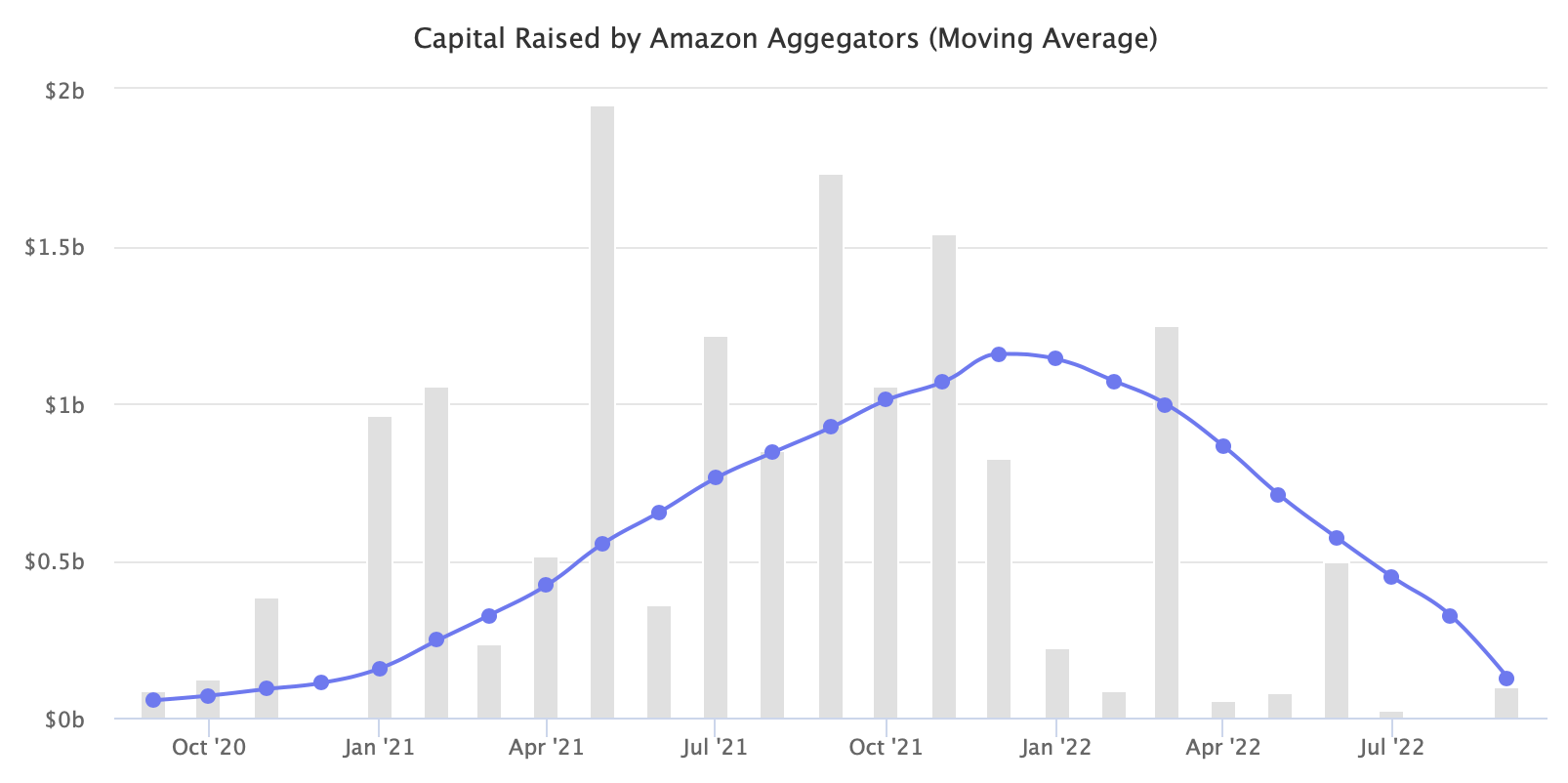

Funding for Amazon aggregators is down over 80% in 2022. However, much of the previously committed capital is yet to be deployed. Thus, despite little new funding, acquisitions have not stopped.

2021 was the boom year in the boom and bust cycle used to describe economies. Over a billion dollars flowed monthly to fund aggregators during the boom period. Due to external and internal factors, that stopped in 2022. This year is shaping up to be the bust period.

Last year by September 2021, aggregators had raised nearly $9 billion in new funding. This year, the figure is only $2.3 billion. The moving average chart forms an almost perfect bell curve. The next period is about to be as quiet as the months leading up to the craze.

Venture capital (VC) funding is down overall, although not as severely as for aggregators. According to Crunchbase, for example, funding fell 27% year over year in the second quarter of 2022. Over the same period, funding for aggregators was down 77%. Macroeconomic factors, including inflation and rising interest rates, have slowed VC funding, but aggregators had additional headwinds.

Macro issues aside, many chased scale before building a foundation, and some turned out to be “worse at being Amazon sellers than the Amazon sellers they acquired.” All of that is getting worked out by adjusting M&A strategy and focus. And sometimes, unfortunately, layoffs. Meanwhile, it led to the “Trough of Disillusionment” stage of the Gartner hype cycle.

If 2021 was the year to launch an aggregator and attract what looked like unlimited capital on a virtually copy&pasted pitch deck, 2022 is the year of survival. Multiple brokers and investment bankers say deals are still getting closed because many aggregators have yet to spend their capital. The acquisitions market is healthy but fundamentally different from 2021. However, the bust period of the cycle might last for a while before winning formulas emerge among the 100 existing aggregators.