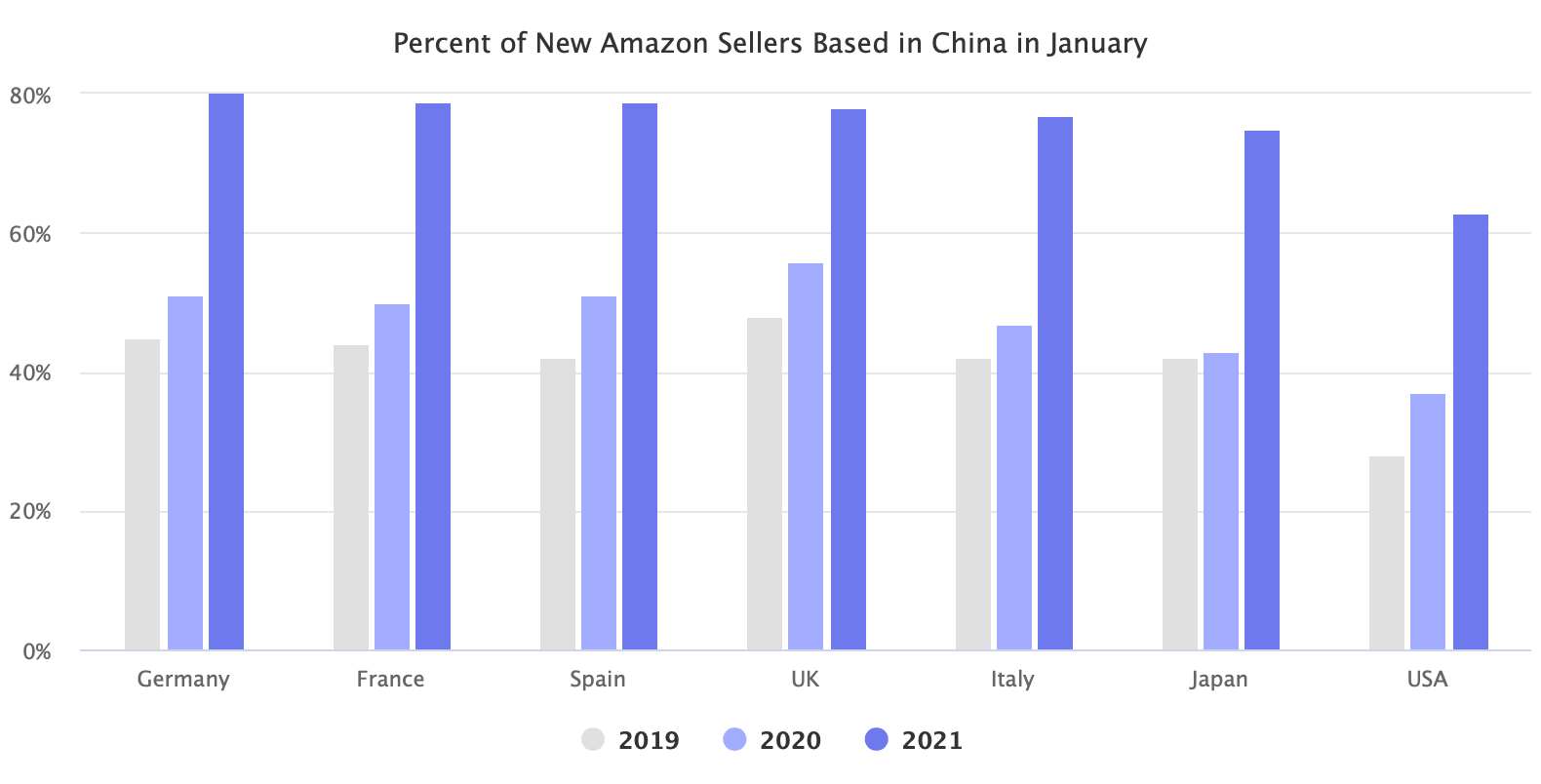

China-based sellers represented 75% of new sellers on Amazon in January. A significant increase from 47% in the previous year. While this hasn’t yet impacted the GMV market share - domestic sellers are responsible for most of the total sales - it is a trend that has been accelerating for years.

75% of new sellers in the top four core Amazon markets - U.S., U.K., Germany, and Japan - are based in China. The percent is the average of the four marketplaces, according to Marketplace Pulse analysis of more than forty thousand sellers that joined those Amazon marketplaces so far in 2021. Each of those four marketplaces and the other three European marketplaces (France, Italy, Spain), and Amazon’s other international platforms, exhibit an identical pattern.

Sellers based in China represented 47% of new sellers in January 2020 and 41% of new sellers in January 2019. The share has more than doubled on Amazon in the U.S. from 28% in 2019 to 63% in 2021. Since March 2020, more than half of new sellers in the U.S. were from China.

Previous estimates put China’s share of Amazon’s GMV at 30-40%, and that on most marketplaces, there are few international sellers present except for those from China. For example, few U.S. based sellers sell on Amazon in the U.K. or Germany, but China-based sellers sell on all Amazon marketplaces.

Amazon didn’t create the market, nor is it alone in it. But it was one of the companies - the list also includes Wish, AliExpress, and others - that five years ago or earlier realized the future. “One of the themes is Chinese factories who made stuff for Walmart and the likes for the past 20 years now realize they have shot at building a brand themselves and selling directly to the world, without the intermediary… and we are that vehicle.” Wrote Sebastian Gunningham, senior vice president of Amazon Marketplace at the time, in an internal email from 2015 released by the House Judiciary Committee.

However, the Amazon sellers industry is bifurcated between China and the rest of the world. For example, most software tools popular in the U.S. have little reach in China, let alone a Chinese language translation, and vice versa. The rapidly expanding seller acquisition market also avoids sellers outside the domestic markets. Due to the language barrier, there is virtually no overlap in content like courses and conferences, and employee talent rarely mixes between the markets.

For Chinese brands, Amazon is the most efficient direct-to-consumer platform to reach the U.S. and European shoppers. Last year, Universal Postal Union slashed the subsidy that enabled low-cost small package shipping from China to the U.S, doubling shipping prices overnight. But sellers on Amazon primarily rely on FBA warehouses, shipping containers worth of products to the U.S., rather than each order directly to consumers. So while some platforms were negatively impacted by the price increase, selling on Amazon didn’t change. The same products might be available on, for example, AliExpress, but they ship in two days on Amazon.