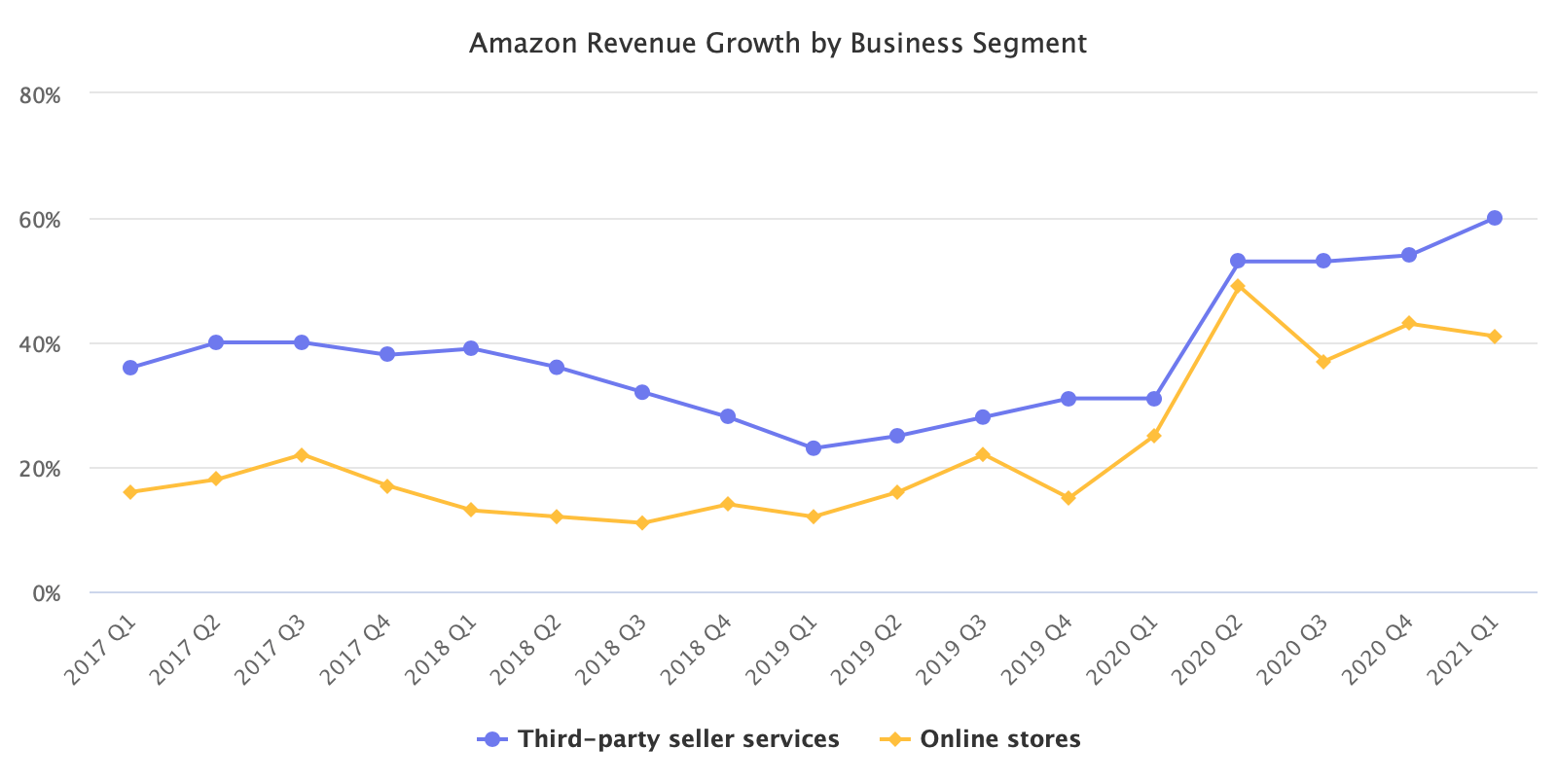

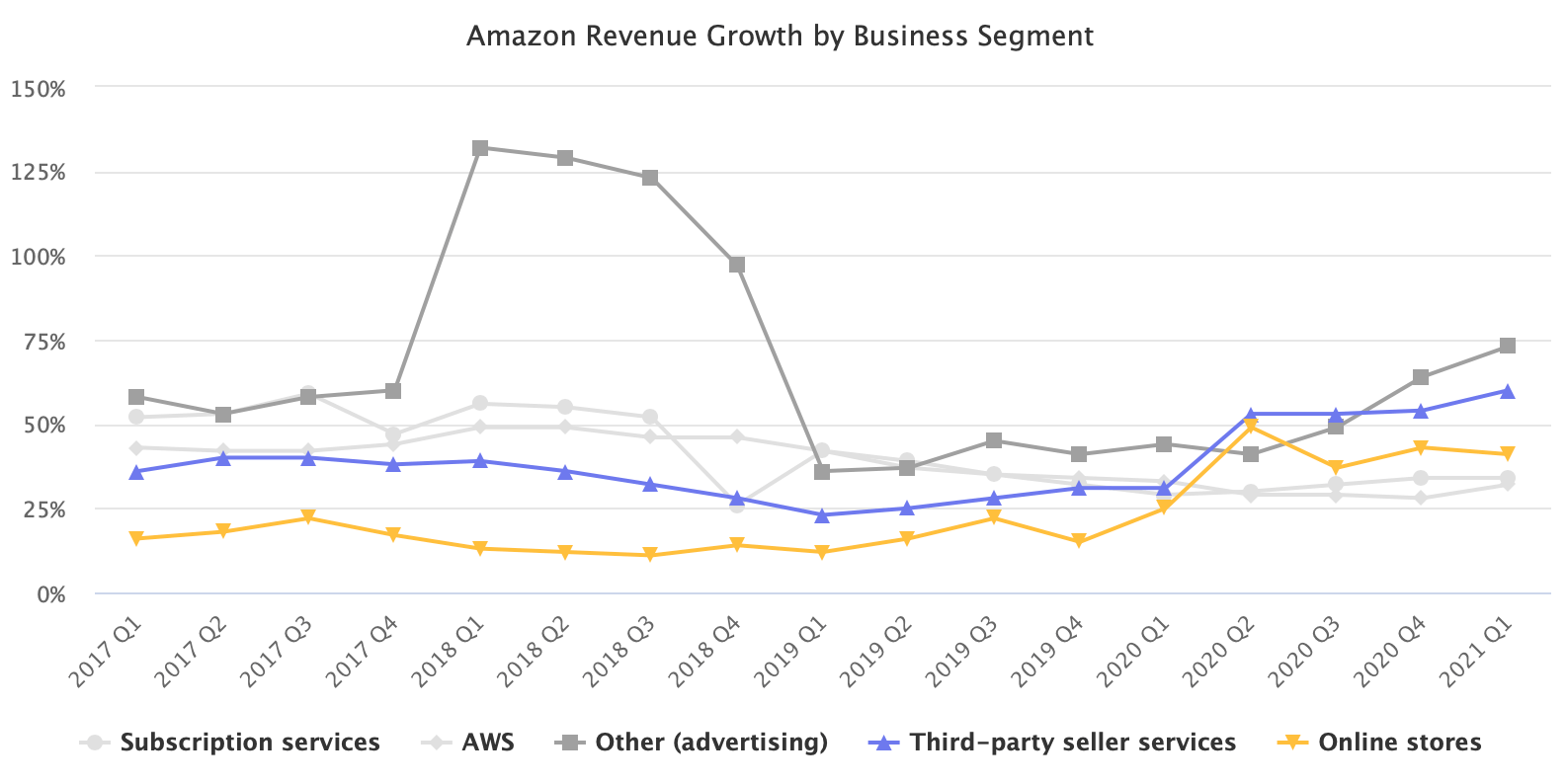

Amazon Marketplace grew 60% in the first quarter of 2021, the fastest in at least five years since the company started reporting third-party seller services revenue.

Third-party seller services revenue, which includes transaction and fulfillment fees, grew over 50% each of the past four quarters. Significantly faster than revenue from Amazon’s online sales. Since the fees sellers pay to Amazon are relatively consistent, the revenue collected from that is a proxy for marketplace GMV growth.

Strong sales growth in the first quarter confirms that e-commerce had a step change. Meaning, the sales lift caused by the pandemic didn’t last only during the quarters with the strictest lockdowns. Even as things went back to normal, more consumers are buying more things online. Q1 2021 growth compared to Q4 2019 was multiple times faster than the years prior.

Amazon’s guidance for the second quarter is 24-30% growth. A further confirmation that the e-commerce growth started in the second quarter last year is not short-lived (otherwise, expected growth would be negative). But percentage growth is naturally slowing down.

In the bigger context, advertising on Amazon grew the fastest in two years. Its growth rate has been accelerating for the past four quarters to reach 73% in the first quarter. Amazon continues to increase advertising inventory (space on the screen for ads), and more brands are bringing bigger budgets. In the next few years, Amazon’s advertising will overtake Amazon Web Services (AWS) in revenue size.

To support the growth, Amazon spent almost $50 billion in capital expenditures in the last twelve months on fulfillment and data centers, up 80% compared to the twelve months prior. The fulfillment operations still haven’t recovered to the pre-pandemic elasticity and likely never will. Nonetheless, Amazon is the default for the more than 200 million Prime members, and thus it is expected to reach $600 billion worldwide GMV this year.