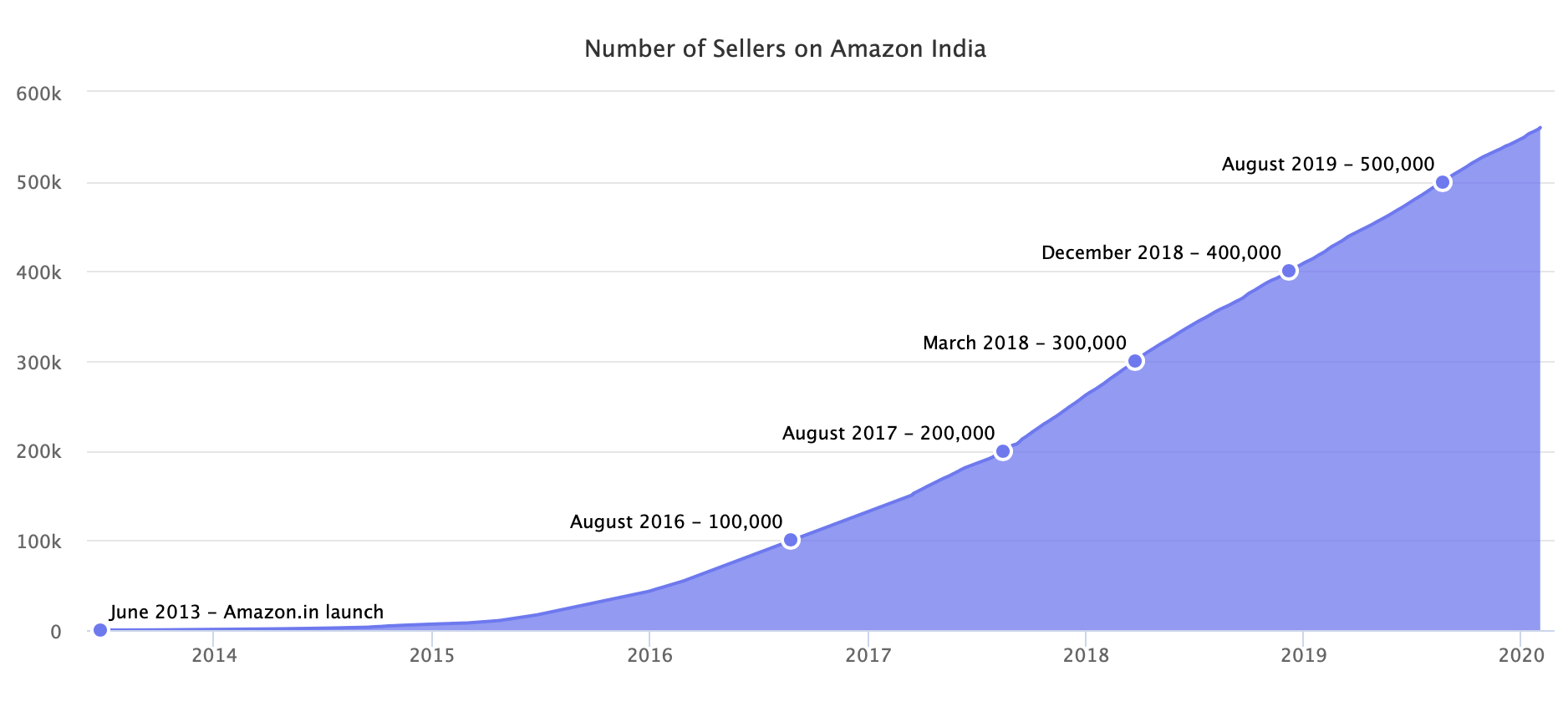

Since launching in India in 2013, the Amazon marketplace there has grown to more than 550,000 sellers. It has doubled in size during the last two years, becoming Amazon’s fastest-growing marketplace except for the U.S.

On a recent trip to India, Jeff Bezos, CEO at Amazon, talked about the company’s plans to bring more than 10 million micro, small, and medium-sized businesses online by 2025. The critical term is micro because Amazon is looking to onboard a different set of sellers than in other key markets - it doesn’t need 10 million sellers in the U.S. or Europe.

“For every 100 companies in India, there are more than 95 micro-enterprises, four small-to-medium businesses, and less than one large company. Developed countries, however, feature around 50 micro-entities, and 40 small-to-medium companies in the same sample size,” said Manish Sinha, Managing Director, Dun & Bradstreet India.

According to Marketplace Pulse research, it wasn’t until the summer of 2016 before the Indian marketplace reached its first 100,000 sellers, three years after it launched in the country. However, since then, the growth has accelerated - it added 150,000 new sellers in 2019 alone. The growth rate will have to drastically accelerate, though, to achieve 10 million by 2025.

However, India is not necessarily welcoming of Amazon. In January, India ordered an antitrust investigation into Flipkart and Amazon India, on the grounds of them indulging in anti-competitive practices to gain a foothold in the country by providing deep discounts and preferential treatment to a select few preferred sellers. Amazon owns a 24% stake in two of the biggest sellers on Amazon - Cloudtail, and Appario - after being forced to reduce its ownership stake in February 2019.

During Jeff Bezos’ trip in India, groups of sellers, as well as local retailers, protested outside, too, holding signs including “Jeff Bezos Go Back.”

And others, including commerce minister Piyush Goyal, have dismissed the announced $1 billion investment for achieving 10 million sellers as funding to cover the losses caused by its predatory pricing. Praveen Khandelwal, the secretary-general of Indian traders’ confederation, said: “Bezos and Amazon have already destroyed many small businesses and are now trying to build a false narrative of empowering small retailers.”

Propelled by rising smartphone penetration, the Indian e-commerce market is expected to grow to $200 billion by 2026. Amazon, together with Flipkart, is creating the foundation for that future. It hasn’t avoided criticism, and yet that criticism is mostly for the same tactics it has used in other markets. India is not the only country inquiring into the company’s alleged anti-competitive actions but is the one where the market is still young.