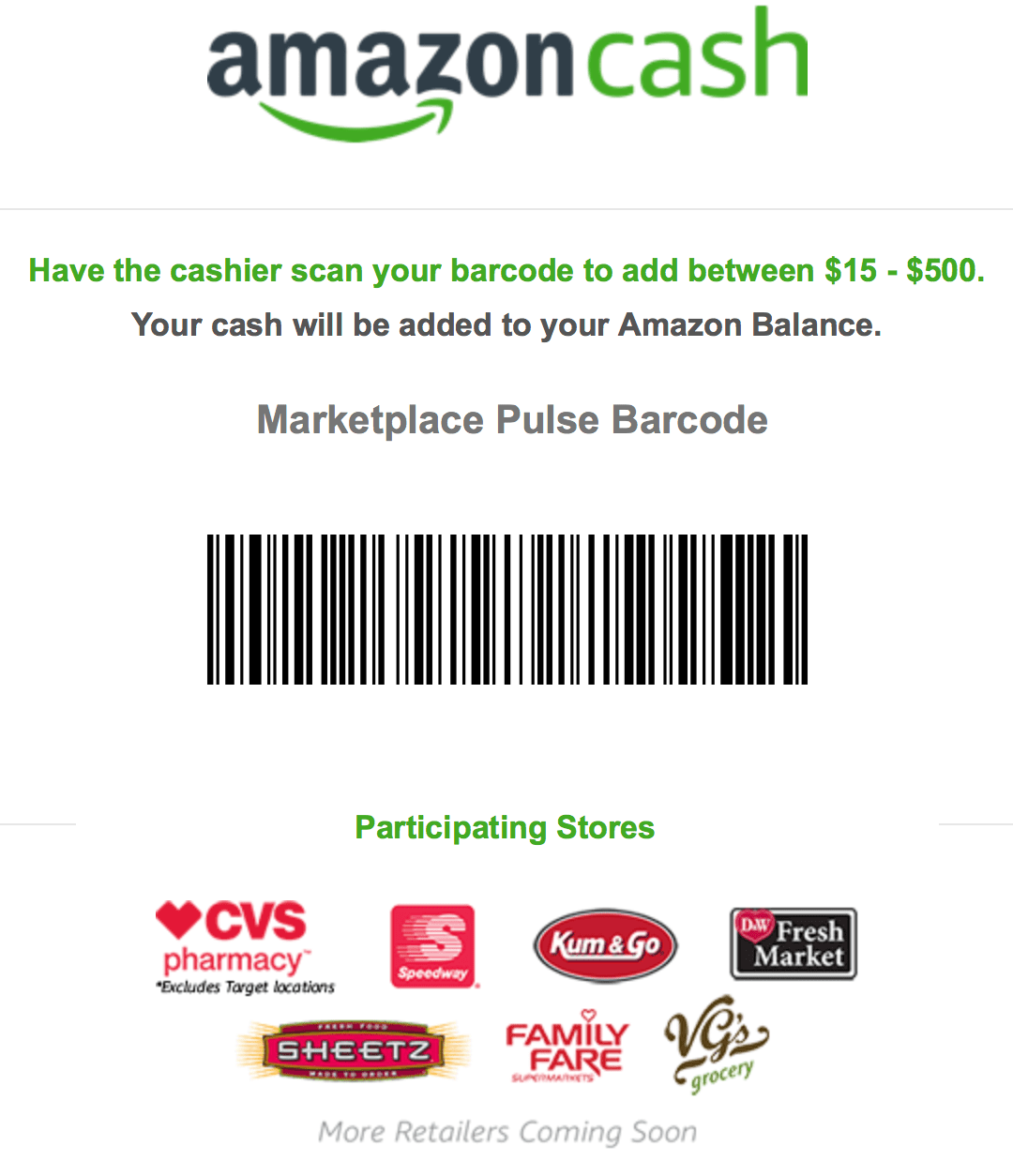

This week Amazon launched Amazon Cash, a service allowing to add to Amazon.com balance by showing a barcode at a brick-and-mortar retailer. This service will appeal to those who are not shopping online because they get paid in cash, don’t have a bank account or debit card, and who don’t use credit cards. The advantage of Amazon Cash is that there are no fees, compared to many pre-paid cards, and that funds are available immediately.

