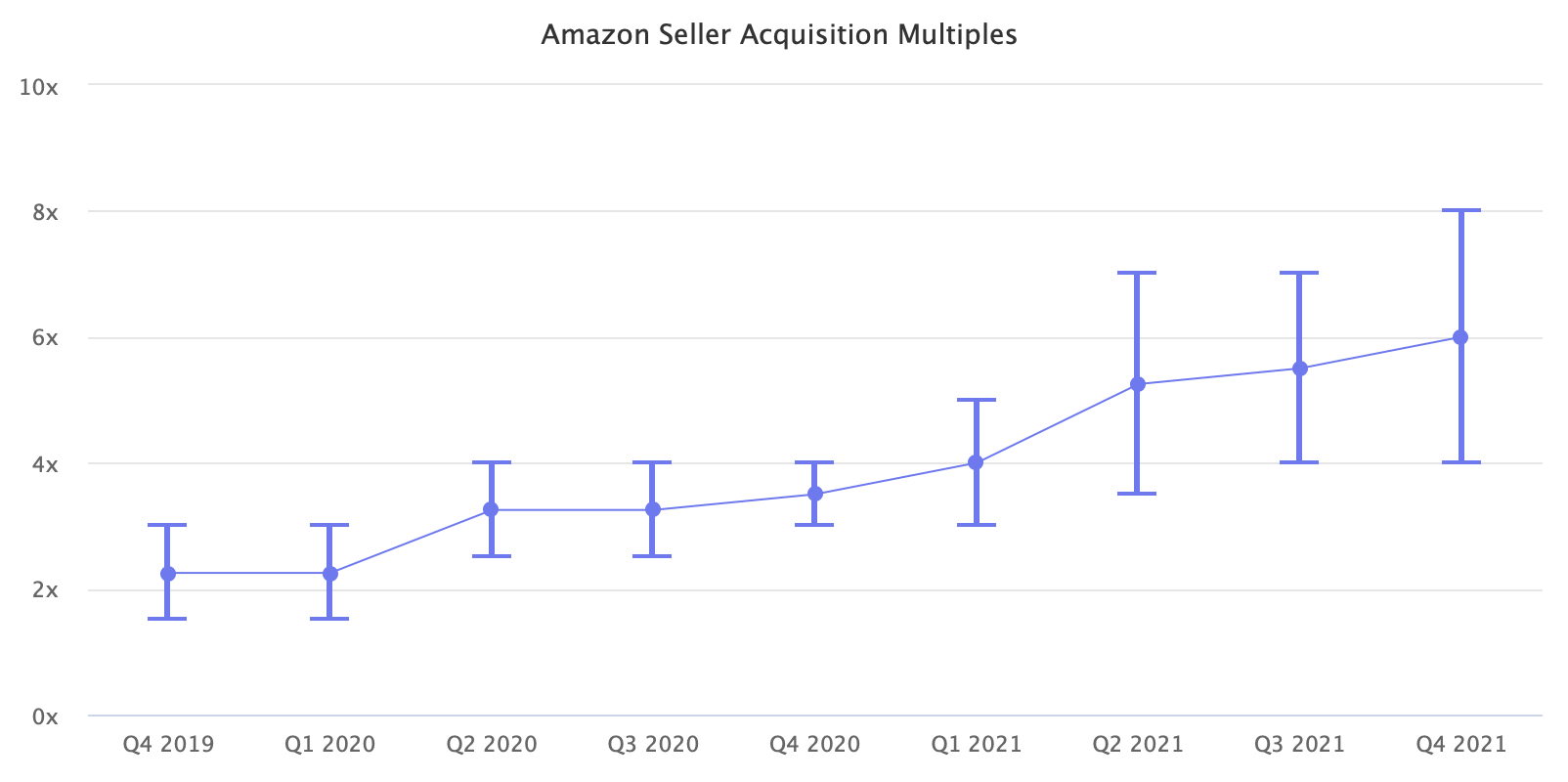

Amazon seller valuations have doubled since the start of 2020. There were only a few buyers then, and the concept of selling an Amazon seller business seemed far-fetched. Sellers were heavily undervalued, and the market is now catching up.

According to Marketplace Pulse research, Amazon private label sellers are getting acquired for SDE/Adjusted EBDITA multiples of 4x - 8x, plus an earn-out that could bring the total valuation north of 10x. At the start of 2020, average valuations were starting at 2.5x - 3x.

Amazon sellers typically get acquired for multiples of Seller’s Discretionary Earnings (SDE), which is a sort of an Adjusted EBDITA or annual net profit in rough terms, including add-backs of certain expenses. A business with $1 million in revenue and $250,000 in SDE profit would typically receive offers of more than $1 million guaranteed payment (4x the SDE) plus earn-out payments.

The above multiples are surface-level benchmarks of the market, however. Valuations are not calculated by simply multiplying the SDE by a pre-set multiple. “Deal structures are now more complex, and not all businesses are valued equally,” said Michal Baumwald Oron, CEO of Fortunet. “The category, the total profit, and its trend, growth opportunities, and competitive position are major differentiating factors for valuation.”

There are additional considerations for how much is paid upfront versus how big the earn-out or the stability payment is. Sellers struggling to grow with large catalogs in a rush to sell receive lower valuations. Declining businesses are harder to sell still. Others, with just a few products, solid brands, and significant revenue and profitability, can be paid a lot more than the average multiples.

Previously, many sellers could be quickly acquired for low multiples, with small competition among buyers, and grown with basic Amazon optimizations to pay back the investment. Because of higher acquisition prices (in part caused by the booming Amazon aggregator industry), buyers need to do more to have a positive ROI, and it will take longer to achieve it.

Higher valuations also mean mistakes are more expensive than before. To adequately understand the companies they are acquiring, buyers are now more cautious and investing in better due diligence. Because of that, acquisitions are taking longer. And the current global supply chain issues are also making some of the agreed deals fall apart.

For those building brand holding companies, the multiples paid are inconsequential - they are betting on being able to build a portfolio that will be orders of magnitude more valuable in the future. For others looking at this from the private equity multiple expansion point-of-view, rising multiples are a concern.

A roll-up of dozens of businesses acquired for 2x - 3x is significantly different from the current 4x - 8x multiples - especially given the prevailing headwinds affecting e-commerce, like the disruption to global supply chains. It was shortly a private equity play but is now very clearly an e-commerce and supply chain challenge. Operational skills matter a lot more than M&A experience.

The most active buyers are Amazon aggregators, which in total have raised more than $11 billion in 2021. While the capital flowing into aggregators appears to be endless, some of it might be chasing a roll-up market that doesn’t exist anymore - a market where businesses had valuations of less than 3x multiples. Yet, even if all of the $11 billion would get spent on acquisitions - aggregators will spend large parts of it on technology, payroll, and other expenses - that would only represent less than 2% of Amazon marketplace’s GMV.

But the market is not slowing down. More aggregators will enter, and more capital will flow in (and other types of buyers - aggregators announcing capital raises are attracting hundreds more private equity and other investment firms). However, some aggregators are already struggling; a few distressed firms are looking for an exit, but buyers typically only want to buy their best brands.

Rising multiples are a reflection of how the industry grew in sophistication over the past two years. They will likely continue to increase, albeit more slowly.