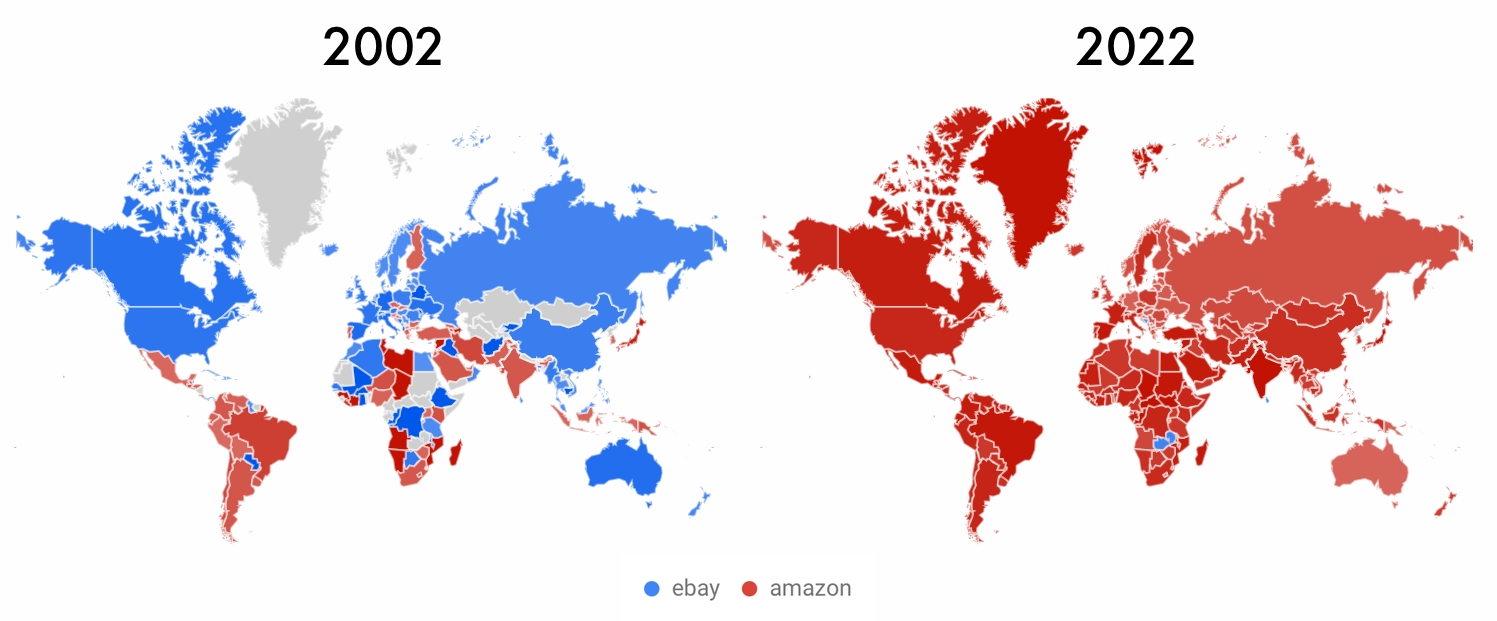

Ten years ago, Amazon was more popular than eBay in only the U.S. It has since dethroned eBay around the world, and Australia is the last remaining country to fall.

Amazon’s dominance in e-commerce appears unchallenged in most of its core markets; however, that position is surprisingly recent. It wasn’t until 2008 when Amazon’s enterprise value outgrew eBay’s, and in many countries, it took even more years for Amazon to overtake in market share.

The color represents the more popular search term on Google during the year - countries marked in red had more searches for Amazon, and countries painted blue had more searches for eBay. The color intensity represents the percentage of searches for the leading search term in a particular region.

While a naive estimate of consumer sentiment, it roughly matches the underlying growth of the two platforms. The two decades of data show how even the regions where neither of them is actively promoting eventually followed global trends (a lot of the noise early on comes from searches for the Amazon river rather than shopping).

Australia is the last country for Amazon to win. It is the one spot on the map that remained blue for two decades, highlighting eBay’s dominance. Amazon launched there five years ago in 2017. By the end of this year, Amazon will have overtaken eBay in website visitors - it is already 90% as big - and thus likely in market share soon too. It has already turned red by the end of 2022 on the map.

The map gets much more colorful when global challengers like Shein, Shoppe, Meesho, Flipkart, Lazada, and others are considered. Shein, a fast-fashion marketplace, has recently been more popular than either Amazon or eBay in countries like Poland, Chile, and Brazil. Amazon overtaking the map also only means it is more popular than eBay - in many countries, it is not the most popular shopping destination.

Amazon has won against eBay, but the fight now has a dozen new and much stronger players.