Amazon’s growth in 2022 was nearly flat. That never happened before in its quarter-century as an online retailer. However, Amazon’s results illustrate macro movements in online shopping rather than Amazon’s underperformance.

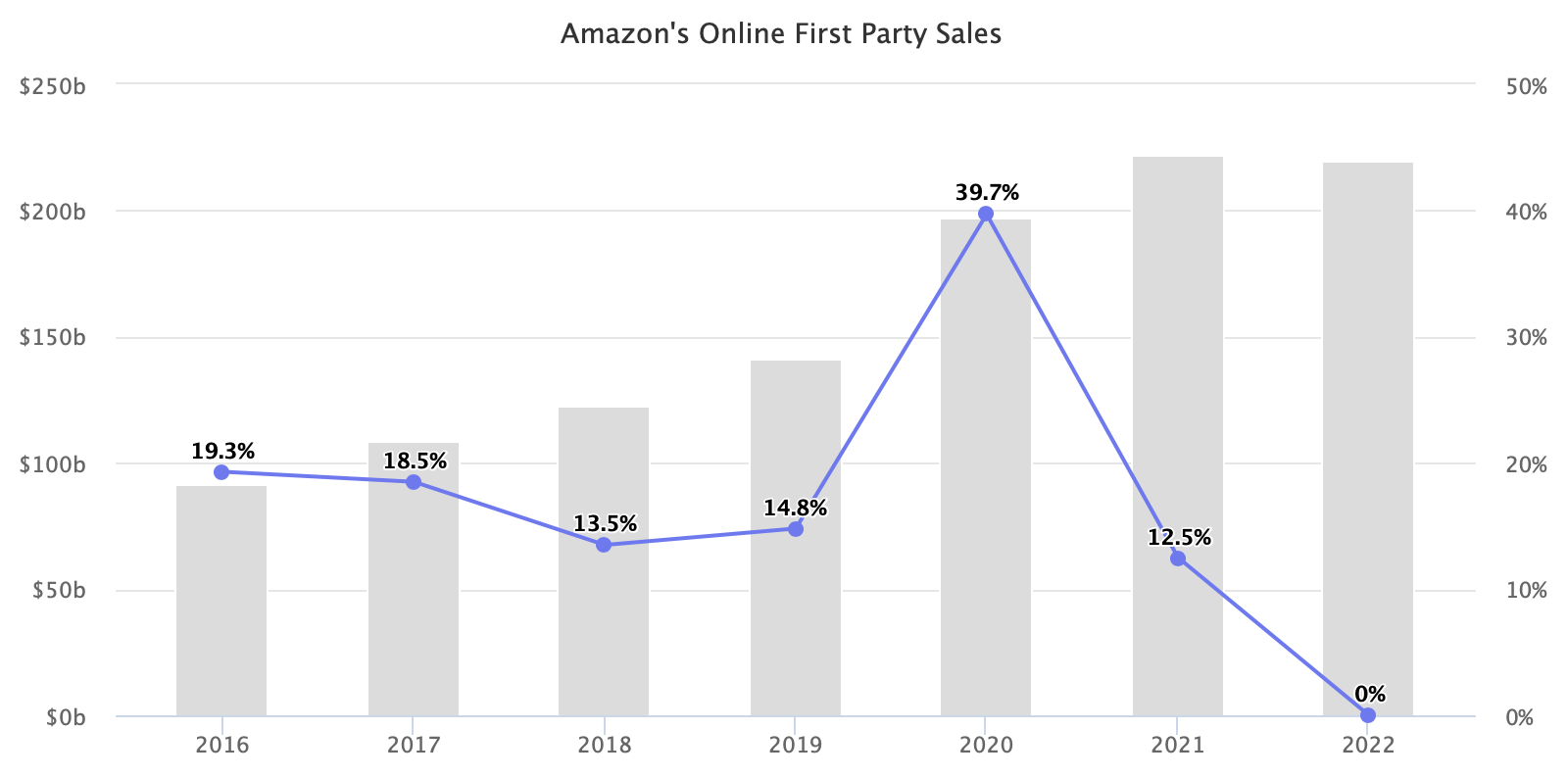

Amazon’s first-party sales were $220 billion in 2022, down 0.9% from 2021. Some of that decline was due to the unfavorable impact of year-over-year foreign exchange rate changes. But even considering the FX impact, 2022 growth was in stark contrast to previous years.

