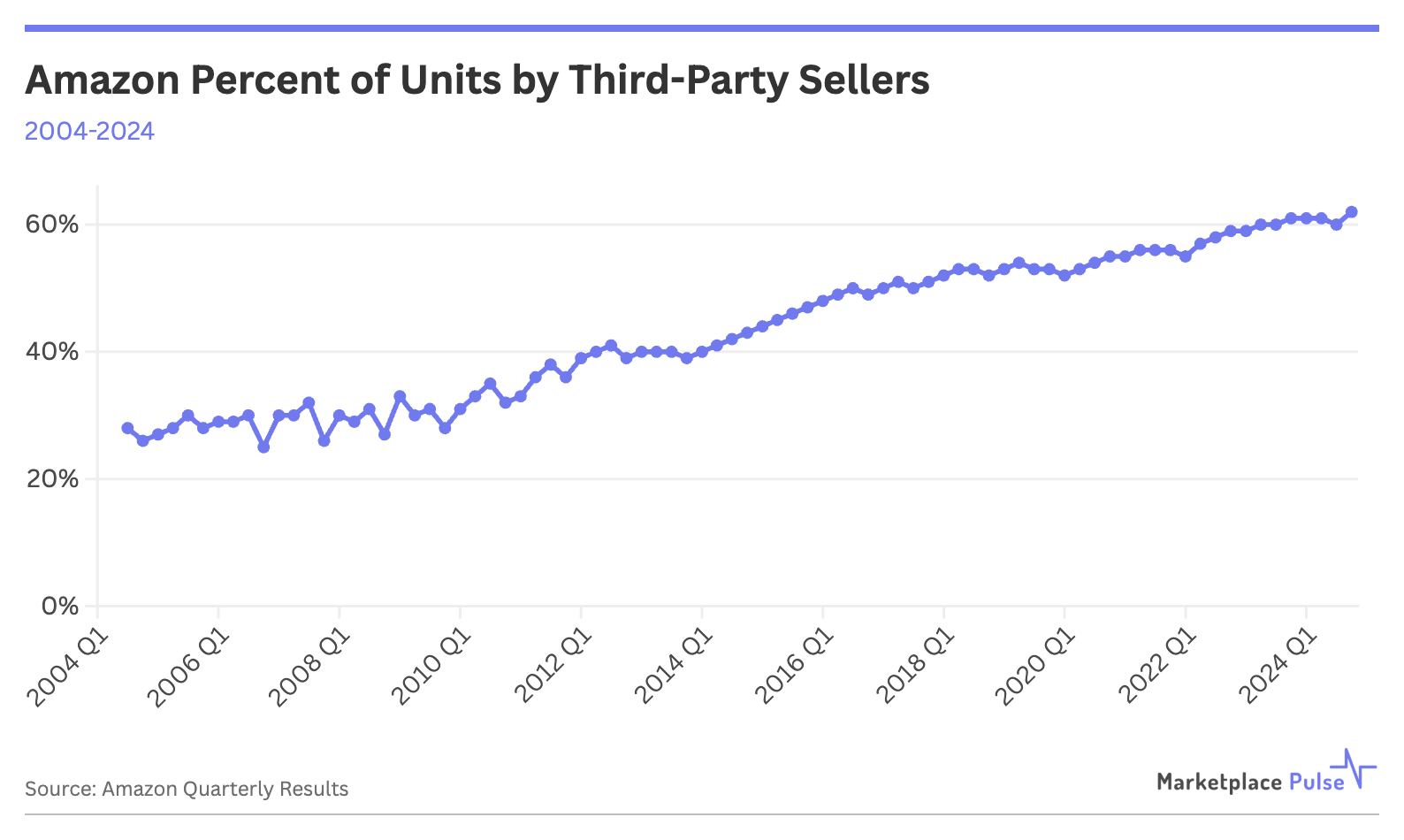

Amazon’s third-party sellers accounted for an all-time high of 62% of units sold in Q4 2024, though this is more by Amazon’s design than sellers’ dominance.

