Walmart is Amazon’s only competitor. Everyone else is too small, too niche, or not a good substitute. A bigger Walmart means a better alternative to Amazon, which means a better e-commerce market.

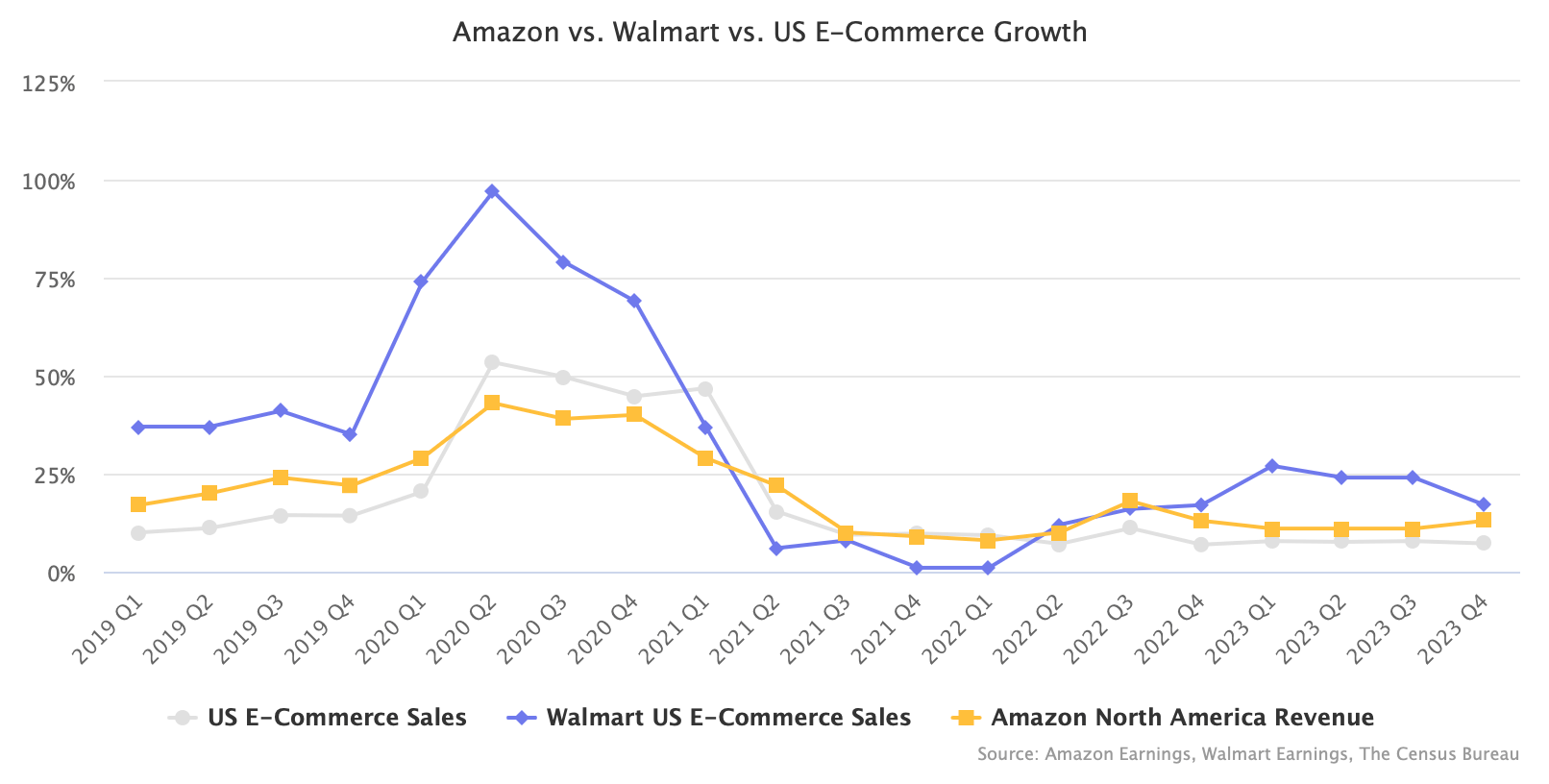

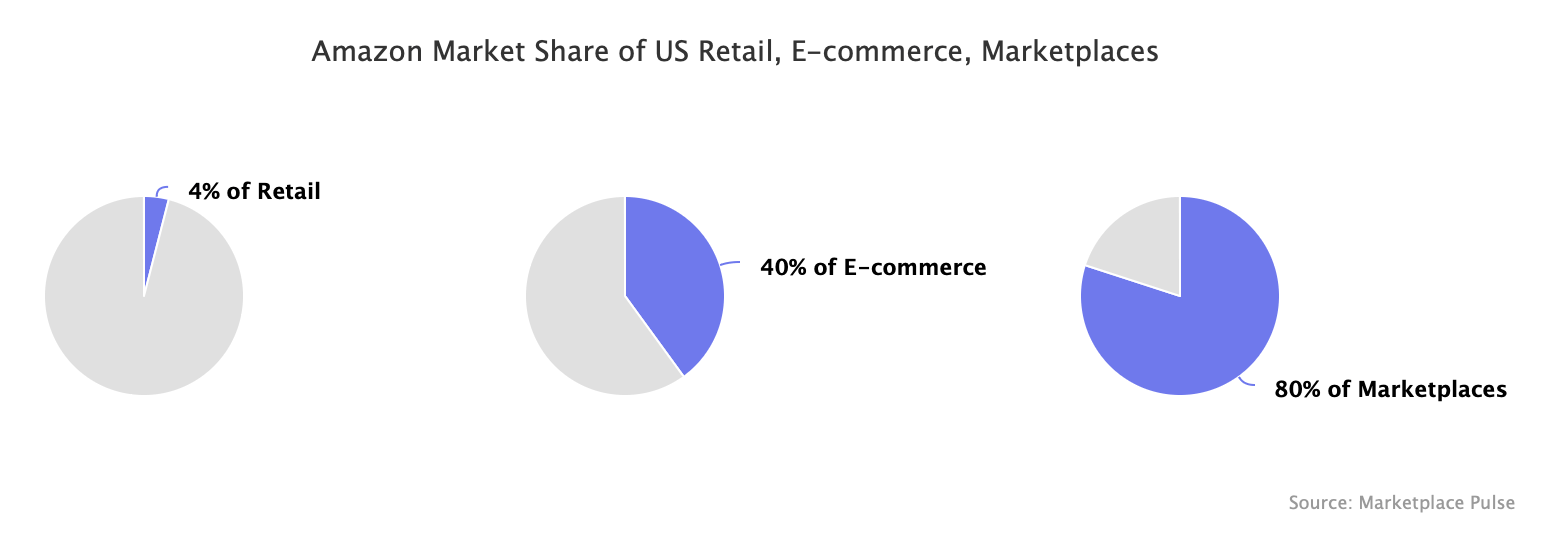

Amazon dominates U.S. e-commerce with a roughly 40% market share. Walmart is far behind, with less than 10%. However, Walmart has been growing faster than Amazon for at least the past five years because it started from a smaller base, its online grocery strength, and because it ultimately refocused on e-commerce in 2016 after letting Amazon grow uncontested for decades. In 2023, it finally crossed $100 billion in global e-commerce sales. Most of that was in the U.S.

eBay remains the third-largest e-commerce channel in the U.S. Yet, while overall online spending increased 120% in five years, spending on eBay was only up by 7%. After a decade of head-to-head competition with Amazon in its early days, eBay, at present, only focuses on enthusiasts and collectors. Target is growing, but 70% of its e-commerce comes from same-day pick-up and delivery from stores, and in five years, its marketplace has only grown to less than 1,000 sellers.

Shopify surpassed $200 billion in annualized GMV in 2023. But, according to comments during the Q4 earnings call, its marketplace-like app Shop is doing less than $1 billion a year (“In Q4, the Shop App nearly reached $100 million in GMV in a single month”). Thus, Shopify is not a shopping destination with a single shopping cart but proof that direct-to-consumer works and is growing. For a few years, Google was working on pivoting its price comparison engine to one where shoppers could check out directly, aggregating Shopify and other stores, but it gave up in 2023.

