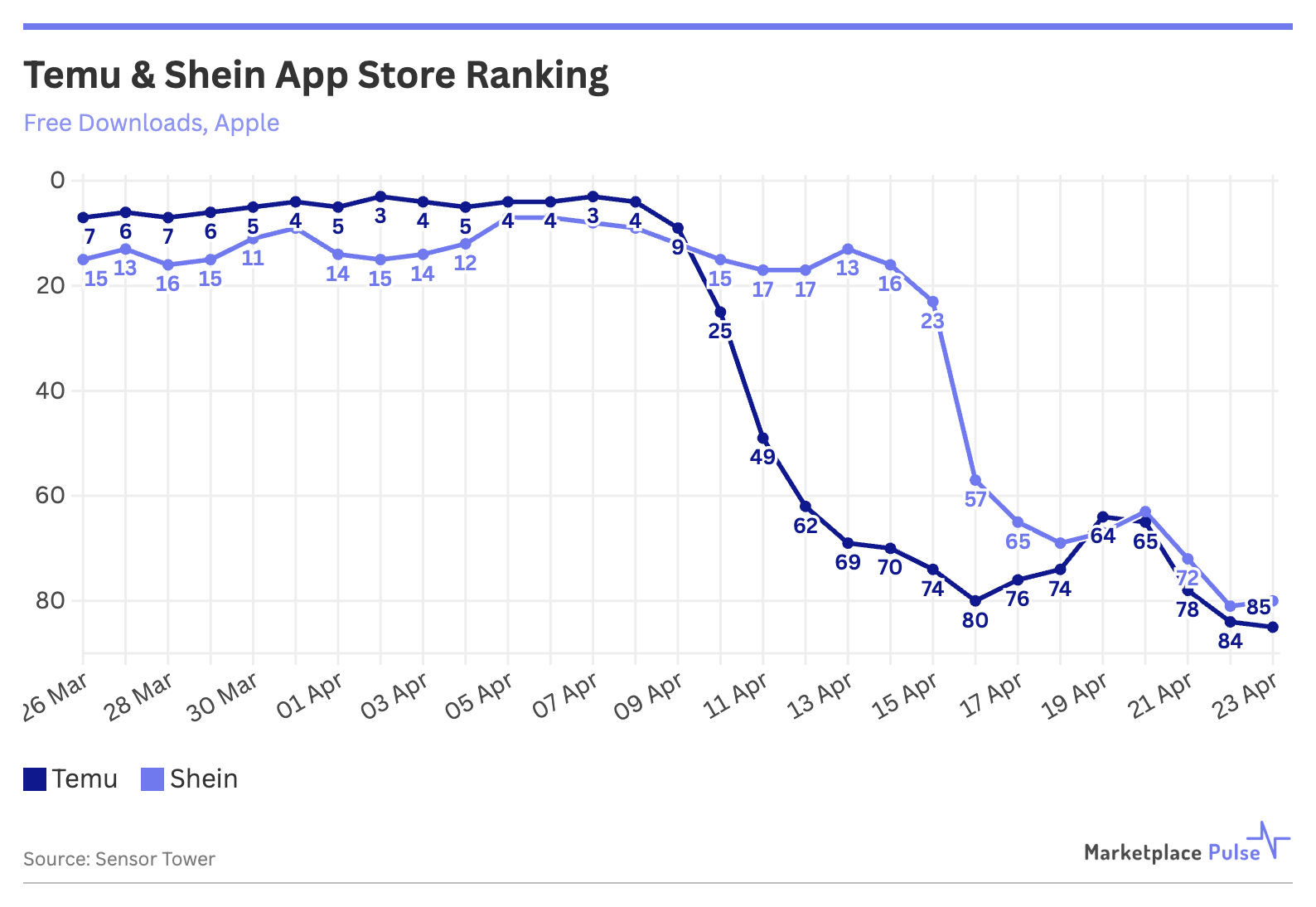

Temu and Shein are rapidly losing their dominant positions in U.S. app stores as the May 2nd de minimis exemption suspension approaches. Temu has plummeted from a high of #3 to #85 in just two weeks, while Shein dropped from #7 to #80 – a clear signal that the direct-from-China shopping revolution is facing its first real market correction.