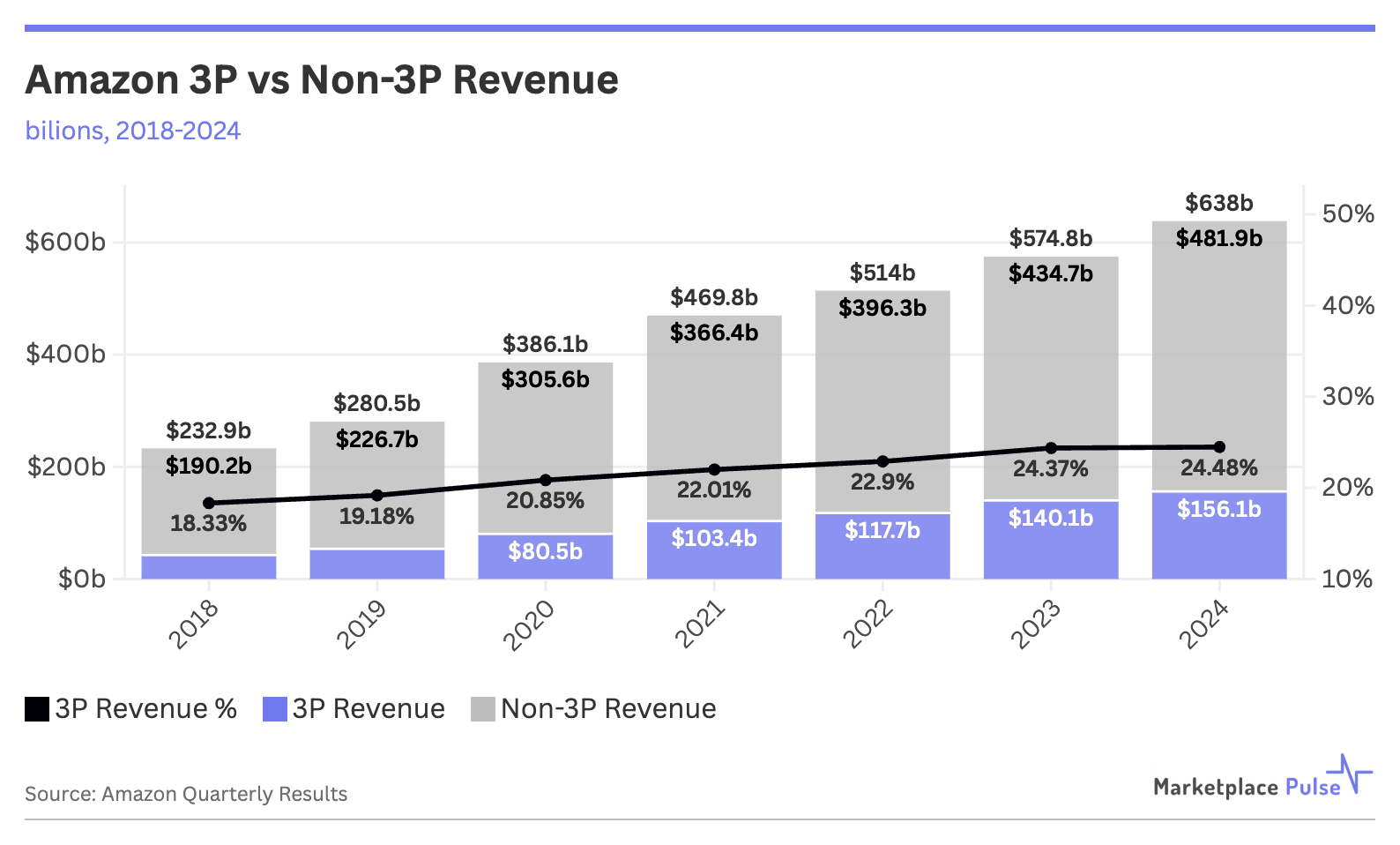

One-fourth of Amazon’s revenue now comes from seller fees, another record high. History suggests that both numbers will continue to rise as Amazon steadily and purposefully shifts from retailer to infrastructure provider.

Twenty-five years ago, Amazon launched its third-party marketplace as one of a long list of experiments designed to rapidly expand its product selection in pursuit of becoming the “Everything Store.”

Ten years later, third-party sales accounted for less than one-third of all units sold. But now, following persistent growth — including a remarkable run in which the third-party unit share grew by a percentage point per quarter, every quarter for eleven straight quarters between 2013 and 2016 – they are on the verge of a complete reversal to a two-third share.

According to Amazon’s latest earnings report, third-party seller services generated $156.1 billion in 2024, representing 24.48% of Amazon’s total revenue. This revenue stream, combined with the growing advertising business – which reached $56.2 billion in 2024 (up 19.8% year-over-year) – has become the core of Amazon’s e-commerce infrastructure flywheel as first-party retail continues to decrease in overall revenue share and importance.