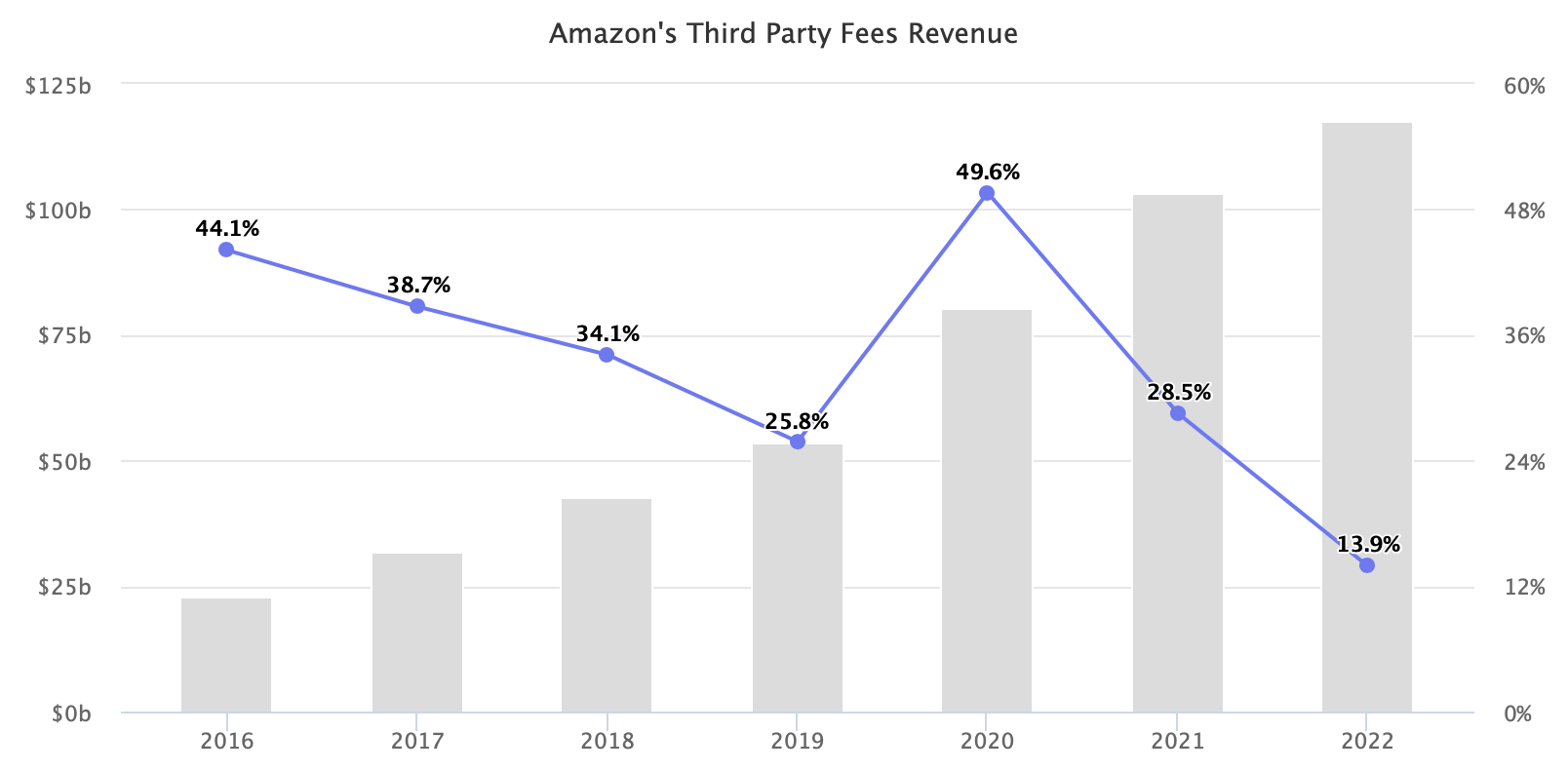

Amazon’s third-party sales - the Amazon marketplace - grew slowest in years too. The company doesn’t report third-party sales, only the fees it collects from the marketplace. But Amazon again increased fees last year, yet third-party revenue it collected grew slower than before. Increased fees but decreased growth mean third-party sales grew slower.

Amazon’s total gross merchandise volume (GMV), including sales by Amazon itself and the marketplace, only grew slightly in 2022 (Amazon doesn’t disclose GMV; growth is estimated from first-party sales, third-party fees, and total paid units growth). It was driven mainly by the marketplace, representing an all-time high of 59% of total units sold in Q4, up from 56% last year.

Amazon’s growth ceiling is e-commerce expansion. It is both driving e-commerce adoption and failing to grow when consumers return to shopping in stores. Some consumers pulling back on discretionary spending also contributed. Thus, in many ways, the lack of growth was out of Amazon’s control. Of course, Amazon sells in over twenty international markets; it performed better in the U.S. than in some other markets, such as Germany, where overall e-commerce spending shrank in 2022.

According to Amazon’s guidance, the first quarter of 2023 will not yet bring growth. The challenge to sellers and brands is that their growth is harder when Amazon is not growing. Yet an even bigger challenge will be maintaining profitability - already last year, Amazon’s advertising business expanded by 21% while sales sagged. More advertising spending and higher fulfillment fees while struggling to find growth is the headwind of 2023.