When Amazon launched the marketplace in 2000 it was mostly to expand their catalog and to avoid out-of-stock days for the most popular products. The model used was similar to that of eBay, which pioneered the marketplace in the US market; with sellers having feedback, ability to message sellers, etc.

But over time the marketplace has not only expanded in terms of scale as Amazon grew, but also started to include different forms of sellers. Manufacturers started using it as a direct-to-consumer platform, sometimes instead of selling first party to Amazon.

Even first party though has grown in size, with hundreds of thousands of brands on the site. The difference between sellers and brands selling to Amazon is shrinking, as it is all a marketplace model either way. The only difference is who gets to compete for a sale.

Yet as much as we’ve been critical about the time it is taking for eBay to implement the structured data initiative, we think Amazon hasn’t kept their own infrastructure up to date either. Primarily it hasn’t developed in ways to follow how the market has changed.

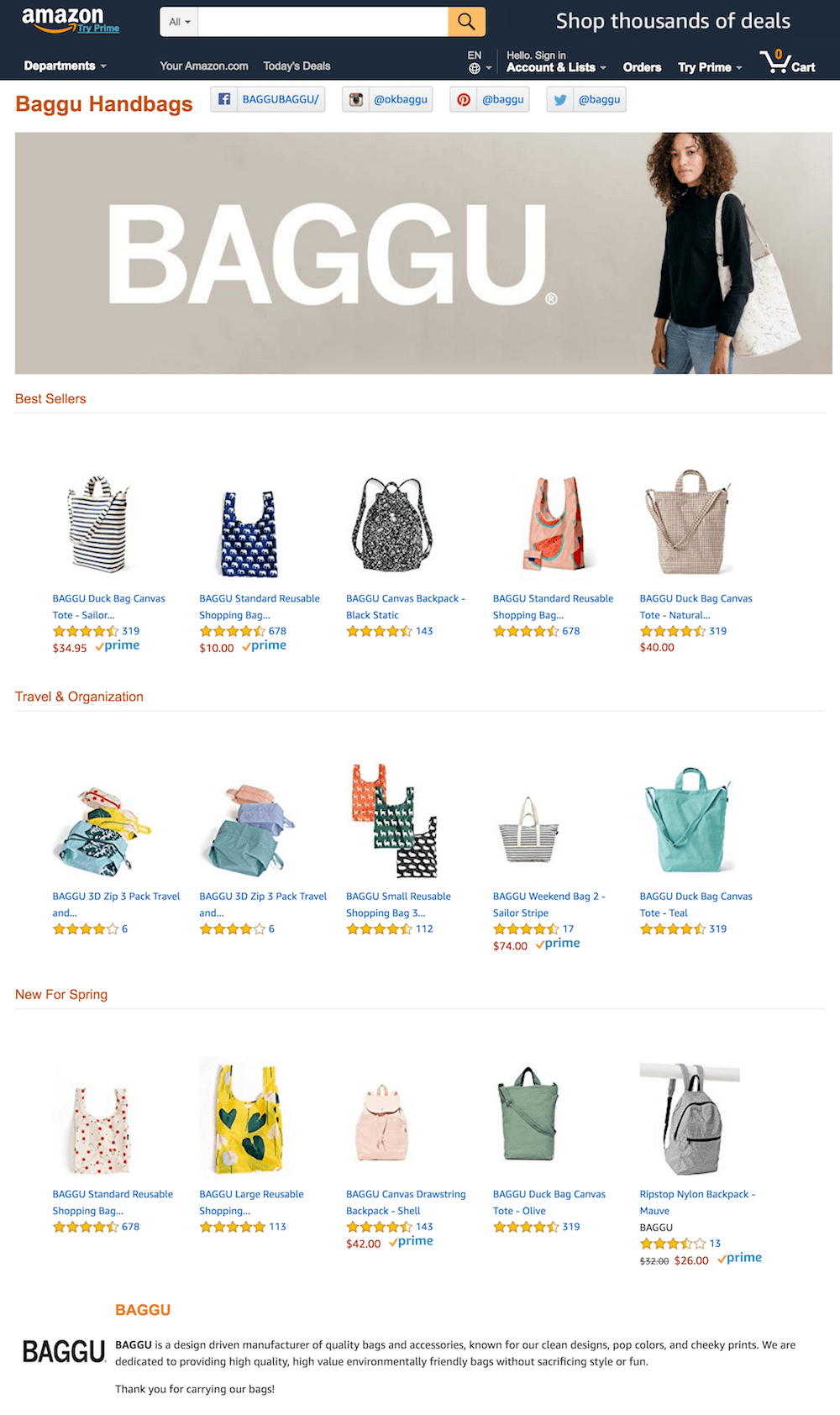

In the last decade there has been a rise of e-commerce companies which focused on a particular niche, and built trust and a following with customers. Amazon though has remained stagnant in this area, and haven’t put anything out to allow brands the same relationship with a customer.

For a lot of brands this is a big problem since on one hand they can refuse to sell on Amazon, and give up major source of extra revenue, or sell on Amazon, but have no way to interact with customers directly or indirectly.

In clothing for example, most e-commerce websites would e-mail previous customers when they would launch a new line, or when there is a sale. Brands on Amazon can’t do that. If a customer has a question about a product they can sort of ask it on the product page, or email Amazon, but the brand itself probably won’t answer it.

Uniquely marketplaces in China do focus on exactly this. They treat sellers and brands (which tend to be the same thing) as retailers in their massive supermarket, and allow communication flow with customers. Most marketplace in the US have largely focused on branding themselves, and pushed off sellers to have almost a supplier relationship.

In the same way many small shops have stopped setting up their own websites, and have started to use Facebook pages as their primary representation online, Amazon could be doing the same for brands. The existing tools for brand storefronts are extremely limited, but by expanding them, and by integrating a two-way communication channel, Amazon could get there.

Amazon has been talking to many big brands, and selling them on the concept that Amazon is an e-commerce infrastructure company, not a retailer:

“Times are changing,” Amazon says in an invitation obtained by Bloomberg. “Amazon strongly believes that supply chains designed to serve the direct-to-consumer business have the power to bring improved customer experiences and global efficiency. To achieve this requires a major shift in thinking.”

Amazon focusing on being an infrastructure company is something we’ve been agreeing with for a while. But direct-to-consumer through Amazon doesn’t work well if there is no communication flow.

As Amazon grows it needs to redefine what is the Amazon marketplace, and how businesses on it get to interact with the bigger picture. By moving away from the original marketplace model of suppliers, there is an opportunity to rethink Amazon.

Once consumers think of Amazon as not a retailer too, but a place brands have set up their presence on, then the true power of the marketplace uncovers. Oh and this is something Walmart and Jet.com could be trying to, instead of mostly following the original marketplace model.