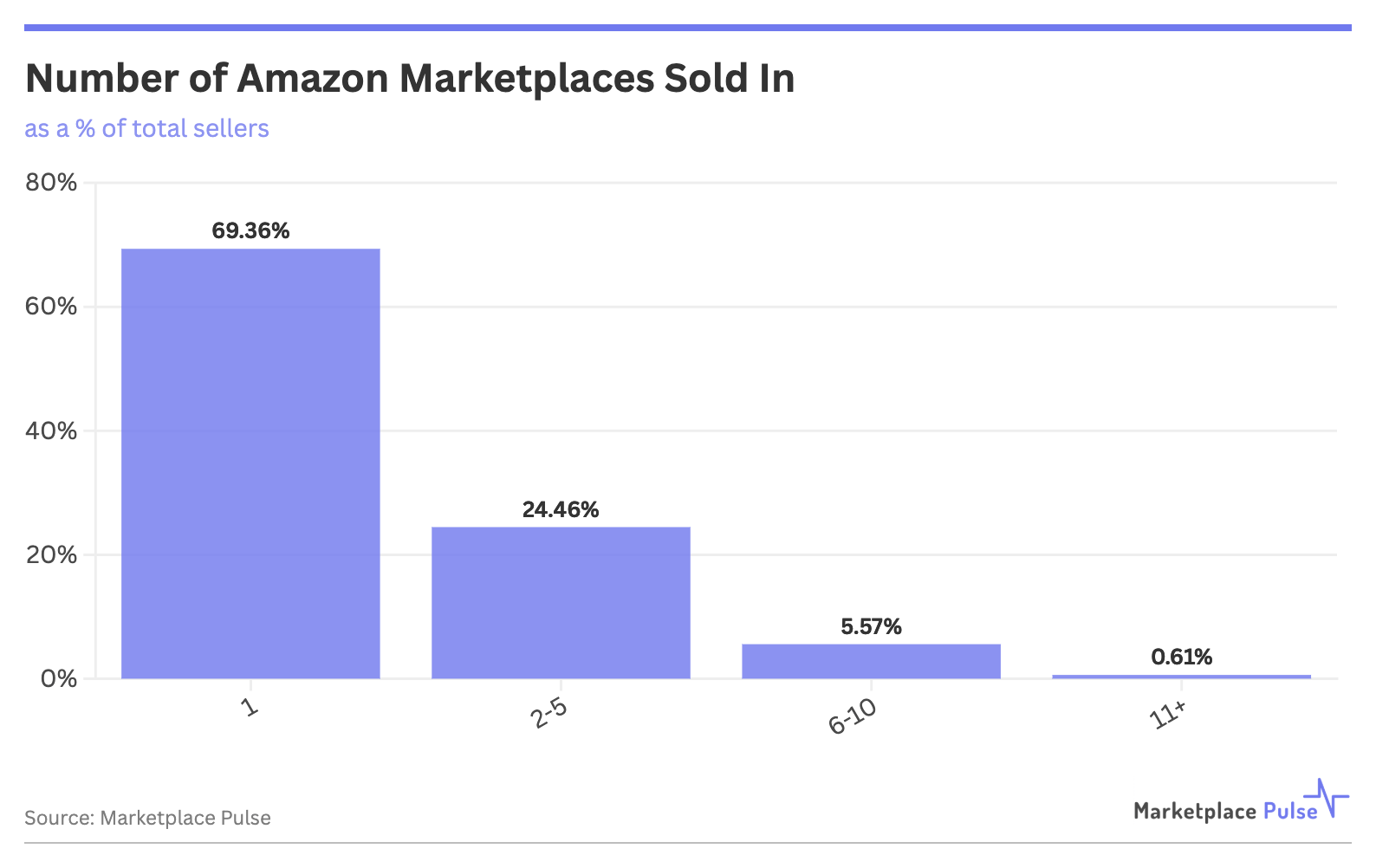

Amazon continues to add international marketplaces, but most sellers aren’t following them across borders. Despite Amazon’s efforts to make global selling easier, nearly 70% of sellers remain active in just one marketplace.

According to Marketplace Pulse research, 69% of Amazon sellers operate in a single marketplace, while less than 1% are truly global – selling in 11 or more countries. Even among the more ambitious sellers, only 6% have expanded to six or more marketplaces.

This hesitation to expand globally persists despite Amazon having 23 active marketplaces and offering numerous tools to facilitate international selling. Amazon provides global unified selling accounts, automated international listing creation, global pricing strategies, in-house supply chain solutions, and international currency management.

The reluctance toward international expansion is particularly pronounced among U.S. sellers. Less than 1% of American merchants sell outside North America. While 12% have ventured into Canada and 5% into Mexico, few make the leap across oceans to markets like Japan, Germany, or the UK.

Amazon’s own international expansion has picked up again after a brief hiatus in 2023. South Africa launched in 2024, and Ireland launched last week.

Several factors contribute to sellers’ hesitation. Regulatory complexity has increased, particularly in Europe, where Brexit, variable VAT reporting structures, and new legislation like the Responsible Person and General Product Safety Regulation have created additional hurdles.

