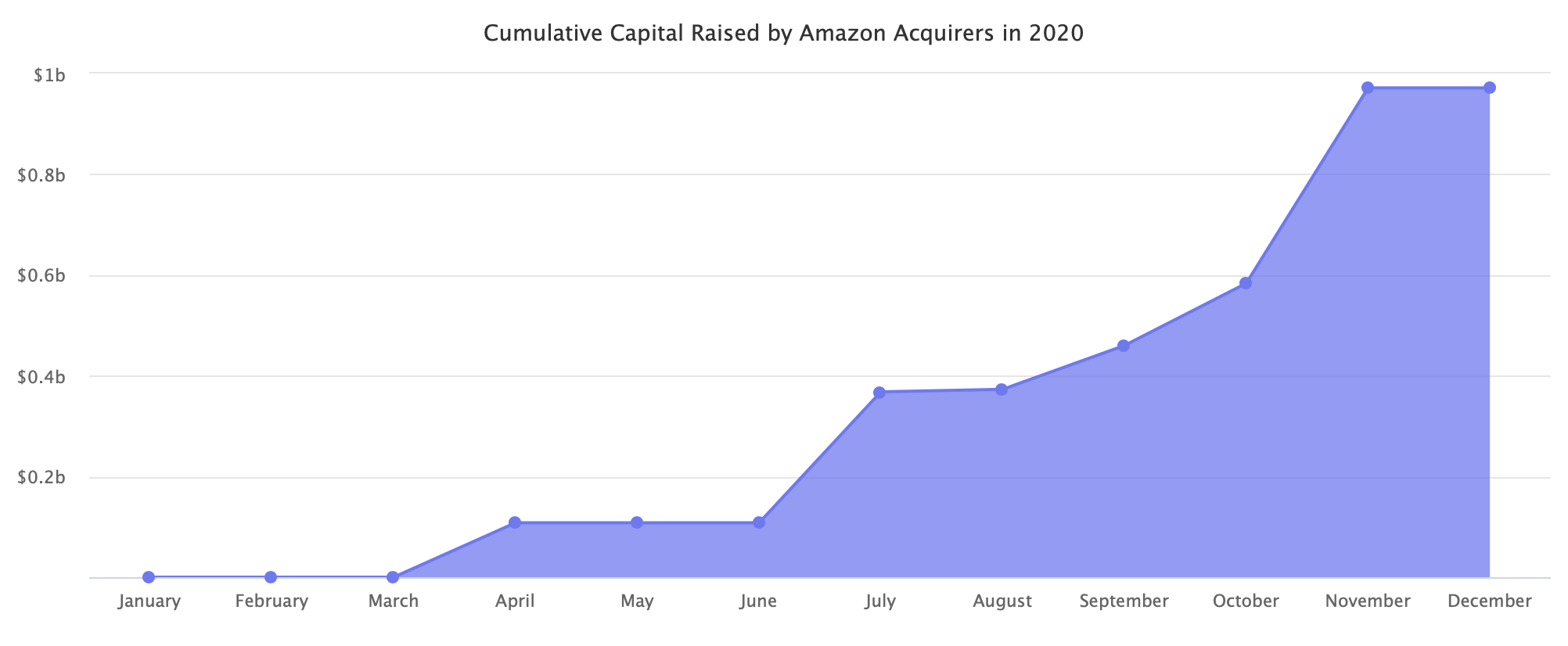

Nearly $1 billion in fresh capital has been committed in 2020 to Amazon aggregators looking to acquire Amazon sellers and brands. The market had a breakout year because of three factors: the pandemic accelerating spending on Amazon, Thrasio raising hundreds of millions of dollars, and Anker, an Amazon-native brand, going public.

- November 2020. SellerX Raises $118M to Buy Up and Grow Amazon Marketplace Businesses

- November 2020. Heyday Raises $175 Million to Buy Amazon Businesses

- November 2020. Razor Raises €25 Million to Acquire and Scale Amazon Brands

- November 2020. Heroes Raises $65M in Equity and Debt to Become the Thrasio of Europe

- October 2020. Perch Raises $123.5M to Grow Its Stable of D2C Brands That Sell on Amazon

- September 2020. Boosted Commerce: $87 Million Funding and Acquisition of Six Amazon Fulfillment Companie

- August 2020. Razor Raises €4 Million Seed Round

- July 2020. Thrasio Raises $260M, Reaches Unicorn Status With $1B Valuation

- April 2020. Thrasio Raises $100 Million in Fresh Capital

- April 2020. Perch Raises $8M to Acquire Top Performing ‘Fulfillment by Amazon’ Products and Companies

Capital committed is a mix of equity and debt. Additional money has been raised by firms that haven’t announced it publicly yet.