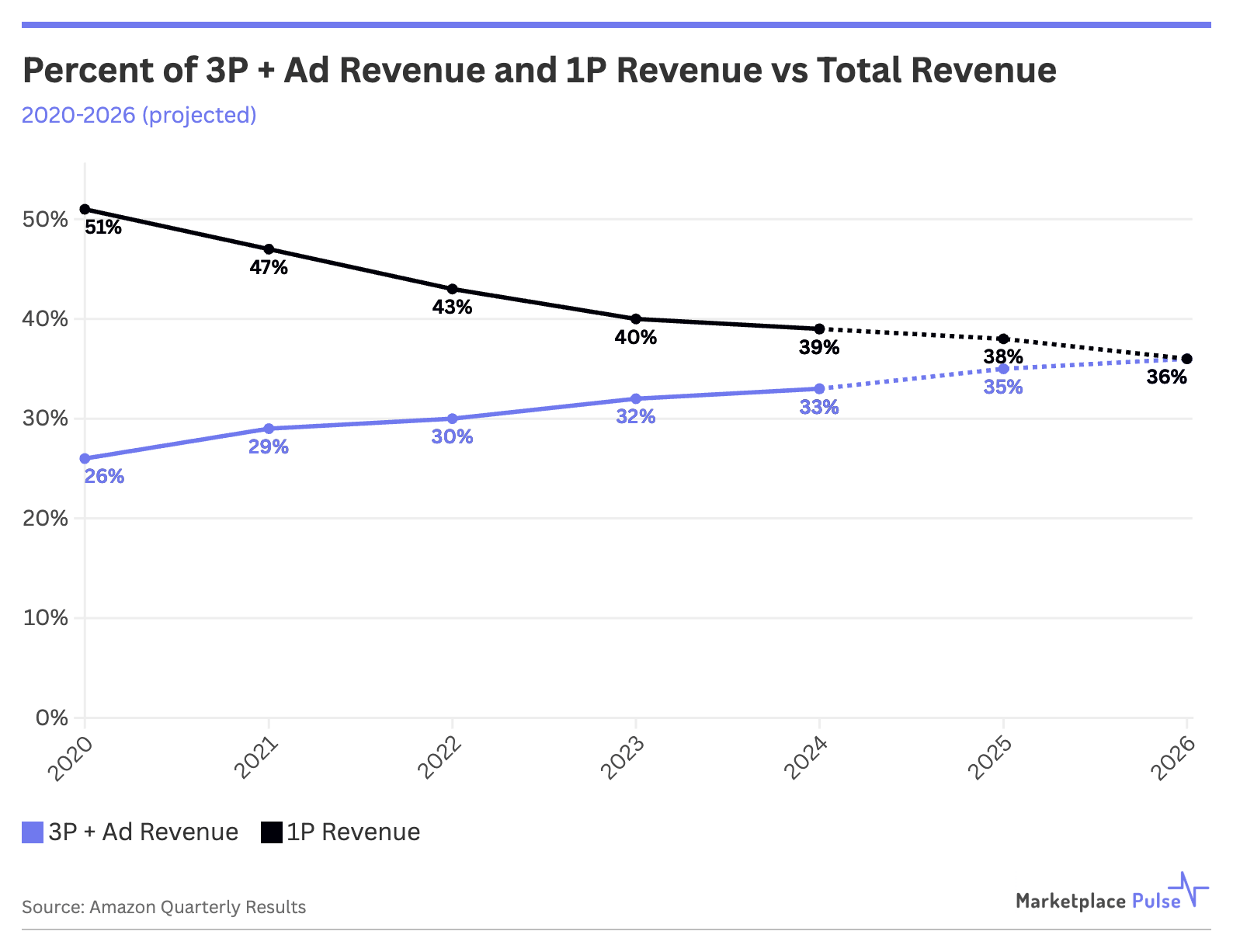

Amazon’s third-party growth is owed more to strategic engineering than seller success. The company continues to terminate vendor agreements with many businesses as part of its operational streamlining, effectively pushing them toward the third-party marketplace model.

This strategic shift away from first-party relationships moves resources from high-risk, low-margin inventory ownership to the lower-risk, higher-margin activities of collecting seller fees and advertising revenue.

On the current trajectory, third-party service fees and ad revenue combined will overtake Amazon’s first-party revenue as a percentage of overall revenue within three years — a significant milestone in an evolving strategy.

UPS recently announced plans to cut Amazon shipping volume by 50% by the end of 2026, aiming to “steer towards margin and away from Amazon,” according to Rick Watson of RMW Commerce Consulting. While logistics providers may have the luxury of significantly diversifying away from Amazon, sellers largely don’t.

Every new fee increase or policy change demonstrates Amazon’s ability to capture more seller margin. Yet sellers remain because Amazon’s market share and infrastructure make it impossible to ignore.

Amazon is betting it can continue raising fees while providing enough innovation and market access to retain sellers. Since third-party unit share and fee revenue continue to hit new highs, that bet is paying off.