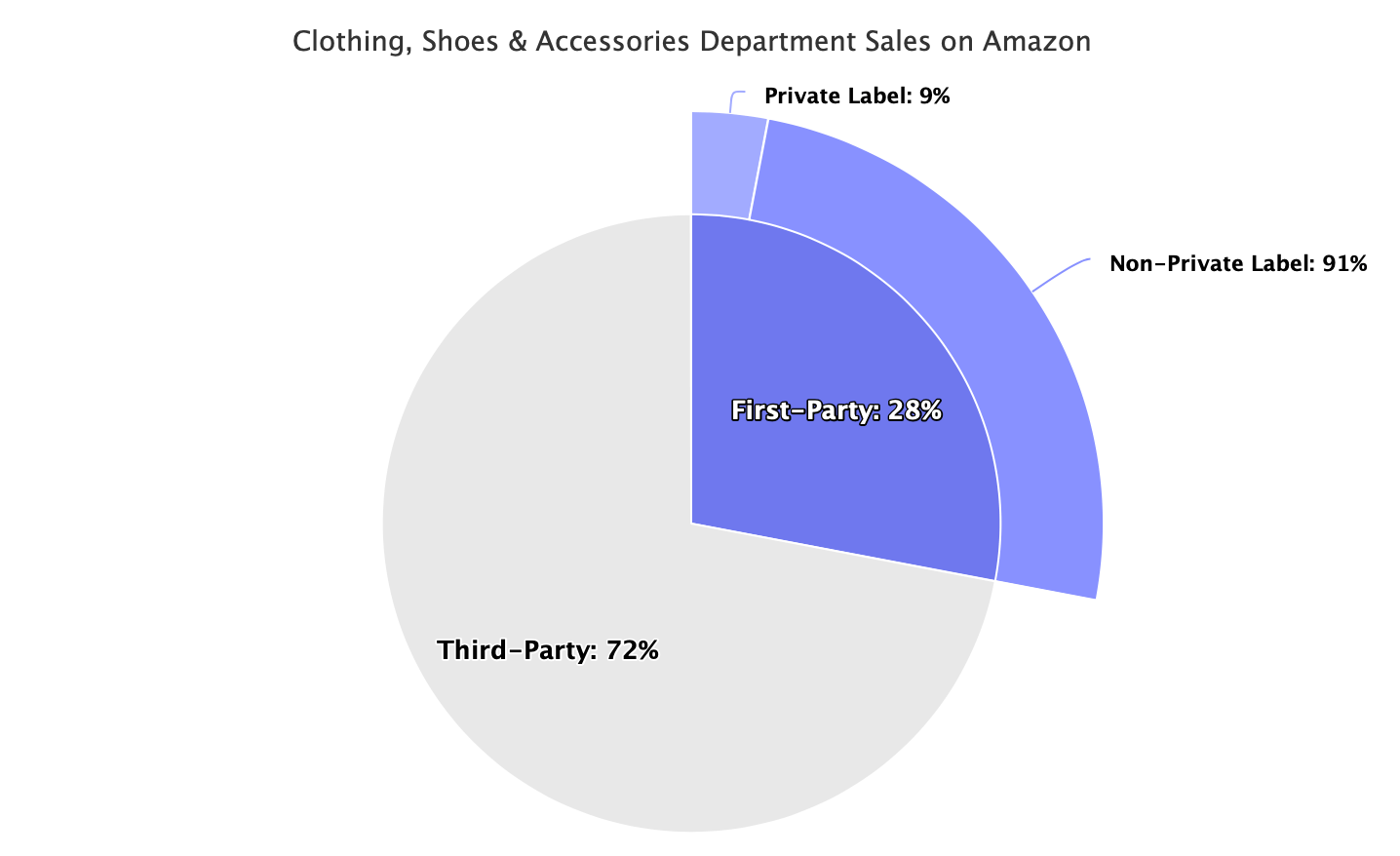

9% of Amazon’s sales in the Clothing, Shoes & Accessories department are from its private label brands. In response to House Antitrust Subcommittee questions following the July 29th hearing, Jeff Bezos included a breakdown by department of Amazon’s private label brands share of total first-party sales.