Disruptors Temu, Shein, and TikTok Shop are the most visible but only serve specific use cases, price points, and types of buying. Each will inevitably try to expand in selection and price points to grow past their original value proposition. However, while Shein’s success in clothing forced Amazon to lower the fees it charges sellers, its attempts to add more categories are far less disruptive.

While shoppers have choices, third-party sellers who make up most of Amazon’s sales have few - Amazon is 80% of the market for businesses that sell through marketplaces. eBay is the second largest marketplace, but its lack of growth means it is losing market share, and its focus on enthusiasts means it only works for some categories. Thus, Walmart has replaced eBay as the second most important channel and grown the marketplace to over 100,000 active sellers.

Amazon’s seemingly infinite selection is what sells Prime memberships. It promises that it will have something to offer no matter the search query. There are cases when buying directly from brands, discovering products from social networks on TikTok, finding collectibles on eBay, or an unbelievably cheap USB cable on Temu is best. But only Walmart comes close to Amazon.

If Amazon had meaningful competitors as it was gaining market share, they would have pushed it to invest more in shopping experiments and treat sellers better, which would likely have led to higher overall e-commerce spending than it is today. Walmart is that competitor. With $100 billion in online sales, finally in the same order of magnitude as Amazon. It is still much smaller but has figured out fulfillment, marketplace, and advertising.