The pool of buyers acquiring Amazon sellers has expanded beyond Amazon aggregators. Thus despite challenges faced by some, the M&A market remains active since it isn’t solely reliant on aggregators.

After raising over $16 billion, many Amazon aggregators started experiencing difficulties when it became clear that operating the acquired businesses took much more work than attracting capital in the 2021 funding environment. Also, most of the raised money was debt which today is inaccessible due to debt covenants. Nevertheless, there are still many active aggregators, and some have continued with their acquisitions, albeit at a slower pace.

Amazon aggregators attracted a wider range of buyers that previously didn’t consider the space. Strategic players such as holding companies of online brands and category-focused companies, private equity funds, individuals, and established Amazon sellers have entered the market. Some were buyers before the aggregator boom, but now more such buyers joined the space. These new buyers now outnumber aggregators.

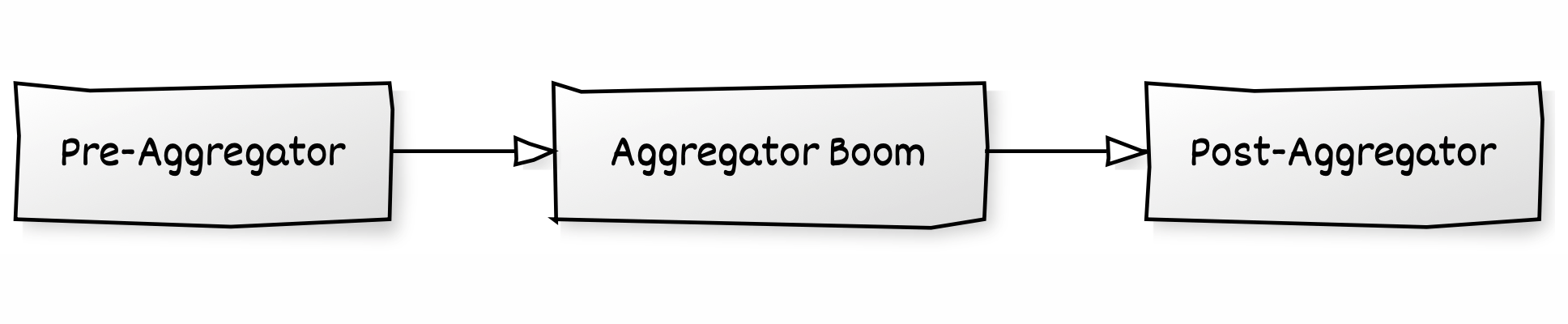

There are three distinct eras: pre-aggregator before 2021, aggregator boom in 2021, and post-aggregator since 2022. Each has clean-cut supply and demand ratios, valuation multiples, and capital inflows. Post-aggregator doesn’t mean aggregators are gone; instead, they no longer identify the space. The aggregators themselves are also very different firms compared to their 2021 approach.

Amazon seller M&A market had become synonymous with Amazon aggregators because acquisitions were rare before aggregators came, and they popularized the market. The critical evolution is that the space has evolved and expanded past aggregators, which are now just one of the types of buyers. “These days, I don’t think that we have a single deal in which we are reliant only upon aggregators,” said Michal Baumwald Oron, CEO of Fortunet, an e-commerce investment banking firm.

Today, there are hundreds of buyers actively seeking to acquire Amazon sellers, including many of the nearly one hundred Amazon aggregators. In contrast to 2021, where aggregators dominated the landscape, non-aggregator buyers now likely represent the majority of closed deals.