In the Home & Kitchen department, private label brands represented 4%, in Consumer Electronics, they represented 3%, and in Consumables, they represented 2% of the company’s first-party sales in 2019. In other departments, private label brands represented less than 1% of the company’s sales.

Rep. Pramila Jayapal, a Democratic Congress member from Washington, asked, “For each of the following product categories, please identify the percentage of product sales that are (i) Amazon first-party vs. Amazon third-party, and (ii) within Amazon first-party, the percentage that are Amazon private label vs. non-private label.” The categories in question were Consumer electronics, Beauty, Kitchenware, Apparel, Children’s apparel, Sports apparel, Textbooks, Trade fiction books, Trade non-fiction books, Batteries, Toys, and Smart speakers.

Jeff Bezos, CEO of Amazon, responded, “The table below provides responsive information for comparable categories. Apparel is included within Softlines, which also includes other non-apparel products such as footwear and accessories. Our store offers a wide range of batteries, which are included in various categories. Most types of batteries are included within Total Consumer Electronics and Consumables, each of which include additional products. Smart Speakers are also included within the Total Consumer Electronics category. These data are for Amazon’s 2019 Fiscal Year.”

| Category | First-Party % of Total Sales $ | Private Brand % of First-Party | Third-Party % of Total Sales $ |

|---|---|---|---|

| Consumer Electronics | 43% | 3% | 57% |

| Beauty | 35% | < 1% | 65% |

| Home & Kitchen | 33% | 4% | 67% |

| Softlines | 28% | 9% | 72% |

| Books | 74% | < 1% | 26% |

| Consumables | 41% | 2% | 59% |

| Toys | 42% | < 1% | 58% |

In the Clothing, Shoes & Accessories department, first-party sales of bought brands represented roughly 25% of total GMV, first-party private label sales represented less than 3%, and the marketplace accounted for 72%.

While the marketplace represents 60% of overall GMV, some departments are outliers. Specifically, Books was the only highlighted department where third-party sales represented just 26% of sales, less than the overall. In contrast, Home & Kitchen, Beauty, and Clothing, Shoes & Accessories departments outpaced the overall GMV share.

Amazon’s private label brands represent less than 1% of total listings, however. According to the data, the third-party marketplace represents over 90% of all listings except for the Books department. The marketplace provides the long-tail of the assortment.

| Category | First-Party % of Total Listings | Private Brand % of First-Party | Third-Party % of Total Listings |

|---|---|---|---|

| Consumer Electronics | 4% | < 1% | 96% |

| Beauty | 4% | < 1% | 96% |

| Home & Kitchen | 1% | < 1% | 99% |

| Softlines | 8% | < 1% | 92% |

| Books | 34% | < 1% | 66% |

| Consumables | 3% | < 1% | 97% |

| Toys | 9% | < 1% | 91% |

Amazon’s most successful clothing brands are Amazon Essentials (men’s and women’s clothing), Simple Joys by Carter’s (children’s clothing), Goodthreads (men’s clothing), Daily Ritual (women’s clothing), and Lark & Ro (women’s clothing). The Clothing department has the highest number of brands launched by the company, and they combine to over 10,000 products, roughly half of Amazon’s private label portfolio.

9% is low compared to big-box retailers. In February, Macy’s said it is on track for its private brands to make up 25% of sales by 2025. Target is at a higher percent already, and half of its owned brands are in clothing. JC Penney is close to half of its sales from private label brands and was targeting 70%. Clothing is one of the most common categories from store brands.

According to Wells Fargo and Morgan Stanley, Amazon has quietly become the nation’s leading apparel retailer. The company has ambitions in clothing beyond Amazon Essentials, like the Vogue x Amazon Fashion storefront launched in July, and the Fashion Stores luxury fashion offering announced in September. In the meantime, Amazon is filling gaps left by brands that have steered clear of the company with its own brands. Like the Amazon Essentials polo shirt that has been the number one best-seller for over a year.