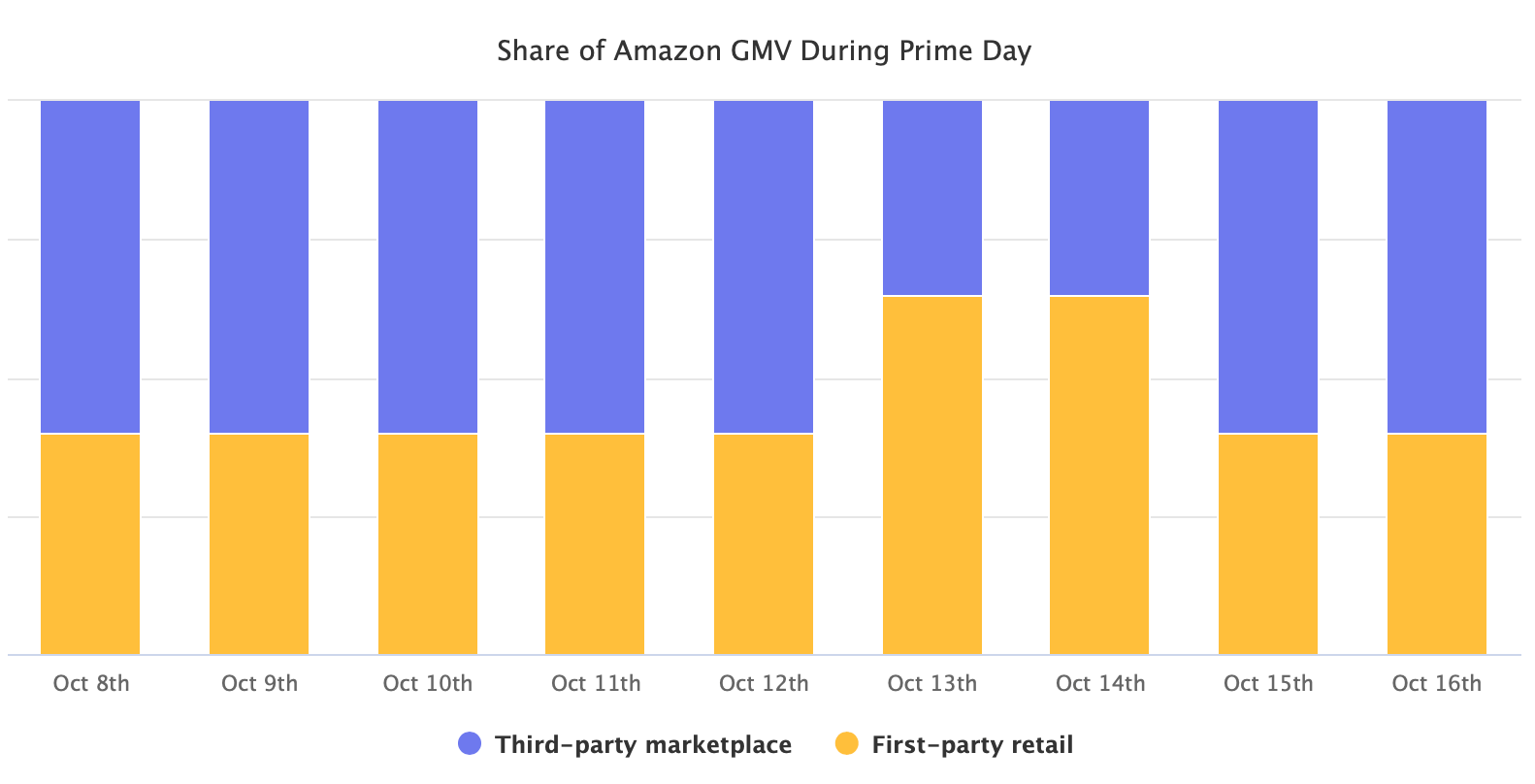

During Prime Day, the third-party marketplace dropped from the typical 60% of GMV to less than 35% as Amazon’s first-party sales’ share grew to nearly 70% from just 40%. Amazon featured heavily-discounted deals for devices like Echo and Fire TV, and thus they, unsurprisingly, gathered the most attention and sales.

According to the company, sellers saw record-breaking sales, surpassing $3.5 billion in total across 19 Prime Day countries (U.S., U.K., UAE, Turkey, Spain, Singapore, Netherlands, Mexico, Luxembourg, Japan, Italy, Germany, France, China, Canada, Brazil, Belgium, Austria, and Australia). It didn’t break out sales by its first-party retail business, but estimates put total sales during the event at $10 billion. Thus, Amazon’s retail sales during the event were roughly $6.5 billion.

The dynamics of an event like Prime Day favor the head of the catalog - most of which is first-party - rather than the tail the marketplace provides. Thus it is expected that a few dozen deals capture most of the sales. Everything else acts as a filler, creating a sense of choice. For this Prime Day, the company added a “Prime Day deals” widget in search that featured deals matching the search term to better surface them.

During peak hours, most of the 5,000 active deals were by marketplace sellers. However, 55% of them were for products under $25, and 48% had just 10-25% discounts, according to Marketplace Pulse research. First-party deals were at higher price points and with more significant discounts. Crucially, they also had orders of magnitude more inventory allocated. Fulfillment issues meant few sellers had large quantities available, and uncertainty surrounding future shipments made some unwilling to risk being out of stock in Q4.

As a result, Amazon dominated sales in key categories. For example, in Electronics, Amazon devices became as many as 40 of the top 50 best-sellers because of the deals. Prime Day originally was designed to expand the Prime membership; however, it has since likely saturated the market. Over the past few years, Amazon’s devices like Kindle, Fire TV, Echo, Ring, Blink, as well as devices with Alexa built-in, have taken center stage.

Amazon rushed this year’s Prime Day as it was running out of time before Black Friday/Cyber Monday, and yet without a noticeable investment in the spectacle, it reached a new sales record. Other retailers rushed more still, reacting to the Prime Day announcement putting up events that had even less preparation. Yet, even without a big marketing push, investment in personalization, or modern interactive commerce staples like live video, they likely reached record sales too.

During Prime Day, marketplace sales were up 60% this year, up from $2 billion in 2019. Amazon said that growth was faster than its retail business. However, the event is still primarily centered around Amazon because it is the only one willing to sell months’ worth of supply nearly at cost (Echo Dot was the most popular item purchased on Prime Day globally; it sold for $18.99, down from the regular $49.99). By doing so, it draws enough attention to generate billions in sales for the marketplace.