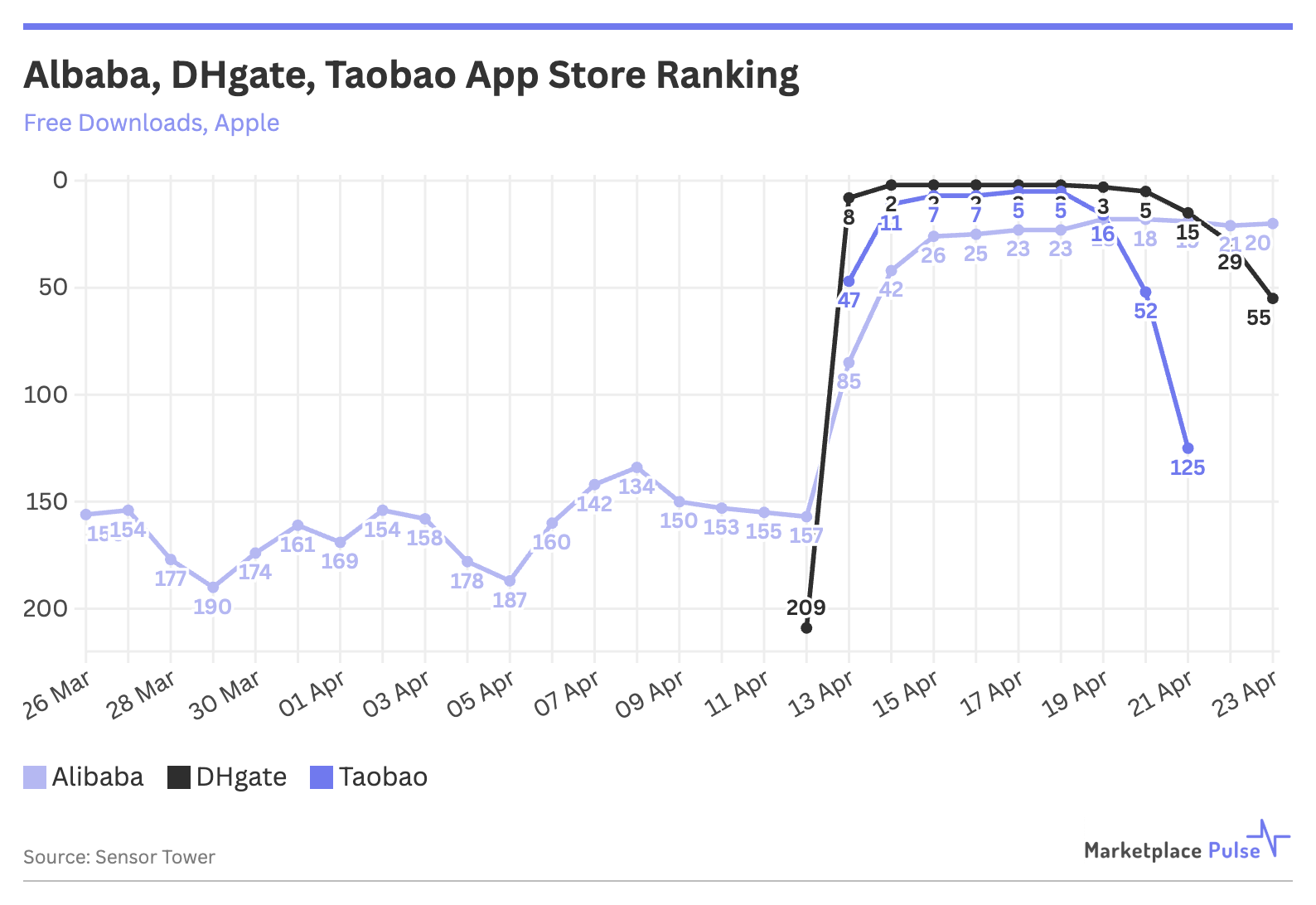

Demand hasn’t disappeared—other Chinese apps surging in the opposite direction are evidence of that. The drop instead represents a strategic concession of U.S. market share as both Temu and Shein pull back on ad spend that had been propping up their rankings and downloads.

