Amazon launched in South Africa on May 7th. The marketplace is Amazon’s first in sub-Saharan Africa, bringing the total number of active markets to 22.

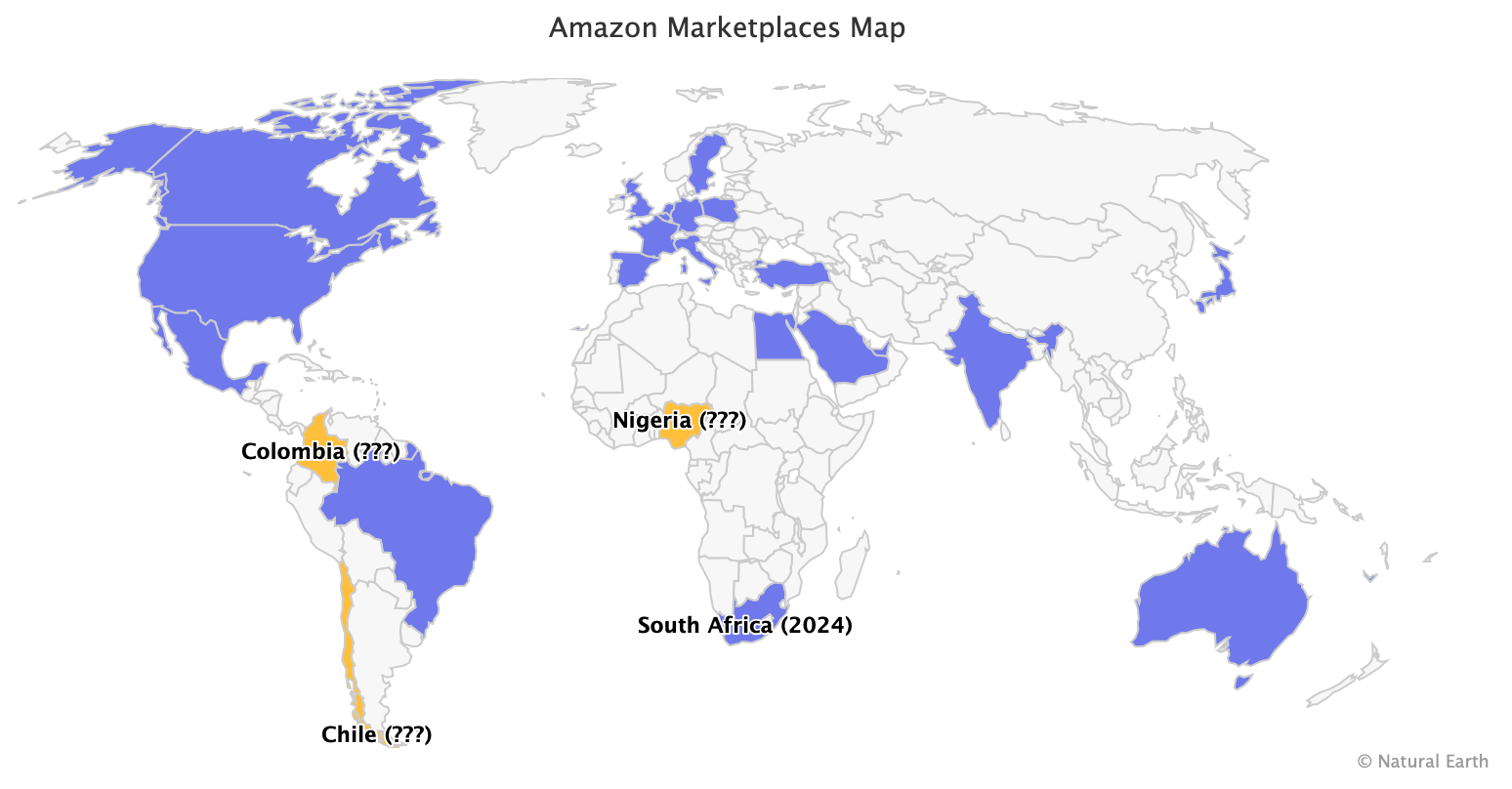

The launch in South Africa is over a year late, delayed by changing priorities inside of Amazon. After six years with at least one new market launched, 2023 was the first year with no global expansion. Before South Africa, Belgium was the last new marketplace in October 2022. Its rollout in the previously planned Colombia, Chile, and Nigeria appears paused. South Africa and Nigeria are the two largest e-commerce markets in sub-Saharan Africa.

Amazon is starting from scratch in South Africa, although it already had some presence there, with the U.S. version of Amazon.com being one of the most visited shopping websites. Amazon’s first entry into the continent, Egypt, launched by replacing a localized Souq.com store after it acquired it in 2017. The acquisition also launched the Saudi Arabia and United Arab Emirates marketplaces.

Without other marketplaces nearby and with no foundation to kickstart from, Amazon is starting with a limited supply of goods and no Prime membership. However, it already operates the Fulfillment by Amazon (FBA) service for sellers in the country. Amazon started recruiting sellers in South Africa more than six months ago and, according to Marketplace Pulse data, had over a thousand local sellers at launch. There are no international sellers yet.

The launch in South Africa is reminiscent of its entry to Australia in 2017. The market has well-established players (eBay and others in Australia, Takealot in South Africa), the new country cannot leverage Amazon’s infrastructure in other countries, and Amazon parachuted in an offering largely reliant on Amazon’s globally recognized brand name.

Amazon’s international bets are wagers on a very long time horizon, and — compared to aggressive players like Temu, which launched in South Africa two months ago — it scales them slowly to match. It took Amazon more than five years to become number one in Australia. In South Africa, Amazon doesn’t look like a disruptor today, but these new bets are so small relative to its core markets that Amazon can out-wait the market.