In March, Amazon launched Belei, a skincare brand consisting of cleansing wipes, moisturizers, masks, and serums. Six months later, the brand has failed to impress consumers. Belei products are rated 3.8 out of 5 stars, and none had become best-sellers.

Belei Triple-Peptide Eye Cream, one of the best selling products in the Belei line, is ranked #89 among eye treatment creams but is rated 3.5 out of 5 stars by 160 shoppers. Belei Retinol Refining Moisturizer is rated 4.2 out of 5 stars, but only ranks #310 in the face moisturizers category. Neither appears in the first few pages of search results for “eye cream” or “face moisturizer.”

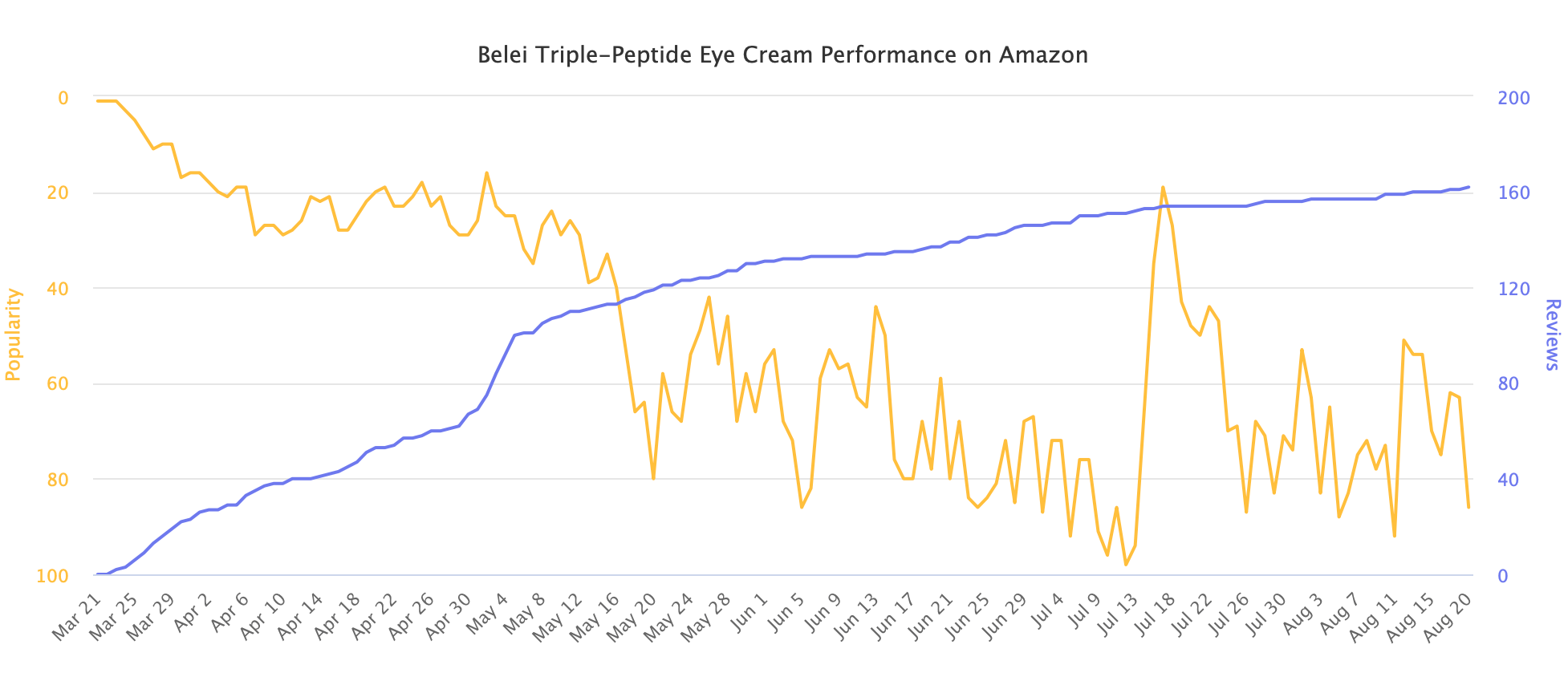

When the brand launched some of the dozen new products became best-sellers. For example, the eye cream item was #1 in its category. However, by May it has fallen to the second half of the top 100. Despite an increase in sales during Prime Day thanks to a 30% discount, it has remained there since. It continued to build reviews slowly, but, never improved the 3.5 out of 5 stars rating. Marketplace Pulse data visualized in the chart below tells the story.

Beauty & Health is a category of Amazon shopping than can be frustrating. Every search query returns tens of thousands of choices, and search filters are limited compared to beauty-focused retailers. One of the features of the Belei line is that products are not tested on animals, and are free of parabens, phthalates, sulfates, and fragrance. For shoppers unsure about what they want, Amazon’s search doesn’t do any guidance, and for those who know, it doesn’t have enough search filters. Those Belei features get missed.

In a vacuum, Belei brand is solid. On Amazon, it gets lost.

While some shoppers like the products, visible from Amazon and external reviews, that doesn’t equal a brand following. There are millions of products in the Beauty & Health category. Once the initial buzz from the press event in New York City at the end of March featuring editors and influencers wore off, Belei was left to compete with the rest of millions of products on broadly the same terms as other brands do - ranking in search. Despite Amazon featuring the brand for some searches in the infamous “top rated from our brands” section, it isn’t enough to stand out.

“The popular narrative has been that by utilizing internal data, Amazon can launch its brands in many categories and capture most of the category’s sales,” according to Marketplace Pulse’s Amazon private label brands report. However, “there is no evidence of this working.” Except for AmazonBasics, Belei is one of the many brands launched by Amazon which didn’t have the effect many would have predicted.

The lesson from Belei is not whether Amazon can use data to develop brands with the products and price points their shoppers want, but rather that launching products is only the first of many steps. Amazon does rely on data to spot niches - why wouldn’t they - but in all categories except for generics that’s not enough to guarantee success. What works for launching AmazonBasics products doesn’t work elsewhere. In the beauty category brands are being built on customer loyalty, social media following, and innovative products. None of which applies to Belei.