The rankings collapse highlights just how much Temu and Shein’s meteoric rise was dependent on aggressive advertising spend at a level that has become unsustainable in new market conditions.

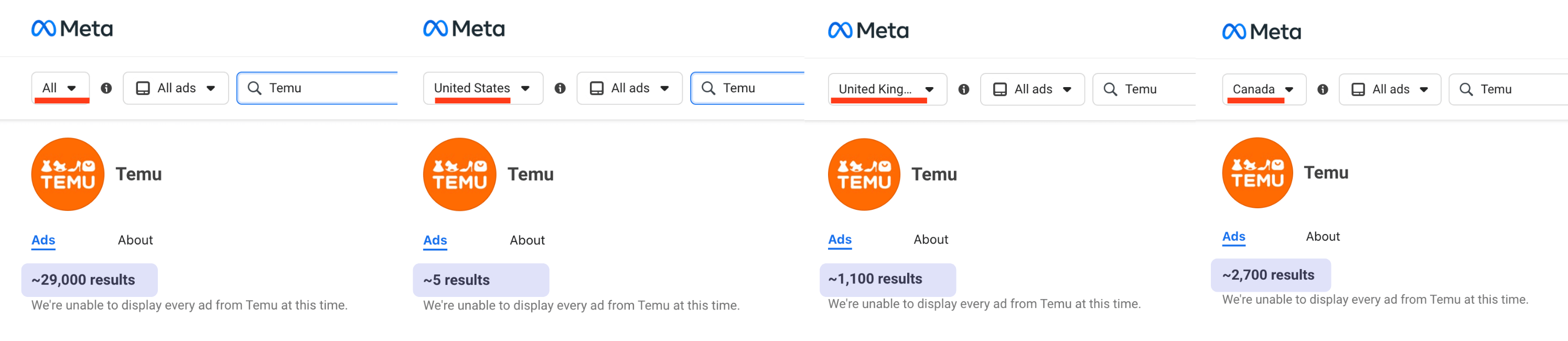

According to Reuters, Temu’s daily average U.S. ad spend declined 31% in early April compared to March, with Shein cutting back 19%. Just a handful of Temu’s nearly 30,000 ads in Meta’s Ad Library remain active in the U.S.

This is the inevitable market correction for a business model built on regulatory arbitrage. When the de minimis loophole expanded from $200 to $800 in 2016, it created the foundation for Temu, Shein, and later Amazon Haul. U.S. Customs data shows de minimis imports exploded from $9.2 billion in 2016 to $54.5 billion in 2023, with Chinese sellers accounting for nearly 60% of all shipments.

Both companies have released almost identical statements announcing price increases starting April 25, effectively conceding that their ultra-low-price model cannot survive the coming tariff reality. Without the de minimis advantage, they’ll face the same tariffs that have burdened U.S. retailers for years.

Shein reportedly just secured approval from Britain’s Financial Conduct Authority for a London IPO. Initially targeting a $66 billion valuation, the company is now reportedly looking at closer to $50 billion amid growing uncertainty.

Specific platforms may rise and fall, but U.S. consumer demand for low-cost Chinese goods remains strong. While Temu and Shein retreat for now, other Chinese shopping platforms surged briefly last week. DHgate reached the #2 position in the U.S. App Store, driven by viral TikTok videos from Chinese manufacturers exposing luxury brand markups.

The de minimis exemption created an unfair advantage, allowing Chinese platforms to consistently undercut U.S. retailers. Now, for the first time since the Trump administration took office, the repercussions of bold policy changes are having a real-world impact on market share.

This correction would usually provide some relief for U.S. sellers who’ve struggled to compete against this unfair advantage. However, with many delaying inventory orders amid tariff uncertainty, they may soon lack the stock needed to capture the newly available market share.