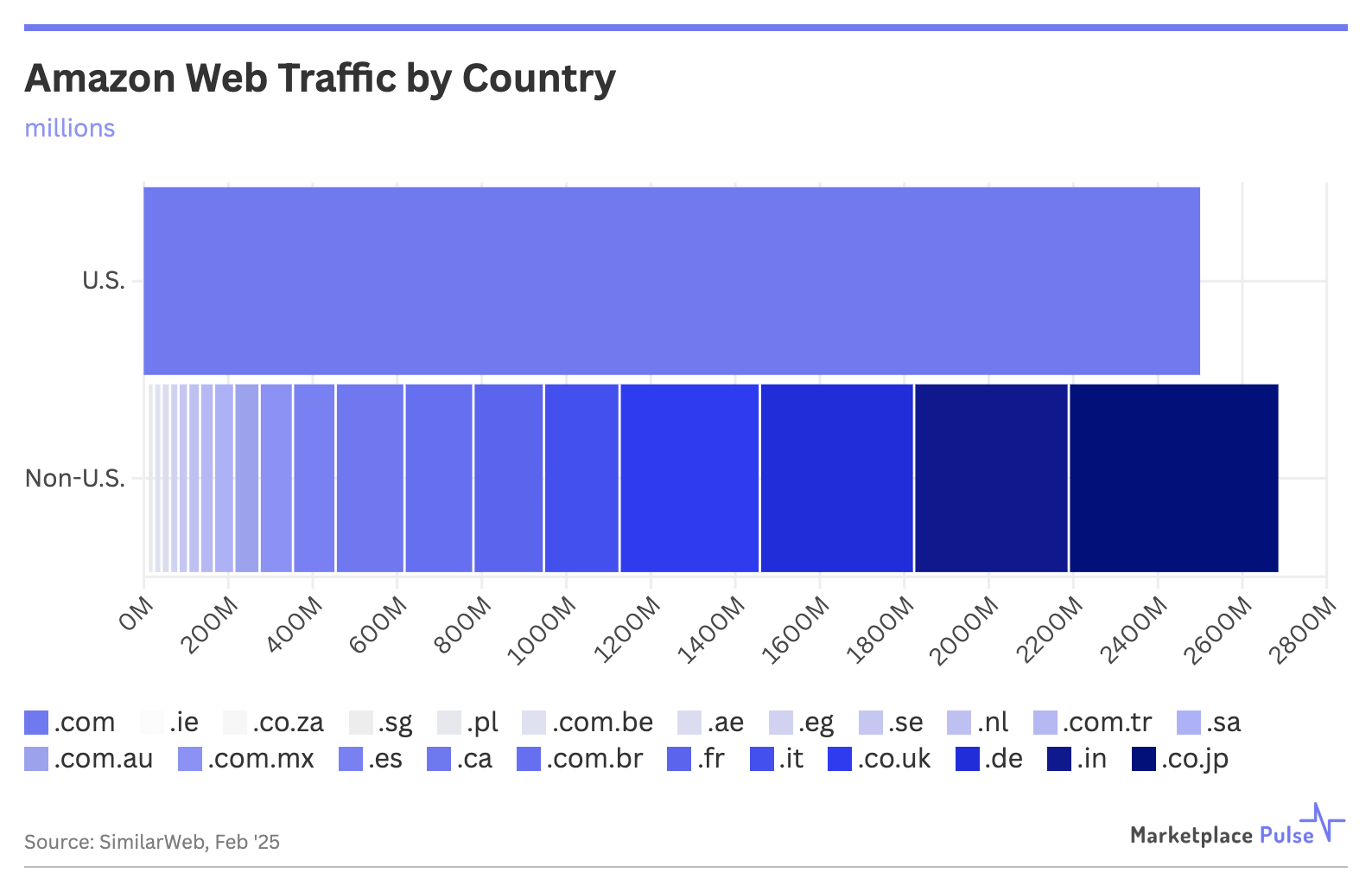

Another deterrent is the vast disparity in market size. Similar Web data shows that the traffic of the 22 non-U.S. Amazon marketplaces combined is only marginally higher than the traffic of Amazon.com in the U.S. When sellers look at potential returns versus the effort required to expand, many conclude that the U.S. market alone offers sufficient opportunity.

The U.S. hosts the largest seller population, followed by India, Canada, the UK, and Germany. Newer marketplaces like Singapore, Egypt, and South Africa have the smallest seller communities, creating a chicken-and-egg problem where limited seller participation results in a smaller selection, which in turn attracts fewer shoppers.

Amazon built a retail infrastructure that theoretically simplifies international selling, but cultural, regulatory, and logistical realities mean most sellers still find it easier to stay in familiar territory.

Amazon’s global marketplace network remains more of an aspiration than a reality for most of its seller base. However, with increasing uncertainty surrounding U.S. tariffs and trade policies and Amazon’s continual push to strengthen its fulfillment infrastructure globally, international expansion will become a higher priority for single-marketplace sellers in the coming years.