Software aggregators focused on Amazon seller tools are securing nine-figure exits. In contrast, brand aggregators continue massive layoffs, with Carbon6’s recent $210 million sale to SPS Commerce validating the software model’s superior resilience.

Just as Carbon6 celebrates its exit, SellerX – once a leading Amazon brand aggregator with over $1.4 billion in funding – announced layoffs of 170 employees, representing 20% of its workforce, and a dramatic reduction from 67 brands to just 19.

These divergent outcomes reveal a fundamental shift in the e-commerce ecosystem: the companies building tools for Amazon sellers are proving more valuable and sustainable than those acquiring the sellers themselves.

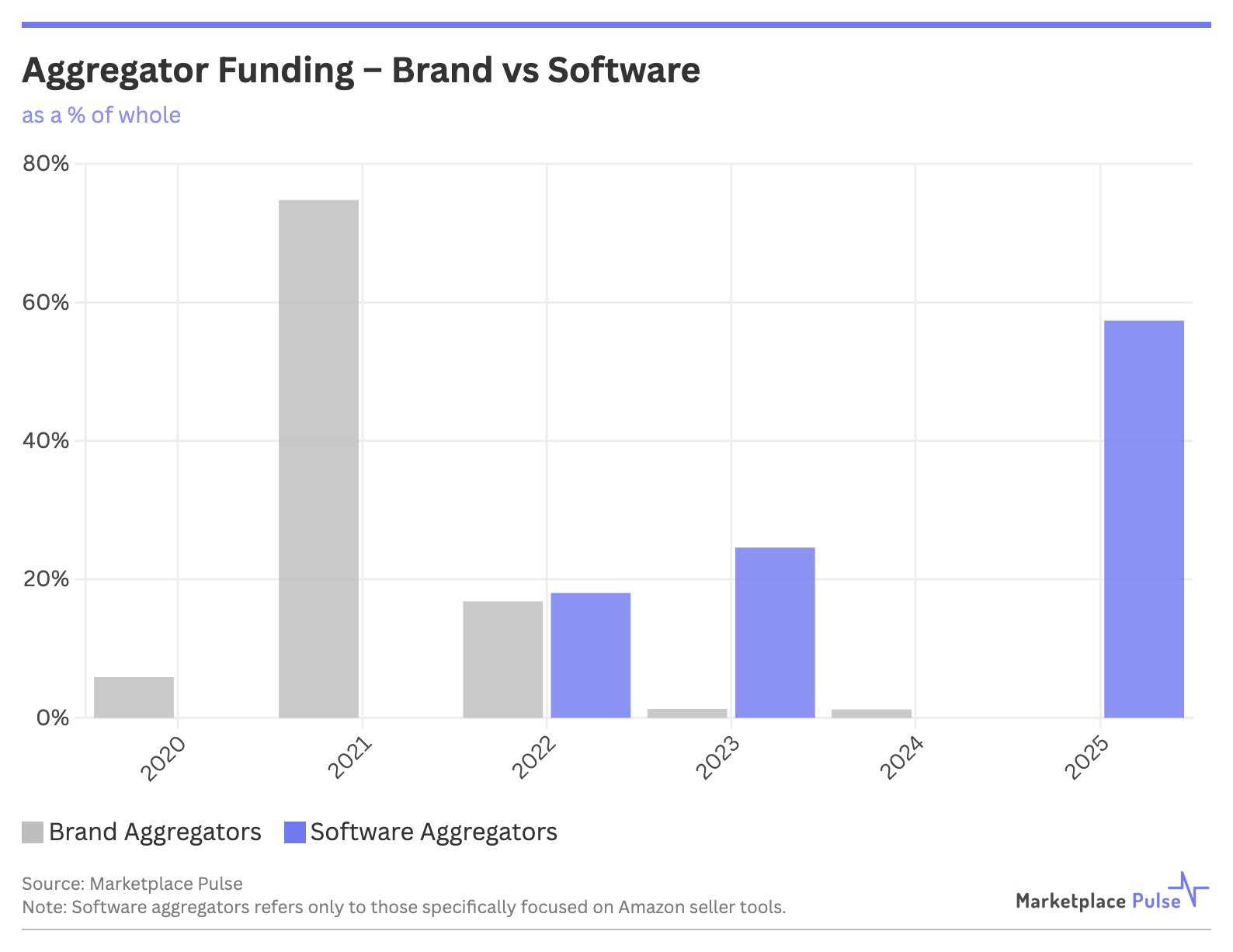

The software aggregator model has emerged as the more lucrative evolution of the original Amazon aggregator concept that attracted over $16 billion in capital, peaking during the funding frenzy of 2021.

While Thrasio, the startup that raised over $3 billion and popularized the concept of Amazon aggregation, has already filed for bankruptcy, and SellerX faces wholesale restructuring, Carbon6’s acquisition represents the culmination of its own aggregation strategy. Having acquired multiple software companies to build out its suite of tools for Amazon sellers, the company itself has now been acquired at a premium.

“We are very excited to welcome Carbon6 employees and customers to SPS Commerce,” said Chad Collins, CEO of SPS Commerce. “Together, we believe we will deliver unmatched solutions for first-party and third-party sellers and establish SPS as a leading provider in the emerging category of revenue recovery.”

The specific nod to revenue recovery is telling. For many sellers, revenue recovery tools have shifted from optional to essential as platforms like Amazon continue to capture more of each transaction’s value.

While brand aggregators rode the pandemic e-commerce wave with promises of operational synergies across dozens of Amazon brands, many discovered the more realistic complexities of managing physical products across fragmented supply chains.

Software aggregators, meanwhile, are mostly isolated from margin-compressing factors that physical product brands face and benefit from natural economies of scale – recurring revenue models, technical talent synergies, and the ability to upsell complementary tools to existing customers.

Carbon6’s sale is not an isolated success. Its competitor, Threecolts, has similarly acquired over a dozen software tools, while other Amazon seller software companies have secured significant exits, including Helium 10 to Assembly and Sellics to Perpetua. All this while brand aggregators are still searching for a viable long-term model after the initial capital bonanza.

As one aggregator strategy continues to falter, another has risen to take its place – demonstrating that the core concept of consolidation within the lucrative e-commerce remains sound, even as its application evolves.