We wanted to elaborate on why Amazon launched this, and why payments are key. In the US it is easy to underestimate the size of the population without access to credit cards or any type of banking. While it might appear like everyone has a credit card, it couldn’t be further from the truth. Roughly a third of US population do not have credit cards.

While access to bank accounts and credit cards is often thought of as an issue in low-income countries, it is fairly big in the US too. A 2015 survey from the Federal Deposit Insurance Association found that 7 percent or 9 million of U.S. households were unbanked - meaning they had no checking or savings account. An additional 19.9 percent or 24.5 million households were underbanked - meaning they had a checking or savings account but also obtained financial products and services outside of the banking system, through payday loans, pawn shops, check-cashing services, prepaid credit cards and other means.

This move thus enables access to Amazon.com for millions of new customers.

In the US use of cash for online retail was never a consideration. Yet many countries around the world have been using cash-on-delivery (CoD) type of payments for many years. In countries like India very few people have any form of bank cards, forcing Amazon, Flipkart, and Snapdeal to introduce CoD payments.

Demonetization last year in India transformed the whole e-commerce industry overnight. While CoD is still an available option, the rise of mobile wallets is extraordinary. PayTM (major investor Alibaba) has been one of the major players to come out of this. Messaging platforms like Facebook Messenger and soon WhatsApp are also adding payments in India. The country is transforming from primarily a cash-based society, to a mobile-based digital payments country at a pace which is hard to grasp.

Payments are one of the key features of e-commerce. In South America MercadoPago by MercadoLibre payments volume has been growing faster than the e-commerce marketplace itself. In India big changes are happening because of demonetization and government push to mobile wallets. Many other countries are also aggressively exploring cashless systems.

So it might be baffling to see Amazon move into the opposite direction and start accepting cash. But the reality is that US market is very large, with a relatively low fraud rate, so there is not going to be a quick shift to mobile payments and especially a cashless population. Unfortunately US is not the leader in payments innovation, as it isn’t a problem here. Existing infrastructure, while severely outdated when compared to leading countries, works well enough. Swipe magnetic strip credit cards and cheques are not used by any other leading country.

This also has effects on competition, as a lot of the unbanked people spend their money in Walmart and other big retail chains. In many ways Amazon wants a slice of that. Furthermore, before other retailers offer similar services Amazon will be owning the online spending by those people.

Time will tell how big this initiative will be able to grow, but it has potential to contribute to Amazon’s cashflow. Since not everyone will spend their balance immediately, and few will completely spend the balance, Amazon could leverage the total balance to fund its own growth. Any time difference between income and spendings is an opportunity if managed well, like we explained in the Amazon’s cash conversion cycle piece.

Amazon payment services as a whole is worth keeping an eye out. Most marketplaces across the globe have built strong payment systems, and we expect Amazon to expand there too. For example a strong competitor for PayPal would be interesting to see. During 2016 “more than 33 million customers have used Amazon Payments to make a purchase. In 2016, Pay with Amazon payment volume nearly doubled, with expansions into France, Italy and Spain and new verticals including government payments, travel, digital goods, insurance, entertainment, non-profits and charities helping fuel this growth.” Amazon said in a press release last month.

If you agree with our view that Amazon Is an E-Commerce Infrastructure Company, Not a Retailer, then it makes sense how important payments are in this vision. The focus of payments services is to enable online retail for as many people in the country as possible, in ways which are most comfortable for them, and then allow that service to be used for and beyond Amazon. PayPal had $354 billion in payment volume in 2016, if Amazon focused on this, it could grow as big or bigger.