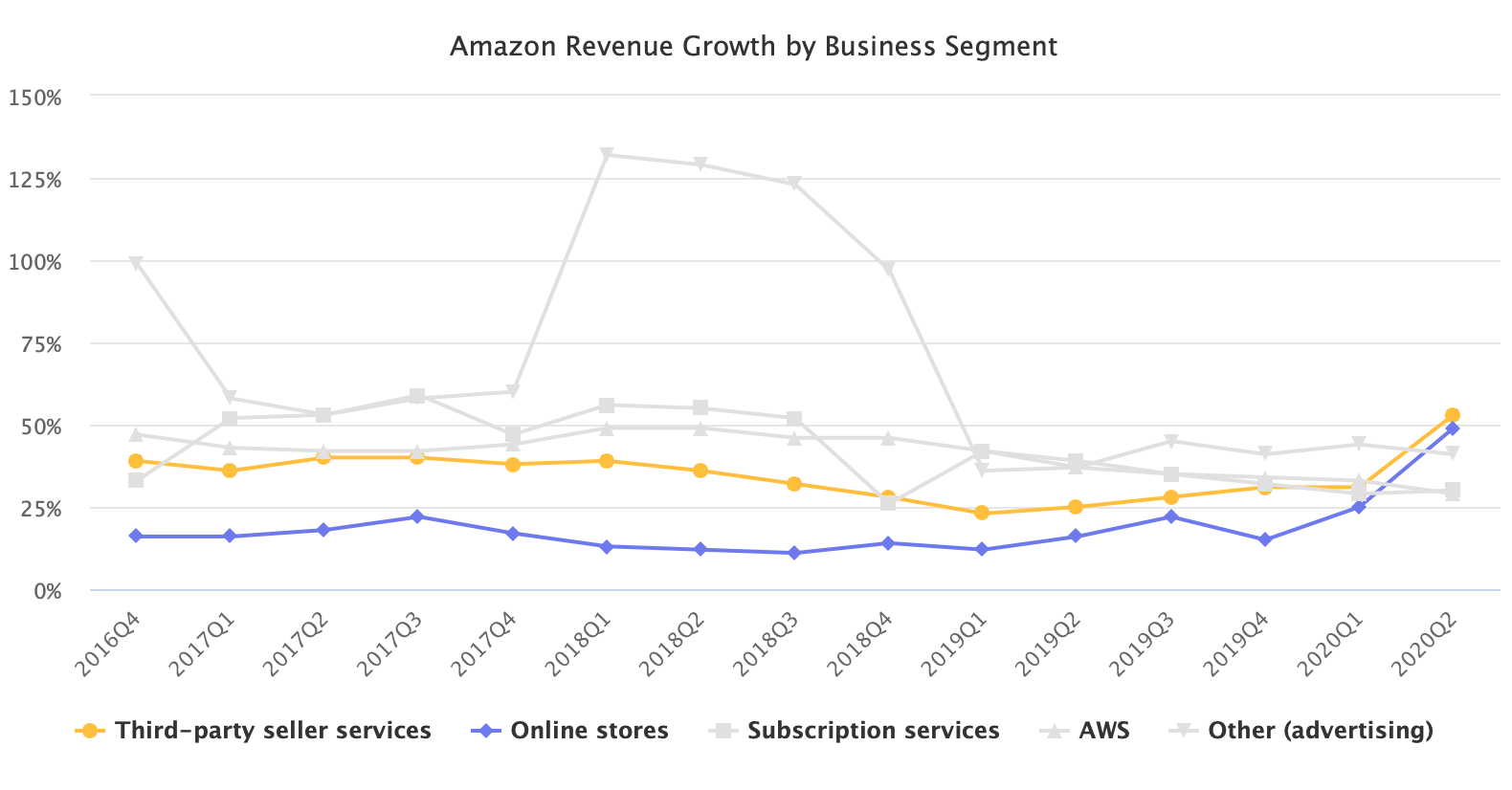

For the first time, in the second quarter, Amazon’s fastest-growing business segment was the marketplace. Revenue from transaction and fulfillment fees was up by an all-time-high 53% in the quarter, indicating strong sales by the marketplace sellers.

“Third-party sales again grew faster this quarter than Amazon’s first-party sales,” confirmed Jeff Bezos, CEO of Amazon. Amazon’s first-party sales were up 49% (marketplace revenue growth of 53% is not marketplace GMV growth, however).

Overall paid units growth was 57% (the metric includes units sold by Amazon and marketplace sellers). A record-high growth for over a decade.

The second quarter’s sales surge has elevated both the marketplace and first-party sales above Amazon’s previously fastest growing business segment - advertising. Advertising revenue is part of the Other segment that grew only 41% in the quarter. For the first time, the segment grew slower than the rest of the company.

