Amazon can’t make the whole world shop on Amazon. But, it will try to be the retail infrastructure even when shopping happens elsewhere.

Yesterday, it introduced Supply Chain by Amazon, a collection of existing physical and online services and some new changes. It’s an end-to-end solution that handles the product’s journey from when it leaves the manufacturer to when the shopper receives it. The most significant change is opening it up to power non-Amazon sales channels. Previously, its logistics and fulfillment services predominantly served Amazon sellers to sell on Amazon.

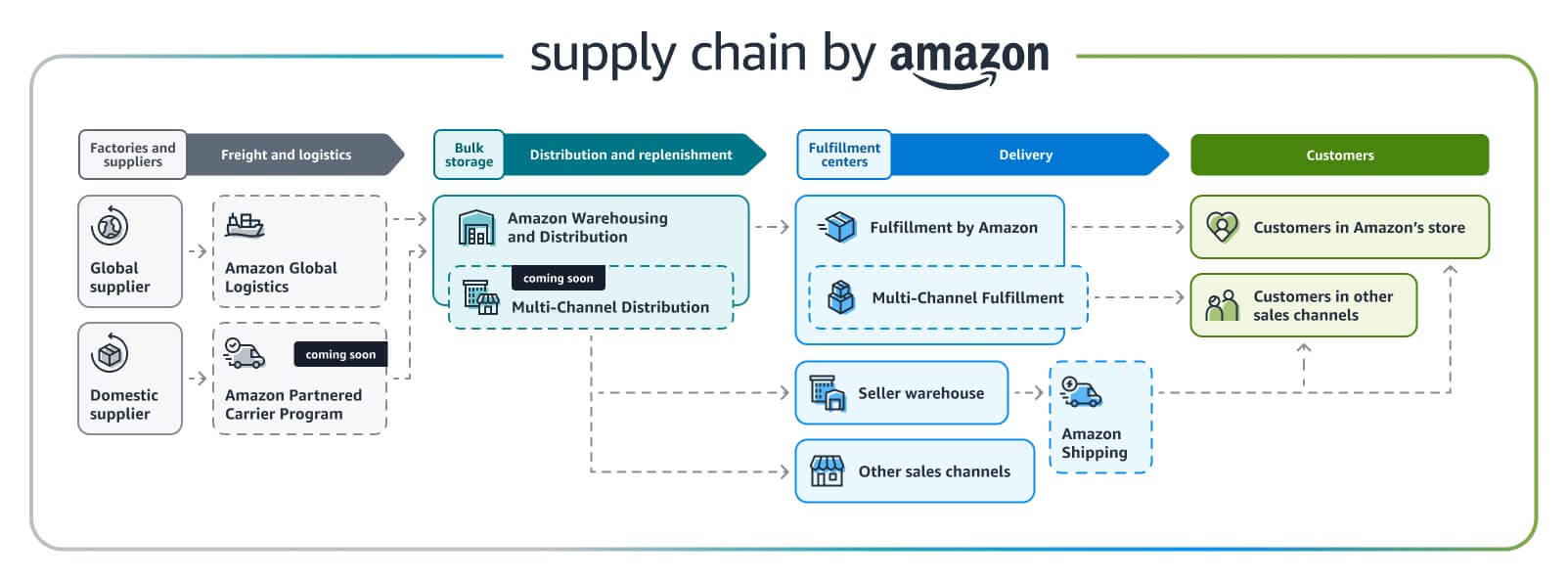

Supply Chain by Amazon consists of three layers. First, services to import goods from factories and local suppliers. Second, a warehousing solution to store those goods and supply them for sale on Amazon, other sales channels, and physical stores. Last is fulfillment on Amazon through FBA and other channels through MCF and Buy with Prime. Before yesterday’s announcement, the warehousing solution (Amazon Warehousing Distribution) would only resupply FBA. That one change transformed this from Amazon-specific to omnichannel.

Amazon now runs two-tiered warehousing. The first tier is Amazon Warehousing Distribution (AWD), which was only introduced a year ago and is for long-term storage and is meant to resupply fulfillment warehouses. The second is Fulfillment by Amazon (FBA), which was both for warehousing and fulfillment when launched in 2006 but, over time, morphed into exclusively fulfillment as Amazon pushed for faster inventory turnover. Both of those tiers can be used without the other.

A seller can now import months of supply and store it in AWD warehouses, which act as the first tier of fulfillment, resupplying Amazon’s FBA, Walmart’s WFS, and others as needed. Or a Shopify merchant can use the same flow but resupply a 3PL for e-commerce orders and FBA for Buy with Prime. Or a brand that doesn’t sell online at all can use it to import goods and store them in AWD, resupplying its physical store as needed.

“With Supply Chain by Amazon, Amazon will pick up inventory from manufacturing facilities around the world, ship it across borders, handle customs clearance and ground transportation, store inventory in bulk, manage replenishment across Amazon and other sales channels, and deliver directly to customers—all without sellers having to worry about managing their supply chain.”

It is still up to the seller to find manufacturers and suppliers and to manage sales channels. Amazon is offering to take care of the rest. The services stack still has gaps; for example, many 3PLs provide features like custom packaging that Amazon doesn’t. Nor will it have flexibility, as proven by the recent years of inventory limits and fee hikes. But one thing its competitors don’t have is its scale and physical footprint, which ultimately means lower costs.

“A seller doesn’t want to have two sets of supply-chain services, one that’s for Amazon and one that’s for someone else. They really want to have someone that can manage all of this together. And it’s not just from a simplicity perspective - there’s also a bunch of benefits in efficiency and lowering costs,” Dharmesh Mehta, vice president of selling partner services at Amazon, told Insider. While true, there are also drawbacks, let alone strategic decisions meant to avoid giving up even more control to Amazon.

The first set of users will be Amazon sellers, who already use some of those services but can now do more with them. The next and more critical group is everyone who is not on Amazon. Suppose Amazon can get them to join, even if they still refuse to sell on Amazon. Then Amazon’s supply chain becomes AWS.