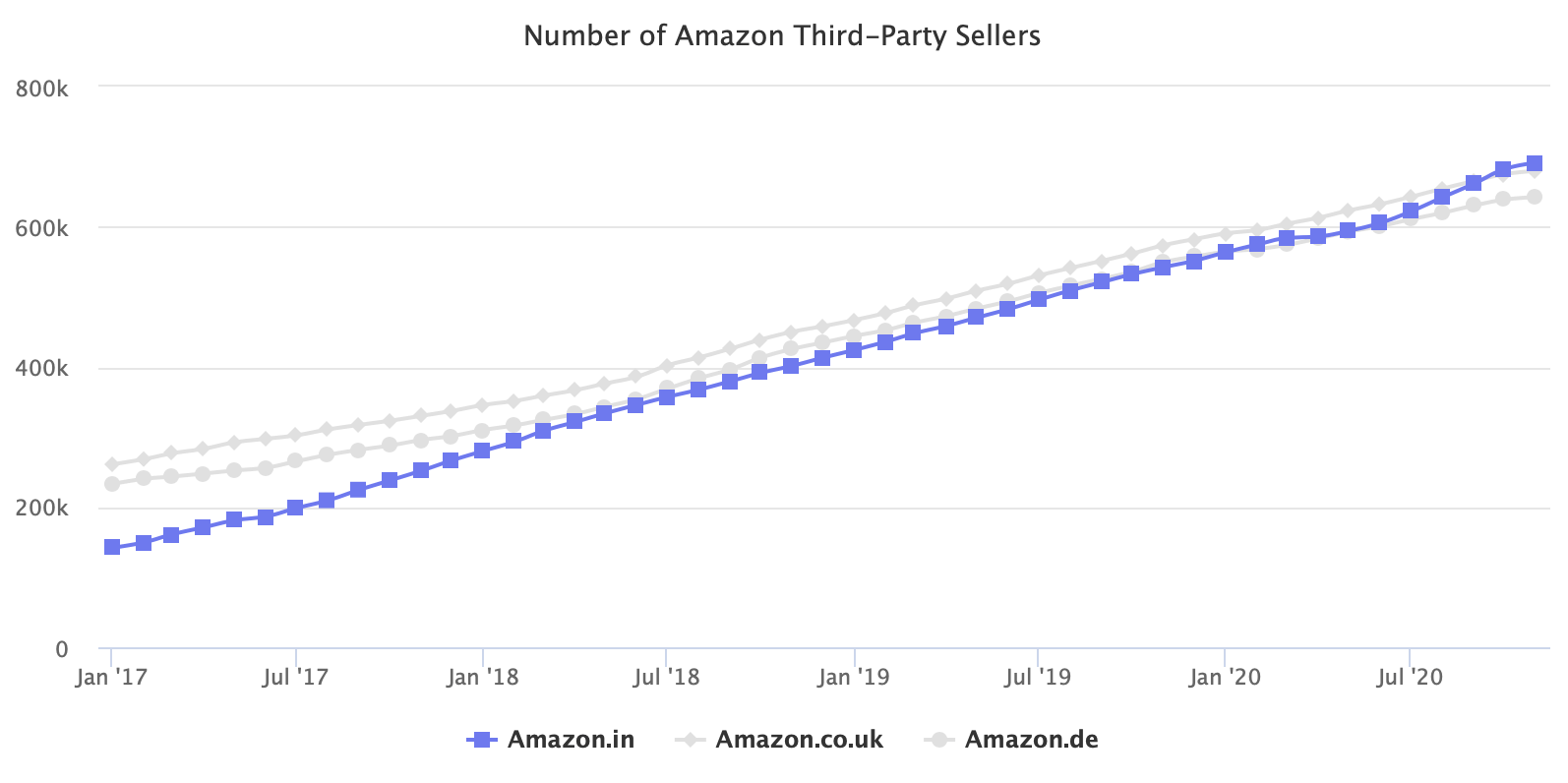

Amazon has attracted 700,000 sellers - mostly local micro-enterprises - to join its India marketplace since it launched in the country in 2013. India has recently surpassed the U.K. and Germany marketplaces to became the second largest marketplace in terms of the number of sellers.

For the past few years, Amazon has been adding more sellers in India than any other country except for the U.S. marketplace. India now also has more sellers than any country except for the U.S., according to Marketplace Pulse research. While some of Amazon’s key marketplaces have started to slow down, India continues to accelerate. This year, it will again add a record number of sellers; it has been adding 20,000 sellers over the past few months.

However, only 5,000 sellers had sales worth at least $13,570 (INR 1MM) during the Great Indian Festival on October 16th-18th. But, 110,000 sellers had at least one order. Thus, Amazon India exhibits the marketplaces power law (perhaps even more extreme than other marketplaces). The observation that a large portion of transactions is generated by a small fraction of the sellers’ population.

On a trip to India early this year, Jeff Bezos, CEO at Amazon, talked about its plans to bring more than 10 million micro, small, and medium-sized businesses online by 2025. The critical term is micro because Amazon is looking to onboard a different set of sellers than in other key markets - it doesn’t need 10 million sellers in the U.S. or Europe.

“For every 100 companies in India, there are more than 95 micro-enterprises, four small-to-medium businesses, and less than one large company. Developed countries, however, feature around 50 micro-entities and 40 small-to-medium companies in the same sample size,” said Manish Sinha, Managing Director at Dun & Bradstreet India.

To enable those micro-sellers, Amazon had to do India-first innovations. Like allowing registering and managing the seller account only using a smartphone. “Every other locale we operated in until we came to India, we didn’t have to worry about seller awareness or whether they were used to a laptop or not. But, India is unique. Many sellers hadn’t even seen a laptop until then, and the fact that they didn’t even want to leverage the technology opportunity was new for us,” said Gopal Pillai, Director and General Manager of Seller Services, Amazon India, in 2018.

Despite adding more than 100,000 new sellers every year since 2016 and continuing to accelerate, the growth rate will have to rise drastically, though, to achieve 10 million by 2025.

In India, Amazon faces competition from Flipkart and, more recently, Reliance Industries and regulatory hurdles, including antitrust probes. It also had to halt operations in India starting at the end of March. India is a unique market for Amazon to operate in, but it will grow to become a key revenue source for the company in a few years. The marketplace made up of hundreds of thousands of micro-sellers with little foreign retailers’ presence is likewise unusual.