Accel Club, Acquco, Alpha Rock Capital, Boosted Commerce, Cap Hill Brands, Centro Brands, Dragonfly, Flywheel Commerce, GOJA, Heyday, Inflection Brands, Perch, Recombrands, Suma Brands, and Thrasio operate in the U.S. Brands United, Razor Group, Thirstii, SellerX, Zeelos, and Orange Brands operate in Germany. The United Kingdom has Heroes.

In 2019, sellers on the Amazon marketplace sold $200 billion worth of products. Amazon marketplace is so large it would rank as the 50th largest economy in the world if it were its own country, below New Zealand’s, but bigger than Qatar’s GDP. Despite that, press coverage has often wrongly focused on stories like sellers buying from Walmart to resell on Amazon instead. Amazon’s press releases have highlighted seller stories similar to those of Etsy sellers.

The capital pouring in is validating the market as something serious. The businesses that sell on Amazon have grown mainly relying on measurable demand, controllable unit economics, and the predictability the data-rich marketplace provides through tools like Jungle Scout, Helium 10, and others. The firms rolling up those businesses use the same principles to evaluate and value them and grow them post-purchase.

The types of businesses those firms are looking to acquire are most often private-label sellers that use Amazon as one of their primary sources of distribution (some are also looking at brands using Shopify). There is no demand for resellers, nor do other marketplaces play a significant role.

Amazon-dependency is both the most significant risk and the fuel that powers those firms. But there are dozens of additional challenges yet to be resolved. For example: transferring the scrappiness of a one-person seller to an employee of a firm, long-term risk of brands on Amazon, building a brand vs. being operationally efficient, buying brands vs. building brands in-house, avoiding suspensions, and others. Money for most of those firms came first; they will spend the next year figuring out the model that could work and scale.

Today many of the firms are look-alike, using the same “we buy Amazon businesses, we close quickly, we have a smooth process” messaging. As more capital continues to flow in, there will be more focus spent on differentiating. “We buy Amazon businesses” is already an outdated concept. Some are already focusing on particular categories; some are investing in exchange for a minority stake. Others want to be incubators for more brands like Anker.

The largest firms modularize Amazon seller operations. Rather than an individual seller trying to be great at sourcing, importing, marketing, financial planning, and omnichannel, those firms run the portfolio by having each area handled by a team of experts. The best are building in-house technology to handle crucial tasks. Amazon’s search algorithms do not rank larger sellers higher, but small sellers (often under-capitalized and over-leveraged) are unlikely to out-run the best-operating firms.

Some firms are e-commerce teams with no investment experience. Some are seasoned investors with no e-commerce experience, let alone Amazon marketplace experience. They will hire for jobs outside of their areas of expertise and utilize agencies to take care of the rest. The operational complexity required to handle and grow dozens of hundreds of Amazon sellers is perhaps currently under-appreciated, thus as those firms scale, some will struggle.

101 Commerce from Austin, Texas, was one of the first firms to enter this market in 2017. It had the right talent, experience, and capital. But it appears to have failed and has since been integrated into GOJA. A few other less-known firms in this space have also shut down or pivoted to building brands rather than acquiring them.

Likely the acquisition multiples will increase. As more firms compete for the same businesses, some will be able to negotiate a higher price. Maybe prices will rise overall. If they do, that will invite even more entrepreneurs to pursue selling on Amazon since the exit plan is simple and predictable.

A few years from now, some of those firms will be worth much more than the parts purchased at 2.5-4x (they acquire businesses at 2.5-4x EBIDTA multiple with earn-out). Performing a roll-up strategy in a fragmented but growing market is a common strategy in private equity. Total addressable market is 15,000 US-based sellers exceeding $1 million in sales and 7,500 European businesses surpassing $1 million in sales. Amazon marketplace had one of its fastest growth years in 2020 - the market has further expanded.