In 2019, sellers on the Amazon marketplace sold $200 billion worth of products, and as a retailer, Amazon’s sales were $135 billion. For a total Amazon gross merchandise volume of $335 billion, Marketplace Pulse estimates based on Amazon disclosures.

Third-party sellers increased their sales by $40 billion in a year, up from $160 billion in 2018. Amazon’s sales grew by $18 billion, from $117 billion. Gross merchandise volume (GMV), the total amount of sales on Amazon websites, including those by the company itself and by the marketplace, grew from $277 in 2018 to $335 billion in 2019.

Gross merchandise volume was up 21%, while first-party sales were up 15%, and third-party volume was up 26%.

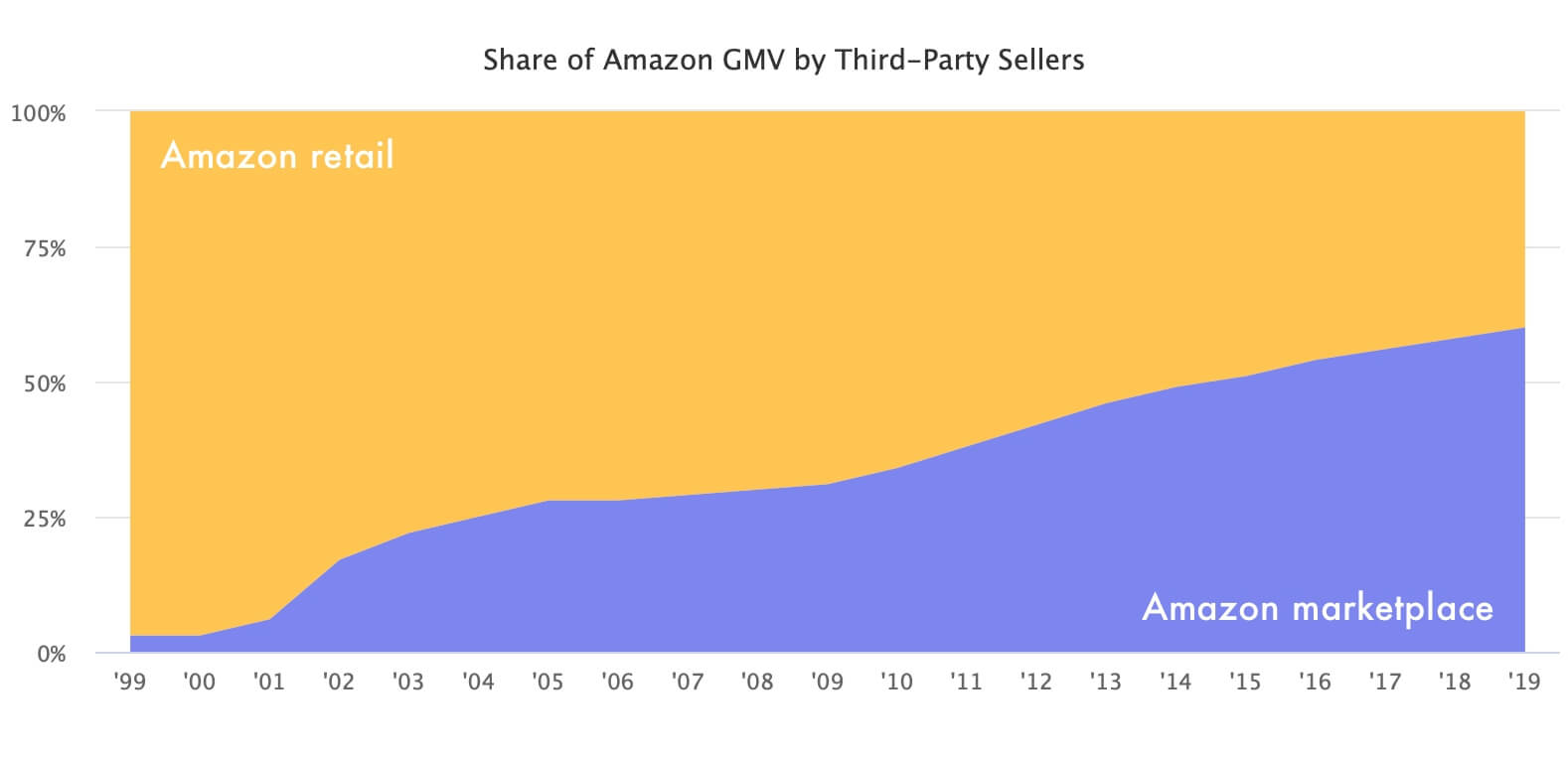

Third-party sellers represent close to 60% of the gross merchandise volume. Their share of the GMV has doubled during the last ten years, from 31% in 2009. The marketplace is growing faster than Amazon’s retail operations and has maintained steady progress for over ten years.

In 1999 sellers on Amazon did $100 million in sales and represented just 3% of the GMV. Since then, the GMV grew a hundred times, and the marketplace materialized to become one of the largest “retail economies” in the world, second only to the one Alibaba built. Amazon marketplace is so large it would rank as the 50th largest economy in the world if it were its own country, below New Zealand’s, but bigger than Qatar’s GDP.

In the US alone, the marketplace volume was north of $100 billion. It was transacted by one of the 898,000 sellers with at least one sale last year.

The large scale has made platform issues more apparent, however. Counterfeits, fake reviews, fraudulent sellers, dangerous products, and other challenges are getting more noticed. And yet, those aren’t significant enough issues still to cause the sales growth to dwindle. The fundamentals are still working well, Prime memberships reached 150 million members in 2019, and the marketplace continues to be driving Amazon’s growth.