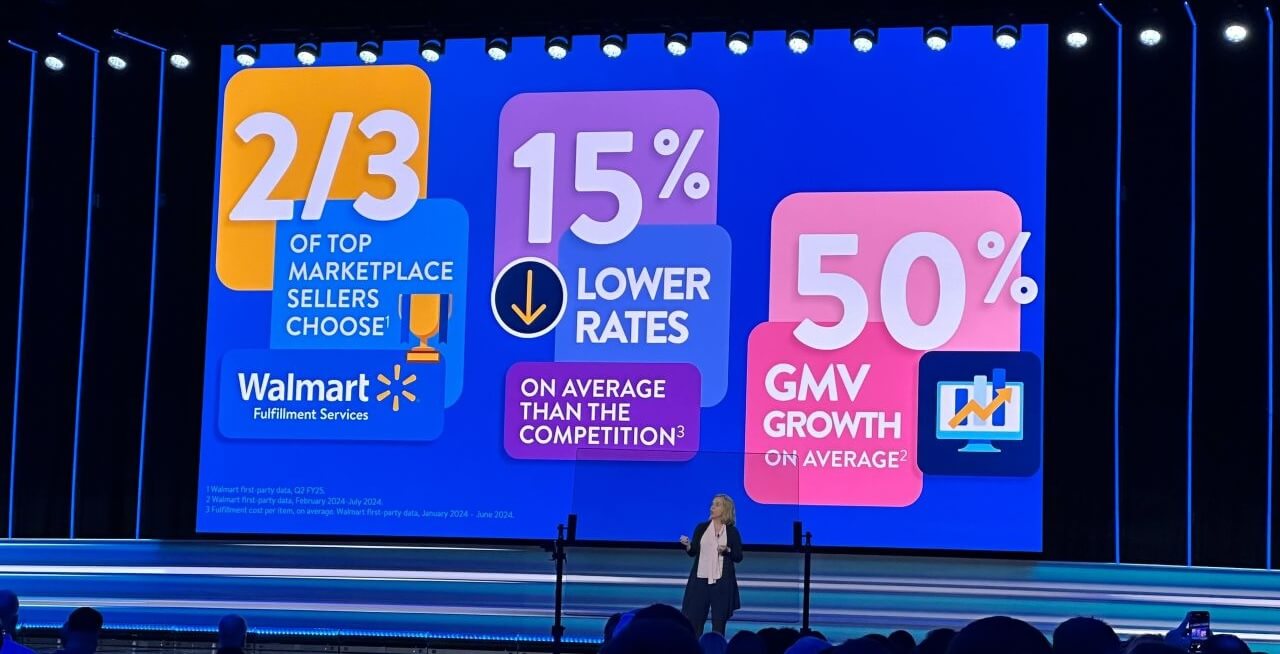

Two-thirds of top Walmart marketplace sellers use WFS, a fulfillment service Walmart launched less than five years ago. Practically everything on Walmart.com ships from Walmart warehouses, whether it’s an item sold directly by the retailer or by one of its 140,000 active third-party sellers.

Jaré Buckley-Cox, Vice President of Walmart Fulfillment Services, confirmed the two-thirds metric during the Walmart Marketplace Seller Summit in San Francisco. Three years ago, 25% of marketplace volume was already flowing through WFS; today, that figure must be more than 50%.

Remarkably, it achieved this less than five years after introducing WFS in February 2020. Before then, all sellers used owned or 3PL warehouses. For comparison, according to Marketplace Pulse research, more than 90% of Amazon sellers use Fulfillment by Amazon (FBA), but the service has been operating since 2006.

Walmart is ultimately all about its 4,606 physical stores in the U.S. — it fulfills 50% of online orders from one of them. In an interview with CNBC a year ago, Jaré Buckley-Cox said store pickup for marketplace items is coming within the next five years and described it as “a high priority.” That will be the ultimate draw of WFS.

Services like FBA and WFS make Amazon and Walmart appear as regular retailers while hiding the complex marketplace that supplies most of the selection. Most shoppers do not notice they are buying from third-party sellers because they rarely get to interact with them directly, and all orders come in the same Amazon-branded box. That marketplace invisibility was critical when Amazon competed with eBay, which couldn’t deliver the same consistency.

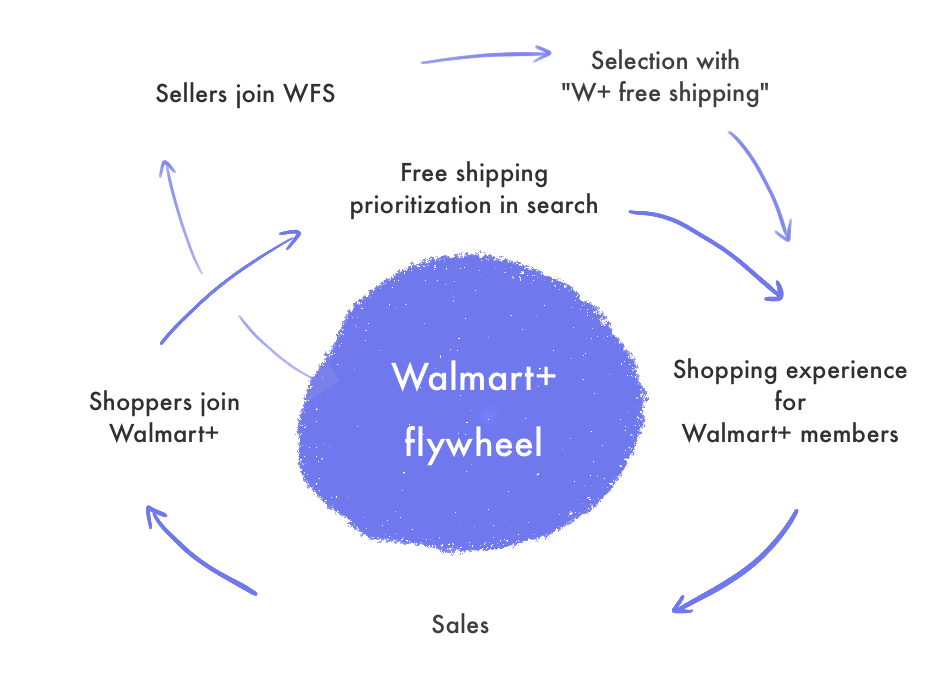

Walmart has positioned WFS as an unavoidable service, much like Amazon did with FBA, despite both companies describing them as optional. Amazon search results show mostly items stored in FBA because those offer Prime shipping, and most shoppers are Prime members. Similarly, on Walmart, for example, 38 out of 40 search results for “headphones” are stored in WFS. Walmart sells a Walmart+ membership that offers free shipping for WFS items.

Walmart previously advertised WFS as offering “higher search rankings and Buy Box wins—for a 50% increase in sales, on average.” That description is gone because WFS no longer gets higher search rankings — WFS now means a choice of being on the first search results page or not visible at all.

Both WFS and FBA create flywheels that benefit sellers using them. That’s how Walmart got most sellers using it in less than five years. The problem is that once the flywheel is spinning, they become required — not optional — and sellers are forced to accept all changes. On Amazon, this has become a reoccurring issue and led to Italian regulators issuing a nearly $1.3 billion fine in 2021.