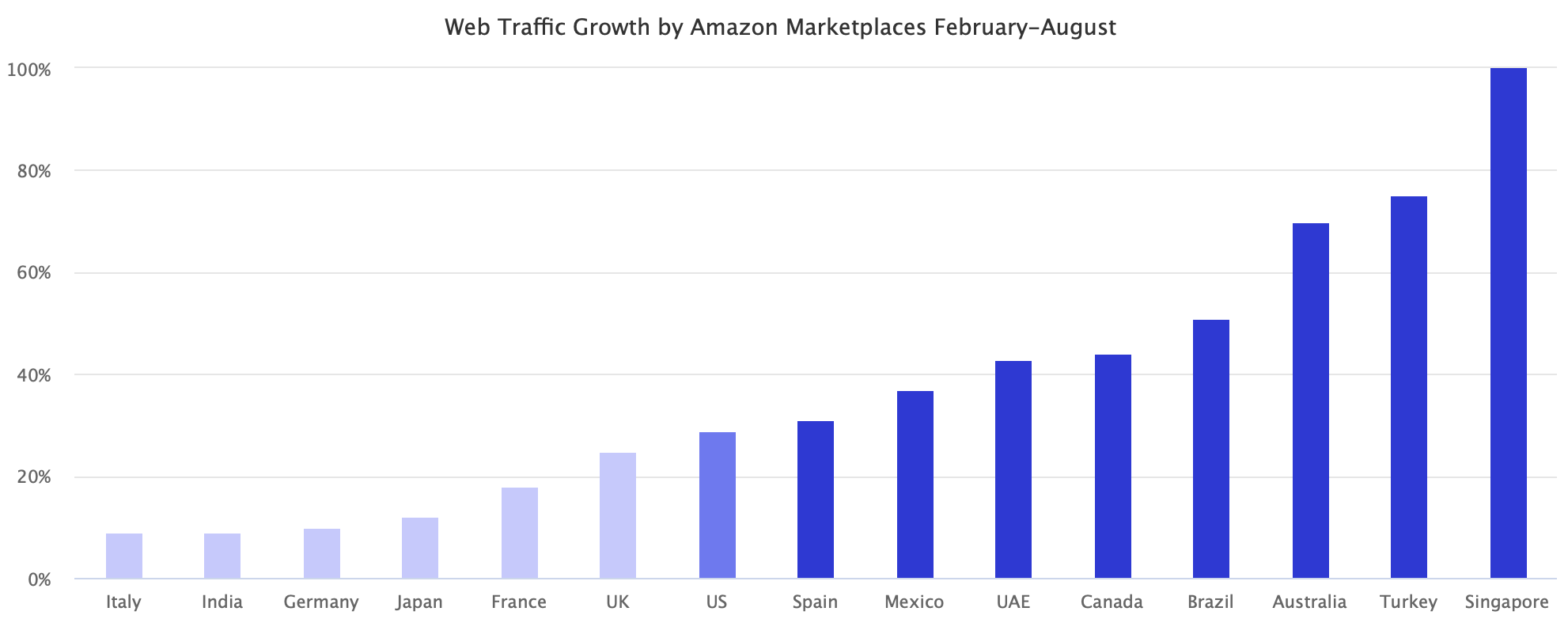

Italy, India, Germany, Japan, France, and the U.K. - Amazon’s key international markets - lagged behind the U.S. in web traffic growth. While others, especially Australia and Canada, outpaced it. Across all seventeen marketplaces, Amazon added one billion monthly visits and was up 24%.

Compared to February, usually the lowest month for e-commerce that this year also happened to be the last month before the pandemic, Amazon’s traffic in the U.S. was up 29% in August. That figure acts as a base to benchmark other markets and allows understanding whether they benefited from the e-commerce boost created by the pandemic. Traffic estimates based on SimilarWeb data.

The other sixteen marketplaces grew combined 19% during the same period. As a group, they lagged Amazon’s growth in the U.S. because Italy and India only grew 9%; Germany, Japan, and France were under 20%. Only the U.K. marketplace, with its 25% growth, was close to the U.S.

Some of the smaller international markets, however, showed strong growth. For example, Australia has nearly doubled traffic year-over-year and was up 70% in the period. Canada, Brazil, and Mexico grew more than 40%; these three markets are geographically close to the U.S., and Canada and Mexico benefit from Amazon’s North America Remote Fulfillment (NARF) program. The rest - Singapore, Saudi Arabia, United Arab Emirates, and the Netherlands - launched recently and grew from much smaller bases.

| Website | Traffic in February | Traffic in August | Growth |

|---|---|---|---|

| amazon.com | 2.0b | 2.5b | 29% |

| amazon.co.jp | 527m | 592m | 12% |

| amazon.de | 455m | 500m | 10% |

| amazon.co.uk | 362m | 453m | 25% |

| amazon.in | 257m | 281m | 9% |

| amazon.fr | 180m | 212m | 18% |

| amazon.es | 138m | 181m | 31% |

| amazon.it | 161m | 176m | 9% |

| amazon.ca | 117m | 169m | 44% |

| amazon.com.br | 51m | 77m | 51% |

| amazon.com.mx | 38m | 52m | 37% |

| amazon.com.au | 20m | 34m | 70% |

| amazon.ae | 14m | 20m | 43% |

| amazon.nl | 0.5m | 11m | |

| amazon.com.tr | 4m | 7m | 75% |

| amazon.sg | 2m | 4m | 100% |

| amazon.sa | 0m | 3m |

In the Shopping category on the iPhone App Store, Amazon was the number one most-downloaded app in India, Canada, U.K., U.S., and Saudi Arabia. The only markets it wasn’t in the top 10 were Brazil and Singapore. App Store rankings indicate relative popularity compared to other e-commerce companies.

| Market | App Store Shopping Category Rank |

|---|---|

| India | 1 |

| Canada | 1 |

| UK | 1 |

| US | 1 |

| Saudi Arabia | 1 |

| Italy | 2 |

| Japan | 2 |

| Germany | 3 |

| Mexico | 3 |

| Spain | 3 |

| UAE | 3 |

| France | 4 |

| Australia | 7 |

| Singapore | 9 |

| Brazil | 12 |

| Turkey | 26 |

A few months earlier, in April, Amazon was forced to shut down in India for some time that caused it to lose half of the monthly visits. While also trying to reduce spending in other marketplaces by removing features designed to increase it. And it was prioritizing essentials that caused non-essentials sometimes to take weeks to get delivered. Still, Amazon was forced to close its delivery centers in France, following an April 14th ruling in a French court that Amazon hadn’t done enough to protect workers in its warehouses from Covid-19.

“The crisis is laying bare the cracks in Amazon’s ability to be there for its customers when they need it most, much less to “delight” them,” wrote Christopher Mims at the Wall Street Journal in April. Fast-forward to now, the answer to Mims headline “Will We Forgive Amazon When This Is Over?” is Yes. In August, Amazon’s worldwide marketplaces had 5.4 billion visits, an all-time high.