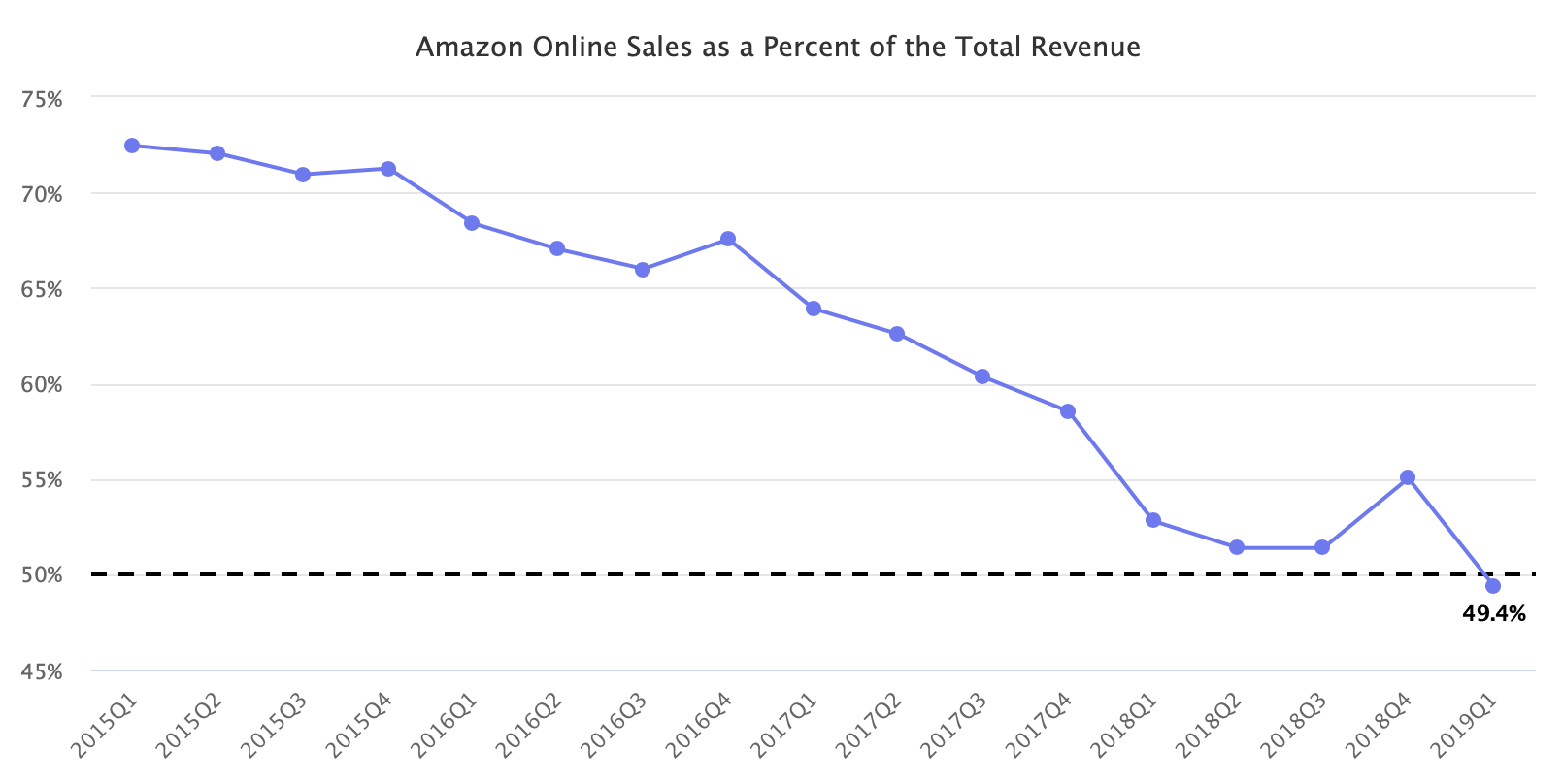

In the latest quarter, Amazon online sales accounted for less than 50% of the company’s total revenue. For the first time since the company was founded in 1994, Amazon generated more revenue from AWS cloud hosting, Prime memberships, the third-party marketplace, and advertising, than it did from selling products online. It sold $29.4 billion worth of products online, 49.4% of the $59.7 billion total revenue.

Four years ago in 2015, online sales accounted for 72.4% of the total revenue. In 2016 it decreased to 68.3% and further in 2017 to 63.9%. Last year it was 52.7%. Despite Amazon online sales continuing to grow, all other sources of revenue are growing faster. Revenue from third-party marketplace services grew 23% and AWS cloud hosting revenue increased by 42% in Q1 2019, compared to 12% online sales growth.

In 2015 the value of goods sold through the third-party marketplace exceeded those sold by Amazon as a retailer. By 2018 the split has grown to $160 billion by the marketplace and $117 by Amazon. However, Amazon’s revenue from the $160 billion marketplace sales was $42.7 billion. Thus the marketplace as a source of revenue is many times smaller than the retail side of the company. Nonetheless, it has a higher profit margin.

Amazon is an e-commerce infrastructure company, not a retailer. Services surrounding the third-party marketplace like the fulfillment network FBA and advertising are that infrastructure. “The greatest trick that Jeff Bezos ever pulled is allowing people to believe that he wants to create the everything store. Bezos has concentrated his investments around logistics and technology,” said Michael Zakkour, vice president of global digital commerce and new retail at Tompkins International.

The company still behaves like a retailer, but long-term that behavior leads to adjacent services businesses. First, it was the third-party marketplace, launched to accelerate SKU growth and remove the bottleneck of Amazon acquiring vendors. Then came the fulfillment warehouses, followed by advertising, and most recently by the last-mile delivery network. Adjacent innovation is a strategy where a business leverages something they do well to develop a new product or service in a related market. For Amazon, the core retail business fuels the adjacent innovation cycle.

Amazon is not a retailer. As a company, it derives more revenue from other businesses, as a retail platform it enables others to sell more than it sells itself.