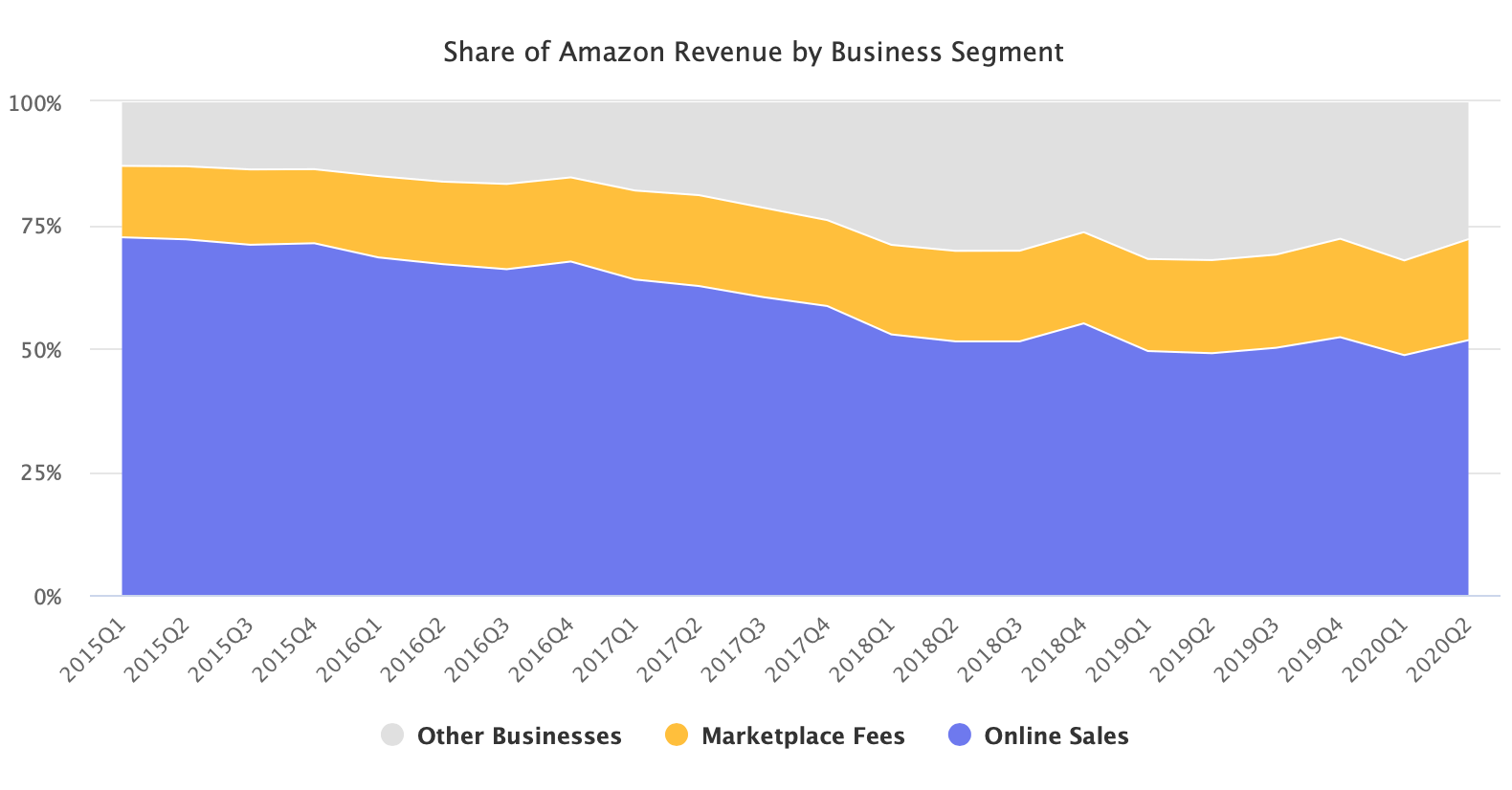

Third-party seller services revenue was $18.1 billion in the quarter and represented 20.4% of the total revenue. Five years ago, revenue from the marketplace represented just 14.4% of the total. The company has built new lines of business like AWS and advertising that reduced first-party sales’ share of the total revenue to 50%, but the marketplace has continued to grow in revenue share too.

Fulfillment services used by marketplace sellers remain significantly impacted. Amazon’s prioritization of essentials has caused many sellers to sell out of their FBA inventory and transition to using their own warehouse. During the investor call, Amazon has confirmed this transition and appears to have confirmed that not all sellers are returning to FBA, even as it resumes some level of normal operations.

“As we moved into late April and early May, we expected that, because a lot of the sellers can toggle between MFN or FBA sales, that we would see MFN drop as FBA picked up. But to a large extent, MFN remained strong even as FBA picked up. It started to normalize a little bit more to normal levels towards the end of the quarter, but MFN still remains high,” said Brian Olsavsky, Chief Financial Officer of Amazon.

Merchant fulfilled (MFN) sales are going to play a crucial role in the next two quarters. Amazon has already introduced quantity restrictions for FBA and some sellers are already reporting inbound delays. Fulfillment and shipping are going to be the most critical areas to watch towards the end of the year, and will either enable or hinder growth for online retailers, Amazon included.